Mobility as a Service Market Size, Trends, and Industry Analysis Report By Service (Ride Hailing, Car Sharing, Micromobility, Bus Sharing, and Train Services), By Transport Type (Public and Private), By Business Model (Business-to-Business, Business-to-Consumer, and Peer-to-Peer), and By Region – Global Opportunities & Forecast, 2022-2029

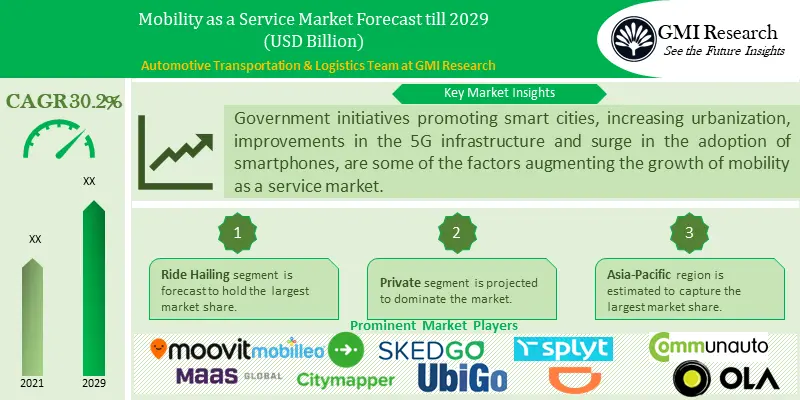

GMI Research analysis indicates that the Mobility as a Service Market is slated to register a CAGR of 30.2% over the forecast period 2022-2029 attributed to rise in the number of smart city initiatives and increasing adoption of on-demand mobility services around the world.

To have an edge over the competition by knowing the market dynamics and current trends of “Mobility as a Service Market”, request for Sample Report here

Main Mobility as a Service Market Trends and Drivers

Mobility as a Service Market is primarily driven by increasing urbanization, growing need to reduce carbon dioxide emissions improvements in 5G infrastructure, surge in the penetration of smartphones and rise in the ownership cost of vehicles. In the last two decades the global urbanization rate has increased immensely although higher urbanization rate has created enormous employment opportunities and helps in reducing poverty as with all things this also has put tremendous pressure on transportation systems globally. Urbanization has increased the volumes of greenhouse gases worldwide, as per World Bank’s estimates, urban areas accounts for more than 70% of Co2 of global carbon emissions for energy use. Witnessing such trends, governments in various countries are focussing to build smart cities. For instance, the Indian government is currently building 100 smart cities nationwide to provide sustainable environment and efficient urban mobility and public transportation systems. As governments are promoting use the public transportation through smart city initiatives, ownership of private vehicles, will decline in future, which in turn will result into reduced less carbon emissions from these vehicles. Such initiatives are expected to create lucrative growth opportunities for mobility as a service companies in coming few years.

Introduction of autonomous vehicle is expected to help ride sharing companies to increase their profit and passing some benefits to users in terms of lower ride cost driving the private vehicle ownership downward. As per estimates introduction autonomous vehicle in of commercial ride sharing will helps company’s revenues to rise by 60%. In addition, the proliferation of electric vehicle in mobility as a service market as government across the globe are promoting EV’s to curb on city pollution levels and to reduce carbon emissions.However, integrating public and private transportation providers becomes a major challenge for ride sharing companies. And availability of mobility infrastructure majorly depends on government’s policies and flexibility to adopt with change. In developing and underdeveloped network infrastructure is poor, is restricting the mobility as a service market growth.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Based on Type, Ride Hailing segment is expected to dominate the market.

Ride hailing applications are gaining traction among consumers as it is easy to book and offers more comfort and convenience to consumers. Additionally, traffic congestion is increasing rapidly on roads especially in urban areas coupled with government programs spreading awareness about air pollution, are propelling the demand for shared mobility services, which is projected to have a positive impact on segment’s growth. Post-pandemic, people are preferring to use e-hailing services over public transportation for maintaining social distancing, which is boosting the demand for ride sharing services. Major mobility as a service companies have started offering new mobility services to consumers. For instance, Uber, a major ride hailing company, based out of United States, launched its Uber Corporate Shuttle services in 7 cities across India, which aims at helping employees to easily commute from their home to their workplace. Currently, the seating capacity in its vehicle varies between 10-50.

Based on Transportation Type, Private segment is estimated to hold the largest mobility as a service market share.

Rising urbanization worldwide coupled with fall in the car ownership rates, are creating demand for personal mobility solutions, which is accelerating the growth of private transportation segment.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

Based on Region, Asia-Pacific region is forecast to lead the market.

Asia-Pacific mobility as a service market is driven by rising urbanization, growing demand for efficient transportation solutions, rise in government’s expenditure on smart city projects and emerging need to reduce first mile and last mile related problems. In Asia-Pacific region, 5G infrastructure is improving, as consumers shifting from 4G to 5G. With increasing focus of governments on building smart cities, the application of 5G will become more critical in smart city as well as autonomous vehicles in the future. Additionally, mobility-as-a service market is growing slower in North American and European region as compared to Asia-Pacific due to local laws set by governments and growing concerns related to private data abuse.

