Middle East Digital Payment Market Size & Analysis Report by Mode of Payment, By End-user Industry and By Countries – Opportunities & Forecast, 2021-2028

Middle East Digital Payments Market Size & Analysis Report by Mode of Payment (Digital Wallet, Debit/Credit cards and Online Banking), By End-Users (BFSI, Telecommunication, Transportation, Retail & E-commerce, Utility bills and Others), and By Countries

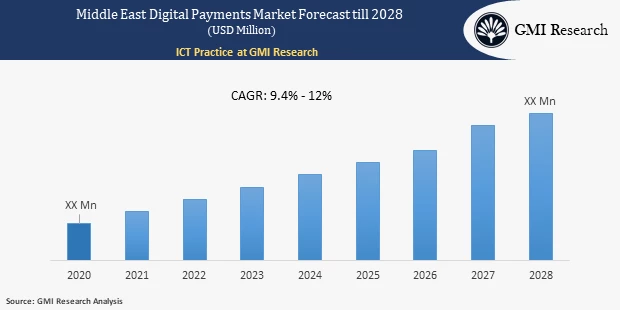

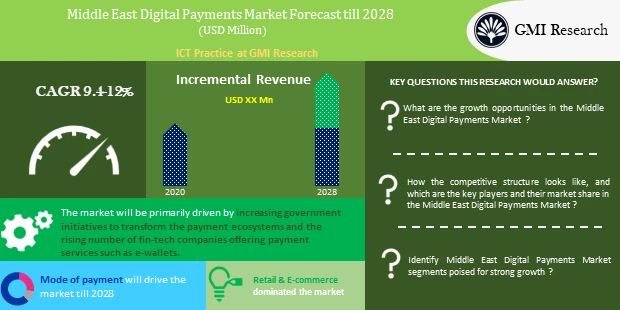

Middle East Digital Payments Market is accounted for USD XX million in 2020, growing at a robust CAGR of 9.4% to 12% during forecast period.

Introduction of the Middle East Digital Payment Market Report

Digital payment refers to the payment method are conducted through the internet and mobile channels. For the digital payment to take place, the sender of the payment must have a bank account, an online banking payment method, a device to make a payment from, and a medium for transmission, meaning that the individual has signed up to a provider. This type of payment is easy to make, more convenient and offers flexibility to customers to make the payment from anytime and anywhere.

To have an edge over the competition by knowing the market dynamics and current trends of “Middle East Digital Payment Market,” request for Sample Report here

Market Dynamic

Key Drivers and Emerging Trends

The Covid-19 pandemic has boosted the adoption of digital payments across the Middle East, with digital wallets and contactless payment methods set to dominate and shape the future of the transactions. In UAE, the volume of consumer digital payments transactions grew at an annual rate of more than 9.5% between 2014 and 2019. In addition to that, card payments in Saudi Arabia, the Arab world’s largest economy, surged more than 70 percent between February 2019 and January 2020. Moreover, the increasing government initiatives to expand the adoption of digital payments in the region is another significant factor driving the Middle East Digital Payments Market size. For instance, Saudi Arabia has taken various initiatives in its transition towards a cashless society in recent years, supported by initiatives taken by the Government and the Central Bank. Regulations laid by the government make it mandatory for employers to assign wages to their employees in their bank account, which accounts to be a major step that has increased access to the digital transaction to a large portion of Saudi Arabia’s population.

The mobile financial services transformation has been witnessed via different payment methods such as Careem Pay in the UAE. For example, Saudi Arabia’s leading telecommunications organization introduced a digital wallet app, STC Pay, which enables people to send money to other users and pay restaurants and stores through digital mode. Furthermore, the increasing collaboration between banks to support digital payments is another factor that is opening new doors for market growth. In 2020, Oman Air and BankDhofar entered into a partnership to launch an e-commerce payment gateway platform, which allows the airline’s customers to book their sets through their debit cards and receive an instant response of the physical transactions. In addition to this, with the outbreak of COVID-19, there has been an increase in the digital payment mode as individuals now prefer digital payment rather than using cash to avoid the risk of contracting coronavirus.

Restraint in the Middle East Digital Payment Market

However, the lack of standards for cross-border payments and the cybersecurity challenges associated with online banking are major factors that are hampering the Middle East Digital Payments Market growth.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Mode of Payment – Segment Analysis

Based on the Mode of Payment, the Digital Wallet segment is expected to grow at a higher CAGR during the forecast period. A digital wallet (or e-wallet) is a software-based system that securely stores customers’ payment information and passwords for numerous payment methods and websites. The adoption of digital wallets is witnessed maximum in UAE among the middle east region. The pay apps such as Samsung Pay, Apple Pay, and Google Pay offers digital wallet platforms as well as allow saving of debit or credit card details and making payments by tapping a mobile phone on point-of-sale (POS) systems using NFC. In Oman, Bank Meethaq and Bank Muscat’s Islamic banking arm launched the Meethaq Wallet. Moreover, Sohar International and Omantel launched efloors to enable customers to load money into the mobile wallet via debit card and use it to transfer money and make payments.

