Lubricating Oil Additives Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

GMI Research analysis indicates that the Lubricating Oil Additives Market size was estimated at USD 18.4 billion in 2022 and is slated to register a single digit CAGR of 2.1% over the forecast period and is projected to reach USD 21.7 billion in 2030.

Major Lubricating Oil Additives Market Drivers

Major Lubricating Oil Additives Market Drivers

The global lubricating oil additives market is predicted to grow at 2.1% due to considerable growth in the automobile industry, a rise in demand for high-quality industrial lubricants, significant development in living lifestyle, speedy industrialization, and an increase in the disposable income of customers. The global market is estimated to continue its substantial growth due to the high growth in the need for energy-efficient lubricants and the rapid increase in automotive industry development. In addition, the considerable growth in the requirement for fuel-efficient lubricants is a foremost driver of the global lubricating oil additives market share.

The growing trend for industrial lubricants with supreme quality is also estimated to propel the lubricating oil additives market size. The industrial lubricants find applications in different industries and uses. Every industry, including pharmaceuticals and food, demands personalized lubricants designed to meet their precise functional demands and the preferences of the producers and operators. In the present scenario, improved machining approaches rely heavily on high-quality lubricants. Industrial lubricants are important wherever machinery and equipment require optimal lubrication and prevention against corrosion. Industrial lubricants are important in modern industrial procedures, serving as metalworking oils, hydraulic oils, and gear oils, fulfilling important operations in different applications. Therefore, the strengthening demand for higher-quality industrial lubricants has led to an enhancing requirement for lubricating oil additives as well.

Sample Request

To have an edge over the competition by knowing the market dynamics and current trends of “Lubricating Oil Additives Market” request for Sample Report here

In addition, with global efforts to drop carbon emissions, there is an increasing need for energy-efficient lubricants as governments globally highlight environmental preservation. Lubricating oil additives help decrease friction and wear in engines and machinery, leading to developed fuel efficiency and decreased emissions. The automotive sector significantly relies on lubricating oil additives. As the demand for automobiles increases, there is a concurrent rise in the demand for lubricants and their additives. Lubricating oil additives develops the performance and longevity of automotive engines, confirming the safety and reliability of vehicles which further drives the demand for lubricating oil additives market.

The increasing sales of both commercial and passenger vehicles are propelling the implementation of lubricating oil additives to develop the performance of operational fluids, thereby driving the industry’s growth. The expansion of production capacities by foremost automobile companies such as Toyota, Hyundai, GM, and Tata Motors is attributed to the increasing requirement for lubricating oil additives. The evolving design and shape of internal combustion engines is causing higher levels of heat and tension within their internal components. As a result, the increased heat and tension in internal combustion engines are leading to a higher utilization of lubricating oil additives in high-revolution-per-minute engines. This trend focuses on developing effectiveness, thereby emerging the lubricating oil additives market. Furthermore, innovations in bearing technology and gear systems are emphasizing the need for lubricating oil additives in different applications. The growing requirement for eco-friendly bio-based lubricants is propelling the growth of the lubricating oil additive industry. The significant growth in the usage of lubricating oil additives in EVs is another key driver estimated to propel the global market growth.