Mobility as a Service Companies

Some of the notable players operating in the mobility as a service market are Moovit Inc., MaaS Global Oy, Citymapper, Mobilleo, SkedGo Pty Ltd., UbiGo Innovation AB, Splyt Technologies Ltd., Beijing Xiaoju Technology Co, Ltd., Communauto, and ANI Technologies Pvt. Ltd., among others.

Key Developments:

-

- In May 2022, M Auto, a motor vehicle manufacturing start-up based out of India, announced that it has raised funds worth USD 20 million from Africa Transformation and Industrialization Fund (ATIF), to offer electric mobility services in Africa.

- In December 2022, Uber announced its plans to launch public robotaxi services in Las Vegas. Riders will not charged any fees during early days, once company commercialize its driverless cars, riders will be charged some amount of fees.

- In June 2021, Grab Holdings a major mobility services provider announced its partnership with Hyundai to boost the adoption of electric vehicles, primarily in markets of Vietnam, Singapore and Indonesia.

- In February 2020, Ola Cabs, a major ride sharing company based out of India, announced that it has launched its ride hailing app in London. Almost 25,000 drivers signed on its taxi booking service app.

- In 2019, Toyota Motor Corporation, a major automotive manufacturer based out of Japan signed an agreement with Didi Chuxing (DiDi), to expand its mobility as service across China. Under this agreement, Toyota will invest approximately 600 million in DiDi to form a joint venture between both companies.

Segments covered in the Report:

The global Mobility as a Service Market has been segmented on the basis of service, transport type, business model, and regions. Based on service (ride hailing, car sharing, micromobility, bus sharing, and train services), by transport type (public and private), by business model (business-to-business, business-to-consumer, and peer-to-peer.

For detailed scope of the “Mobility as a Service Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2021) |

USD Million |

| Market Base Year |

2021 |

| Market Forecast Period |

2022-2029 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Service Type, By Transport Type, By Business Model, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Moovit Inc., MaaS Global Oy, Citymapper, Mobilleo, SkedGo Pty Ltd., UbiGo Innovation AB, Splyt Technologies Ltd., Beijing Xiaoju Technology Co, Ltd., Communauto, and ANI Technologies Pvt. Ltd.,, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Mobility as a Service Market by Service Type

-

- Ride Hailing

- Car Sharing

- Micromobility

- Bus Sharing

- Train Services

Global Mobility as a Service Market by Transportation Type

-

- Public

- Private

Global Mobility as a Service Market by Business Model

-

- Business-to-Business

- Business-to-Consumer

- Peer-to-Peer

Global Mobility as a Service Market by Region

-

- North America Mobility as a Service Market (Option 1: As a part of the free 25% customization)

- By Service Type

- ByTransportation Type

- By Business Model

- US Market All-Up

- Canada Market All-Up

- Europe Mobility as a Service Market (Option 2: As a part of the free 25% customization)

- By Service Type

- ByTransportation Type

- By Business Model

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific Mobility as a Service Market (Option 3: As a part of the free 25% customization)

- By Service Type

- ByTransportation Type

- By Business Model

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW Mobility as a Service Market (Option 4: As a part of the free 25% customization)

- By Service Type

- ByTransportation Type

- By Business Model

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America Mobility as a Service Market (Option 1: As a part of the free 25% customization)

Major Players Operating in the Mobility as a Service Market (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Moovit Inc.

- MaaS Global Oy

- Citymapper

- Mobilleo

- SkedGo Pty Ltd

- UbiGo Innovation AB

- Splyt Technologies Ltd.

- Beijing Xiaoju Technology Co, Ltd.

- Communauto

- ANI Technologies Pvt. Ltd.

Frequently Asked Question About This Report

Mobility as a Service Market [UP1294A-00-0620]

Mobility as a Service market is estimated to expand at a CAGR of 30.2% during the forecast period 2022-2029.

Ride Hailing segment is estimated to lead the market.

Asia-Pacific region is estimated to dominate the market.

Some of the prominent players operating in the mobility as a service market are Beijing Xiaoju Technology Co, Ltd., Communauto, Moovit Inc., MaaS Global Oy, Citymapper, ANI Technologies Pvt. Ltd., Mobilleo, SkedGo Pty Ltd., UbiGo Innovation AB, and Splyt Technologies Ltd., among others.

- Published Date: Sep - 2021

- Report Format: Excel/PPT

- Report Code: UP1294A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Mobility as a Service Market Size, Trends, and Industry Analysis Report By Service (Ride Hailing, Car Sharing, Micromobility, Bus Sharing, and Train Services), By Transport Type (Public and Private), By Business Model (Business-to-Business, Business-to-Consumer, and Peer-to-Peer), and By Region – Global Opportunities & Forecast, 2022-2029

$ 4,499.00 – $ 6,649.00

Why GMI Research