Nanosatellite and Microsatellite Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2024-2031

Nanosatellite and Microsatellite Market size reached USD 2.6 billion in 2023 and is estimated to reach USD 11.0 billion in 2031 and the market is estimated to grow at a very high CAGR of 19.8% from 2024-2031.

To have an edge over the competition by knowing the market dynamics and current trends of “Nanosatellite and Microsatellite Market”, request for Sample Report here

Major Nanosatellite and Microsatellite Market Drivers

The nanosatellite and microsatellite market growth is driven by an increase in demand for earth observation applications, a growing need for LED-based services, and a rising need for miniaturized satellites across military and defense industries. The Earth observation services offer tasks like monitoring disaster, agricultural fields, meteorology, weather forecasting, mining, and many more. The demand for high-resolution Earth imaging is on the increase in different segments. These pictures serve different purposes, including specific management of water, land, and forest reserves. Pictures address the developmental and security requirements of the country. Space-based information is highly valuable for anticipating and managing disasters effectively. The rising demand for data is propelled by forthcoming satellite constellations, robust data pipelines, and increased subscriptions to insight services. Nanosatellites and microsatellites boast shorter development cycles and improve orbit maneuverability compared to traditional satellites. These miniature satellites allow consistent data gathering, supporting long-term, systematic measurement of crucial climate variables. This consistent data help researchers in attaining a deeper understanding of global climate and continuous weather patterns.

Nanosatellites and microsatellites contribute to resource effectiveness, eradicating barriers to space admittance and exploration. Their lightweight and compact design has attained popularity since their inception, offering a cost-effective alternative to traditional satellites. Moreover, depending on demands, introducing, and launching a small satellite in orbit can incur lower costs compared to conventional counterparts. Also, beyond being smaller and lighter, a significant advantage of small satellites is their rapid development time. Unlike traditional large satellites, which may take 5 to 15 years to develop and deploy, nanosatellites can be designed and launched into the required orbit in not more than 8 months. Microsatellites and nanosatellites find applications in communication, space research, and commercial. Their growing demand is attributed to characteristics like lightweight design, enhanced and updated computing capabilities, shorter development cycles, and many more cost-effective innovation and launch procedures in present period. For instance, in 2021, York Space Systems focused to build a substantial manufacturing facility in Denver, U.S., focusing on quadrupling its production of small satellites. The increased importance of satellite manufacturers on compact satellite development, propelled by reduced costs and quicker development times, serves as a foremost factor driving the global nanosatellite and microsatellite market growth in the coming period.

Furthermore, the increase in demand for miniaturized satellites in different segments is predicted to propel market growth. For instance, in 2021, a Japan-based Epsilon rocket launched nine small satellites into orbit, making efforts to involve educational institutions and businesses in space exploration. In launching small satellites, the usage of heavy vehicles has been projected to be a challenge, leading to an increase in the need for dedicated small launch vehicles. Previously, small satellites were sent as secondary payloads with larger satellites, causing restraints in terms of both launch capabilities and costs. The growing demand for small launch vehicles to address cost restraints has resulted in the emergence of Small Satellite Launch Vehicles. In 2022, Chinese scientists aimed to develop a fleet of small satellites for improved astronomical investigations.

Meanwhile, small satellites face challenges in launch options, serving as secondary payloads on rockets intended for larger satellites or cargo to the International Space Station. These restrictions result in challenges related to integration and launch schedules, orbit destinations, and flexibility loss regarding subsystems in small satellites. Moreover, navigating the launch procurement procedure is complex for small satellite operators. Therefore, companies such as TriSept, Spaceflight Industries, Innovative Solutions in Space, Tyvak, and ECM Space have enhanced technologies to safely integrate a large number of small satellites, serving as secondary payloads on big launchers. Success for small launchers is estimated to be restricted due to challenges such as the struggle to match the price competitiveness of large launchers, the challenge in securing the required investment for development and operations, technological setbacks, and the risk of an oversaturated market resulting in tough competition.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Whereas, it is anticipated that the demand for satellite imagery is projected to rise from non-governmental entities, using images and image-based analytics for different applications, including economic forecasting, agriculture, resource management, urban planning, retail, disaster monitoring, and many more. The SpaceWorks 2020 report estimates that commercial operators’ market share for satellite use will increase from 55% in 2020 to 70% by 2024. While non-governmental requirements are projected to rise, their present size is insufficient to indicate a definitive growth. The success of commercial small satellite organizations is reliant on their ability to transform images and metadata into valuable information for end-users. As per SpaceWorks, a predicted 2,000-2,800 microsatellites and nanosatellites are expected to be launched in the next five years, with an aim for Earth observation and communication applications.