Request Research Methodology

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

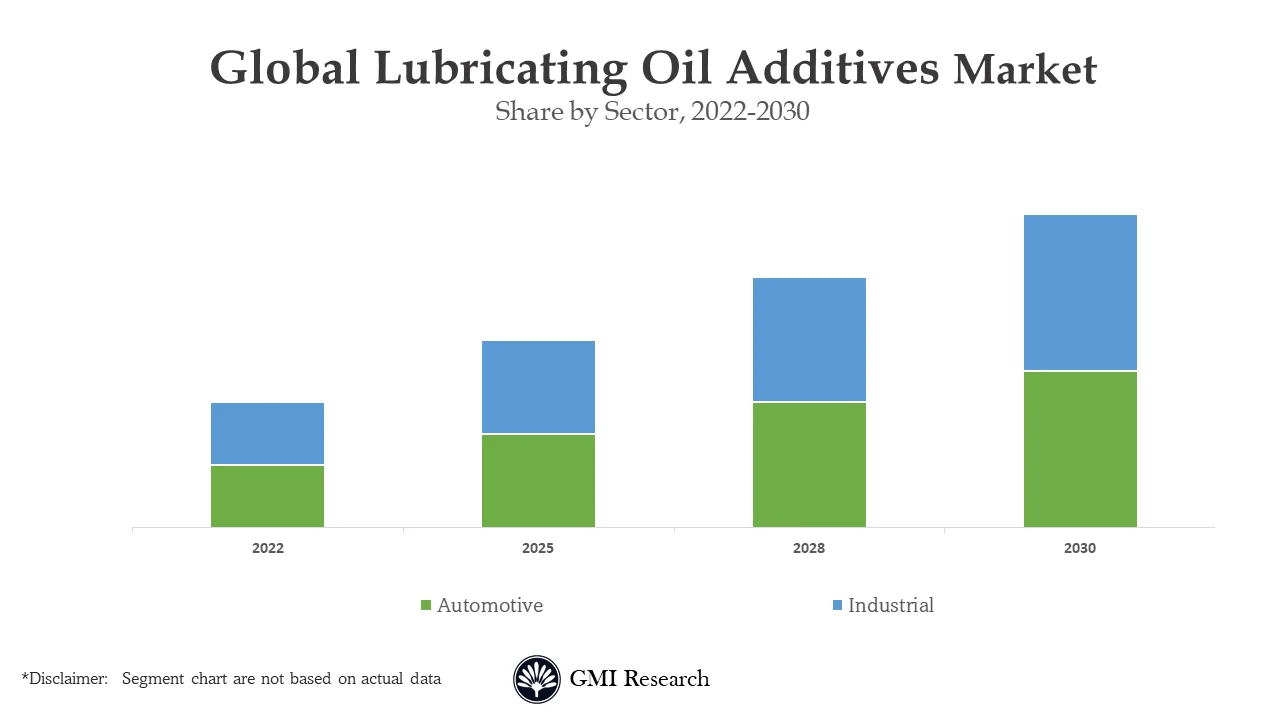

The industrial segment is a significant customer of lubricating oil additives. These additives are used in a variety of industrial machinery, including turbines, hydraulic systems, and compressors. Utilizing lubricating oil additives in these applications develops machinery performance and reliability, resulting in higher productivity and decreased downtime. Additionally, the marine sector is another foremost customer of lubricating oil additives, relying on them for optimal performance and effectiveness of marine engines and equipment. The marine sector heavily depends on lubricants to sustain the performance of marine engines and different equipment, confirming smooth function and longevity. Lubricating oil additives is developing the performance and longevity of marine engines, resulting in decreased fuel consumption, and emissions.

Urbanization’s swift pace and growing customer requirements are propelling the growth of industrial manufacturing hubs. This expansion is fuelling the need for lubricating oil addition. Lubricant industrial oil and ISO grades, personalized to fulfil different application demands. These applications vary from surroundings requiring long service life and extremes of high or low temperatures to marine settings. Also, in situations involving incidental food contact, the usage of low-toxicity lubricants becomes necessary. The growing adoption of lubricant oil additives at deliver fuel economy and decreasing viscosity is predicted to contribute increasingly to the expansion of the industry’s market share.

However, global warming is an extensive concern connected to the utilization of petroleum products owing to their involvement in greenhouse gas emissions. The statistics presented by the Union of Concerned Scientists highlight that cars and trucks contribute considerably to U.S. emissions, releasing nearly 24 pounds of carbon dioxide and other global warming gases for every gallon of gas utilized. The concern over emissions has led to the development of alternative fuels focused on replacing gasoline and decreasing environmental pollution. As stated by the U.S. Department of Energy, natural gas produces nearly 6% to 11% lower levels of greenhouse gases (GHGs) than gasoline around the finished fuel lifecycle.

Request for Customization

In case, any of your pain points areas are not covered in the current scope of this report, Request for Customization here

Whereas, the production of electricity through wind power has been significantly growing due to concerns connected to petroleum prices. U.S. Energy Information Administration states that wind energy accounted for 7% of the total electricity generation across the U.S. Additionally, the International Renewable Energy Agency states that the global installed wind-generation facility, both offshore and onshore, increased by nearly 75% over the past two decades, reaching approximately 564 GW in 2018, a substantial growth from 7.5 GW during 1997. With the increasing number of wind turbines, the requirement for lubricants to confirm their optimum operability is growing, principally in remote and offshore places where these turbines are being installed. Therefore, performance is important in wind turbines, as any gearbox or else bearing breakdown could result in a complex and challenging resolution procedure. Hence, the increasing number of wind turbines, coupled with developments in gearbox and bearing technologies, has led to an increased usage of advanced lubrication, propelling the demand for lubricating oil additives.