End-user Industry – Segment Analysis

Based on the End-Users, the Retail & E-commerce segment is expected to grow at a higher CAGR during the forecast period. This can be attributed to the rising traction among the population of the middle east region for online shopping through e-commerce platforms. For instance, consumer sentiment and spending have revealed the rapid growth of online shopping, with 77 percent of consumers in Saudi Arabia spending more money online since the onset of the pandemic. Furthermore, the Middle East retail market is on the verge of digital disruption, with the major players undergoing a structural shift from traditional in-store concepts to online platforms through the adoption of digital technologies, thereby contributing to the growth of the retail and e-commerce segment.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

Countries – Segment Analysis:

Based on the countries, the UAE is expected to grow at a higher CAGR during the forecast period. The improvement in the payment infrastructure is a significant factor driving the growth of digital payments in this region. For instance, the number of POS terminals in the UAE rose from 190,000 in 2016 to 254,815 in 2020. Furthermore, due to growth in payment acceptance infrastructure, the volume of online card payments registered strong growth, rising from 428.6 million in 2016 to 670.7 million in 2020. The major fin-tech companies disrupting the payment industry in UAE are Amazon Payment Services, CASHU, Trriple, Monami Tech, among others.

Top Market Players

Various notable players operating in the market, include, Samsung, Apple, Google LLC, Visa Inc., Paypal, Mastercard, Fiserv, ACI Worldwide, Saudi Digital Payment Company and Denarii Cash, among others.Key Developments:

-

- In 2021, Paypal launched new services by adding access to high yield savings, in-app shopping services, rewards, and discounts, up to two-day early access Direct Deposit. This personalized app offers PayPal customers a single stop to manage daily secure financial transactions.

- In 2021, Apple Inc. launched its service, “Apple Pay Later,” which allows its customers to pay for any Apple Pay purchase in installments over time.

- In 2020, ACI Worldwide entered into a partnership with Arvato Financial Solutions to combat the increasing levels of eCommerce fraud during the COVID-19 pandemic. In this collaboration, ACI will provide Arvato Financial Solutions best-in-class Manual Order Review service to all its merchant fraud customers.

- In 2019, Fiserv collaborated with two of the biggest technology and digital payments companies, Samsung and Visa, for software that will allow businesses to accept payments with the wave of a smartphone or tablet.

- In 2020, Matercard collaborated with three local issuing banks in the UAE, including RAK Bank, Mahreq Bank and Emirates NBD, to provide digital wallets powered by Mastercard to cardholders in the UAE.

Segments covered in the Report:

The Middle East Digital Payments market has been segmented on the basis of Mode of Payment, End-Users, and countries. Based on Mode of Payment, the market is segmented into Digital Wallet, Debit/Credit cards and Online Banking. The End-Users segment is further categorized into BFSI, Telecommunication, Transportation, Retail & E-commerce, Utility bills and Others.

For detailed scope of the “Middle East Digital Payment Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is Middle East Digital Payment Market growing? What will be the growth trend in the future?

- What are the key drivers and restraints in Middle East Digital Payment Market? What will be the impact of drivers and restraints in the future?

- Which Mode of Payment generated maximum revenues in 2020 and identify the most promising Mode of Payment during the forecast period?

- What are the various End-user Industries of Middle East Digital Payment Market and how they are poised to grow?

- What companies are the major participants in this market and their business strategies, how does the competitive landscape look like?

|

Report Coverage |

Details |

| Market Base Year |

2020 |

| Market Forecast Period |

2021-2028 |

| Market Revenues Currency |

USD Million |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Mode of Payment, By End-user Industry, By Countries |

| Regional Coverage | Middle East |

| Companies Profiled | Profiles of Top 10 Major Companies Operating in “Middle East Digital Payment Market” |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Middle East Digital Payment Market by Mode of Payment

-

- Digital Wallet

- Debit/Credit cards

- Online Banking

Middle East Digital Payment Market by End-user Industry

-

- BFSI

- Telecommunication

- Transportation

- Retail & E-commerce

- Utility bills

- Others

Middle East Digital Payment by Countries

-

- UAE Digital Payment Market All-Up (Option 1: Free 25% Customization)

- Saudi Arabia Digital Payment Market All-Up (Option 2: Free 25% Customization)

- Rest of Middle East Digital Payment Market All-Up (Option 3: Free 25% Customization)

Frequently Asked Question About This Report

Middle East Digital Payment Market [ICT22A-00-0719]

The growth rate of middle east digital payments market during forecast period is 9.4% to 12%.

The top players in the Middle East Digital Payments Market are, Samsung, Apple, Google LLC, Visa Inc., Paypal, Mastercard, Fiserv, ACI Worldwide, Saudi Digital Payment Company and Denarii Cash, among others.

The UAE is expected to grow at a higher CAGR during the forecast period. This can be attributed to the improved payment infrastructure which is a significant factor driving the growth of the digital payments in this region.

The Digital Wallet segment is expected to grow at a higher CAGR during the forecast period. A digital wallet (or e-wallet) is a software-based system that securely stores customer’s payment information and passwords for numerous payment methods and websites.

- Published Date: Mar-2022

- Report Format: Excel/PPT

- Report Code: ICT22A-00-0719

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Middle East Digital Payment Market Size & Analysis Report by Mode of Payment, By End-user Industry and By Countries – Opportunities & Forecast, 2021-2028

$ 4,499.00 – $ 6,649.00

Why GMI Research