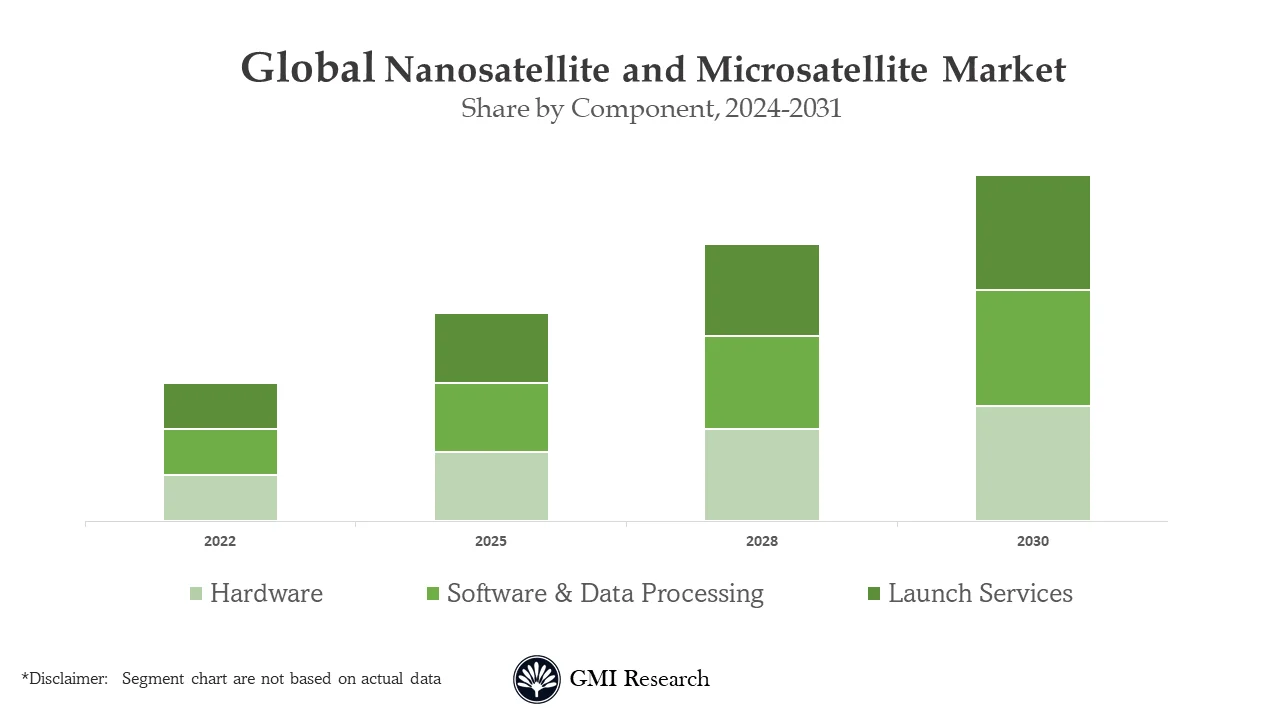

The software is accountable for executing commands, managing data, determining and controlling attitude, and adhering to satellite space protocol. Despite its critical functions,

For instance, in 2019, ISRO launched CARTOSAT-3 and 13 U.S. nanosatellites, topped by achieving 300 foreign satellite launches. In addition, in 2022, Carnegie Mellon University introduced a program to develop nanosatellite capabilities in low-earth orbit, receiving nearly USD 7 million as a grant from the Cyber-Physical Systems Frontiers Program initiated by the National Science Foundation. Factors including advanced processing in space allow the monitoring of agriculture, environmental protection, and geology on Earth. This significantly improves our understanding of environmental damage, its causes, and the rate at which such devastation occurs.

Larger enterprise segment dominated the market by organization type

Large enterprises, categorized as organizations with more than 1,000 employees, are probably to experience an increasing adoption of nanosatellites and microsatellites in the coming period. Nanosatellite constellations offer situational awareness and serve different determinations, including gathering brief data bursts from remote regions, monitoring sea and meteorological conditions, as well as remote sensing and surveillance. Continuous innovation and technological enhancements in electronics miniaturization are predicted to substantially develop the proportion of nanosatellite launches by large enterprises.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here.