By Application, Engine Oil segment held the largest revenue share in global market

The proper amounts of lubricant oil additives are essential. Without them, vehicles are vulnerable to increased wear and tear, corrosion, rust, breakdowns, oil sludge, reduced fuel efficiency, expensive engine damage, and overheating. Engine oil additives foster lubrication, enhance high-temperature performance, and extend the engine functions smoothly and effectively. Few additives develop the viscosity of engine oil, confirming optimal performance in different temperatures and decreasing wear and tear on the engine components. Engine performance is developed through the usage of friction-decreasing additives. Due to these factors, there is a rising need for engine oil, attributing to the growth of the segment.

By type, Anti-oxidants register the largest revenue share in the global market

Anti-oxidants and oxidation inhibitors is extending the life of lubricants by safeguarding the oxidation of the base oil’s components. Antioxidants are commonly found in different lubricating greases and oils. Examples include limited zincdialkyldithiophosphates, phenols, aromatic amines, and sulfurized phenols. These components help maintain the stability and longevity of the lubricants. These substances work by breaking down peroxides and halting procedures involving free radicals within the lubricant, confirming its stability and performance. Additionally, the antioxidants are additives designed to develop the oxidative resistance of base oils, thereby developing the life of the lubricants by safeguarding premature degradation and maintaining their effectiveness. Antioxidants enable lubricants to function at higher temperatures than what would be feasible without them. This capability is propelling revenue growth in the antioxidant segment as the demand for high-temperature lubrication solutions continues to grow.

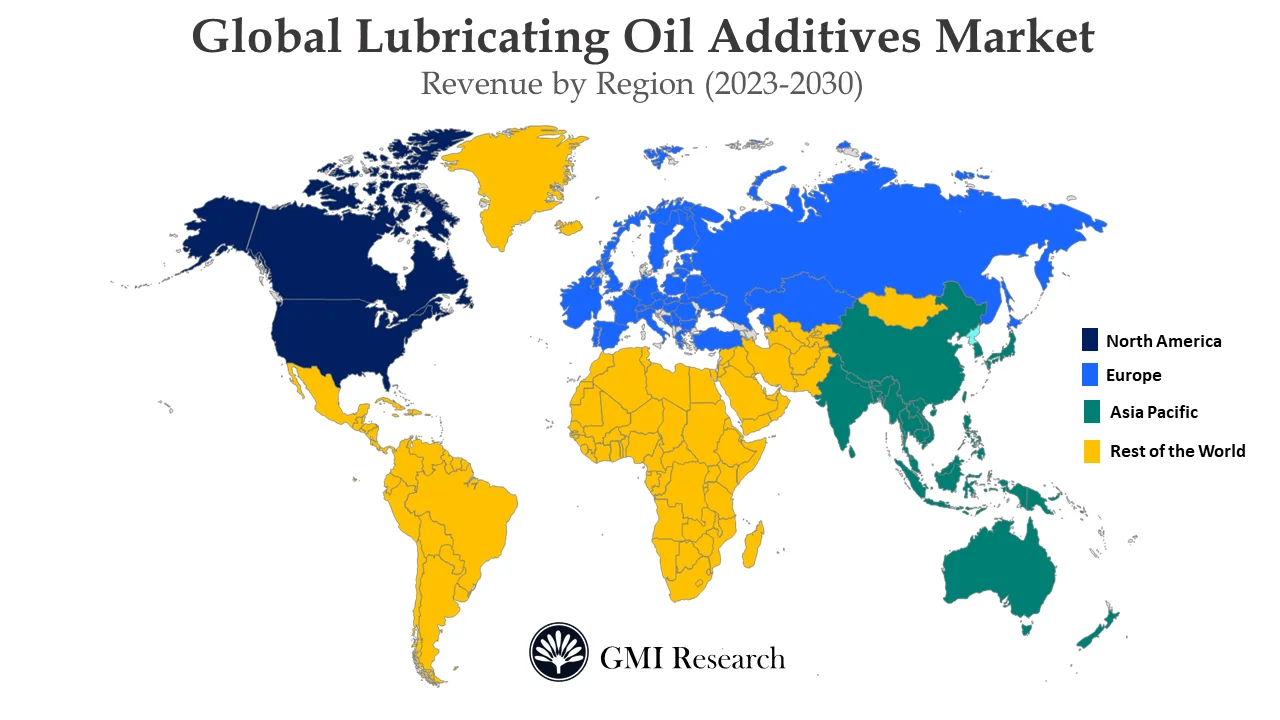

By Region, Asia Pacific Region is the largest regional segment of the lubricating oil additives market

The significant growth in demand for these products in the automobile industry, essentially in emerging nations such as India, China, Indonesia, Japan, and South Korea, is a foremost factor attributing to this growth. The market for lubricating oil additives is predicted to rise in the forecast period, propelled by the industrial segment’s expansion and the continuous requirement to develop machine effectiveness and performance. For instance, projects like the Indian government’s plan to build 65,000 km of national roadways by 2022, with a predicted cost of USD 741.51 billion, further highlight the requirement for lubricating oil additives in different applications to maintain and develop machinery and equipment. In addition, with the changing road infrastructures and developed vehicular traffic, the requirement for lubricating oil additives is predicted to grow. The growing need for metalworking fluid, grease, gear oil, and gearbox fluid, thereby led to an increase in market revenue growth globally.

Top Market Players

Various notable players operating in the market include BASF SE, Evonik Industries AG, Infineum International Limited, Chevron Oronite Company LLC, Chemtura Corporation, The Lubrizol Corporation, Croda International PLC, Afton Chemical Corporation, VAnderbilt Chemicals LLC, and Rhein Chemie Corporation. among others.

Key Developments

-

- In 2022, BASF established a new product and the extension of its Irganox manufacturing facility to develop its product portfolio and meet the growing needs of clients and partners.

- In 2020, Chevron Oronite Company LLC successfully joined hands with quantiQ to be competitive in the global and develop their customer base globally.

- In 2018, GE Power established a Biotechnology manufacturing center around Stevenage Bioscience Catalyst to produce fibre-drived purification platform.

Sample Request

For detailed scope of the “Lubricating Oil Additives Market” report request a Sample Copy of the report

Segments covered in the Report:

The Global Lubricating Oil Additives Market has been segmented on the basis of Type, Sector and Application. Based on the Type, the market is segmented into Viscosity Index Improvers, Dispersants, Detergents, Antioxidants, Anti-wear Agents, Rust and Corrosion Inhibitors, Friction Modifiers, Extreme-pressure Additives, Others. Based on the Sector, the market is segmented into Automotive, Industrial. Based on the Application, the market is segmented into Engine Oil, Metalworking Fluid, Transmission and Hydraulic Fluid, Grease, Gear Oil, Compressor Oil, Others.

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 18.4 Billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Type, By Sector, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | BASF SE, Evonik Industries AG, Infineum International Limited, Chevron Oronite Company LLC, Chemtura Corporation, The Lubrizol Corporation, Croda International PLC, Afton Chemical Corporation, VAnderbilt Chemicals LLC, and Rhein Chemie Corporation. among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Lubricating Oil Additives Market by Type

-

- Dispersants

- Viscosity Index Improvers

- Detergents

- Anti-wear Agents

- Antioxidants

- Rust and Corrosion Inhibitors

- Friction Modifiers

- Extreme-pressure Additives

- Others

Global Lubricating Oil Additives Market by Sector

-

- Automotive

- Industrial

Global Lubricating Oil Additives Market by Application

-

- Engine Oil

- Transmission and Hydraulic Fluid

- Metalworking Fluid

- Gear Oil

- Grease

- Compressor Oil

- Others

Global Lubricating Oil Additives Market by Region

-

-

North America Lubricating Oil Additives Market (Option 1: As a part of the free 25% customization)

- By Type

- By Sector

- By Application

- US Market All-Up

- Canada Market All-Up

-

Europe Lubricating Oil Additives Market (Option 2: As a part of the free 25% customization)

- By Type

- By Sector

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Lubricating Oil Additives Market (Option 3: As a part of the free 25% customization)

- By Type

- By Sector

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Lubricating Oil Additives Market (Option 4: As a part of the free 25% customization)

- By Type

- By Sector

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Global Lubricating Oil Additives Leading Market Players (Option 5: As a part of the free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- BASF SE

- Evonik Industries AG

- Infineum International Limited

- Chevron Oronite Company LLC

- Chemtura Corporation

- The Lubrizol Corporation

- Croda International PLC

- Afton Chemical Corporation

- Vanderbilt Chemicals LLC

- Rhein Chemie Corporation

Related Reports

- Published Date: Oct-2023

- Report Format: Excel/PPT

- Report Code: UP3562-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Lubricating Oil Additives Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

Why GMI Research