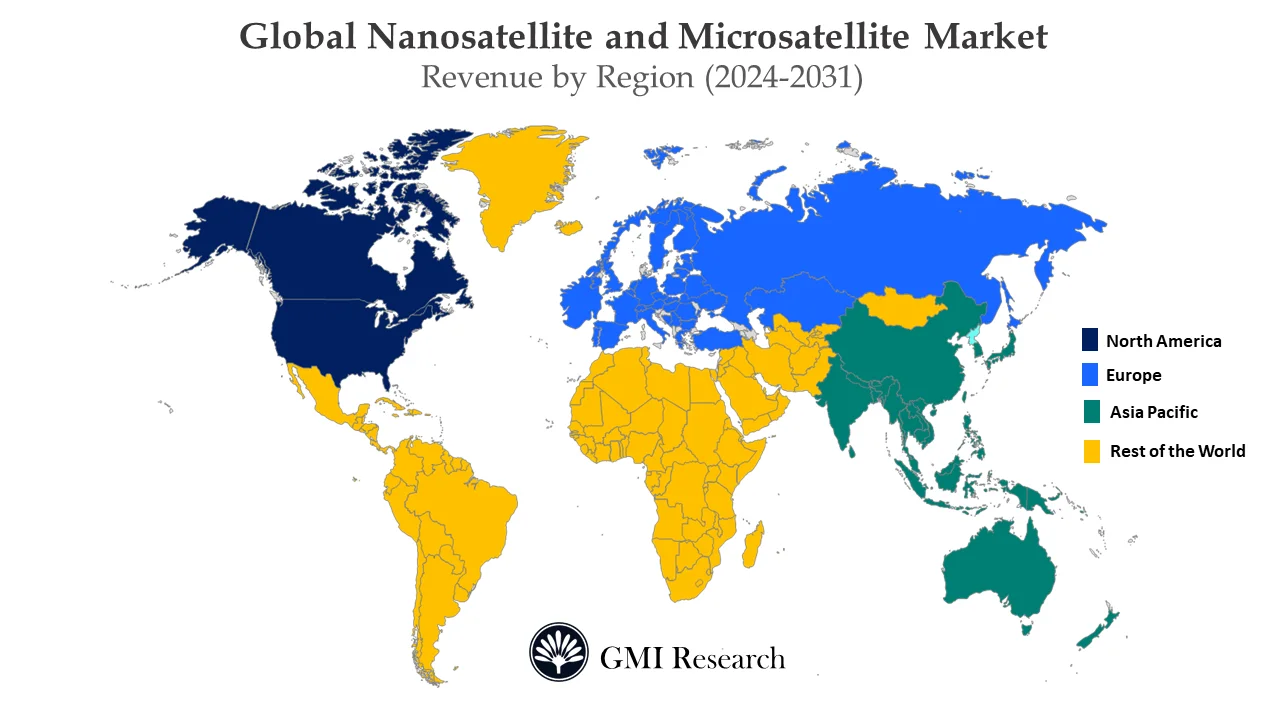

Europe by region accounted for the largest market revenue share in the global nanosatellite and microsatellite market

The European region leads the market growth due to an increase in demand for Earth observation, remote sensing, and scientific exploration activities. In 2022, Tenali-based Sai Divya developed, and innovated a 1U CubeSat nanosatellite called LakshyaSAT, which effectively launched into the stratosphere from the UK. The European Space Agency and other regional, and national space agencies are anticipated to launch different small satellites to collect data for climate monitoring, surveillance, navigation, and disaster management. Moreover, in 2022, Sateliot gained endorsement from the European Space Agency under the Future Preparation Generic Programme of the ARTES program. This approval is for launching the initial constellation of low-orbit nanosatellites, focused on delivering 5G coverage for the Internet of Things (IoT). The increase in technological innovations within the nanosatellite and microsatellite ecosystem, coupled with their expanded deployment, is projected to propel the growth in the Europe nanosatellite and microsatellite market.

Top Market Players

Various notable players operating in the market include Dauria Aerospace, GomSpace, Innovative Solutions in Space (ISIS), Sierra Nevada Corporation (SNC), Spire Global, Inc., SpaceQuest Ltd., Surrey Satellite Technology Limited (SSTL), The Boeing Company, Tyvak Inc., Vector Launch, Inc. among others.

Key Developments:

-

- In 2021, GomSpace joined hands with Unseen Labs to introduce an innovative next-generation satellite platform.

- In 2021, L3Harris signed an agreement of partnership with Air Tractor to launch a cost-effective production-ready ISR strike system to merge Air Tractor’s robust platform with L3Harris’ mature mission solutions.

- In 2020, Kepler Communication agreed with Space Flight Laboratory to announce Operational Nanosatellite Constellation to focus on attaining expertise on SFL designing and in-house production.

- In 2021, ISRO launched the Cartosat-2 satellite with 29 nanosatellites with 14 other countries on board the PSLV-C38 vehicle.

- In 2021, GomSpace and SIGCOM collaborated on the FNR-funded MegaLEO project. MegaLEO will advance the state-of-the-art large satellite constellations that operate semi-autonomously by deciding and executing satellite and network operation configurations in space.

Segments covered in the Report:

The Global Nanosatellite and Microsatellite Market has been segmented on the basis of Mass, Application, End-Use and Organization Size.Based on the Mass, the market is segmented into Nanosatellites, Microsatellites. Based on the Application, the market is segmented into Earth Observation/Remote Sensing, Communication & Navigation, Technology & Academic Training and Scientific Research. Based on the End-Use, the market is segmented into Government, Defense & Security, Commercial, Civil. Based on the Organization Size, the market is segmented into Large Enterprises and SMEs.

For detailed scope of the “Nanosatellite and Microsatellite Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2023) |

USD 2.6 billion |

| Market Base Year |

2023 |

| Market Forecast Period |

2024-2031 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Mass , By Application, By End-Use, By Organization Size and By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Dauria Aerospace, GomSpace, Innovative Solutions in Space (ISIS), Sierra Nevada Corporation (SNC), Spire Global, Inc., SpaceQuest Ltd., Surrey Satellite Technology Limited (SSTL), The Boeing Company, Tyvak Inc., Vector Launch, Inc., among others; a total of 10 companies covered |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Nanosatellite and Microsatellite Market by Mass

-

- Nanosatellites

- Microsatellites

Global Nanosatellite and Microsatellite Market by Application

-

- Communication & Navigation

- Earth Observation/Remote Sensing

- Scientific Research

- Technology & Academic Training

Global Nanosatellite and Microsatellite Market by End-Use

-

- Government

- Defense & Security

- Commercial

- Civil

Global Nanosatellite and Microsatellite Market by Organization Size

-

- SMEs

- Large Enterprises

Global Nanosatellite and Microsatellite Market by Region

-

-

North America Nanosatellite and Microsatellite Market (Option 1: As a part of the free 25% customization)

- By Mass

- By Application

- By End-Use

- By Organization Size

- US Market All-Up

- Canada Market All-Up

-

Europe Nanosatellite and Microsatellite Market (Option 2: As a part of the free 25% customization)

- By Mass

- By Application

- By End-Use

- By Organization Size

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Nanosatellite and Microsatellite Market (Option 3: As a part of the free 25% customization)

- By Mass

- By Application

- By End-Use

- By Organization Size

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Nanosatellite and Microsatellite Market (Option 4: As a part of the free 25% customization)

- By Mass

- By Application

- By End-Use

- By Organization Size

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Nanosatellite and Microsatellite market (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Dauria Aerospace

- GomSpace

- Innovative Solutions in Space (ISIS)

- Sierra Nevada Corporation (SNC)

- Spire Global, Inc.

- SpaceQuest Ltd.

- Surrey Satellite Technology Limited (SSTL)

- The Boeing Company

- Tyvak Inc.

- Vector Launch, Inc

Frequently Asked Question About This Report

Nanosatellite and Microsatellite Market [UP2604-001001]

The factors driving the global Nanosatellite and Microsatellite market include with the rise in the demand for small satellites in observation of earth, the demand for Low Earth Orbit (LEO) based services is increasing.

Accordion Some of the leading players in the Nanosatellite and Microsatellite Services market includes Dauria Aerospace, GomSpace, Innovative Solutions in Space (ISIS), Sierra Nevada Corporation (SNC), Spire Global, Inc., SpaceQuest Ltd., Surrey Satellite Technology Limited (SSTL), The Boeing Company, Tyvak Inc., Vector Launch, Inc. and among others.

Commercial sector market is projected to witness the fastest growth during the forecast period owning to the Private companies are investing in small satellites as they are cheaper and faster to build.

The growth rate of Nanosatellite and Microsatellite Market during 2024-2031 is 19.8%.

Related Reports

- Published Date: Feb-2024

- Report Format: Excel/PPT

- Report Code: UP2604-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Nanosatellite and Microsatellite Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2024-2031

$ 4,499.00 – $ 6,649.00

Why GMI Research