Nutraceutical Ingredients Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2024-2031

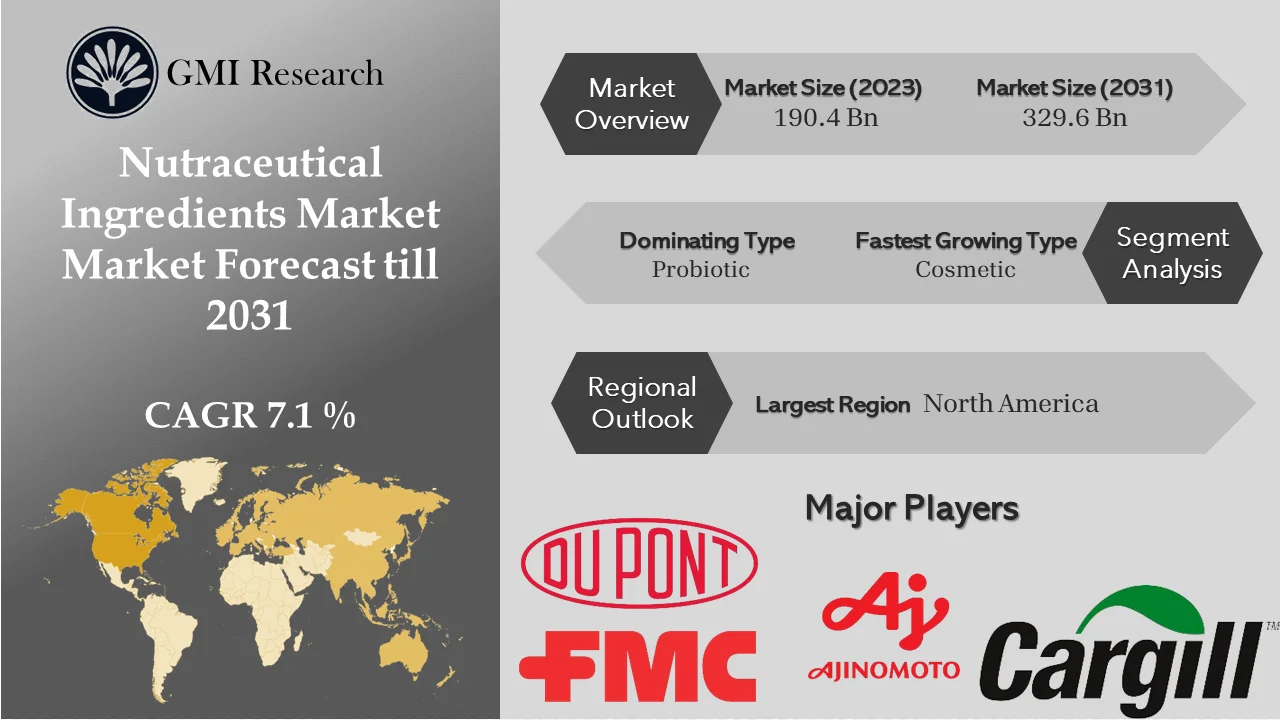

Nutraceutical Ingredients Market registered a revenue of USD 190.4 billion in 2023 and is projected to reach USD 329.6 billion in 2031, growing at a CAGR of 7.1% during the forecast period from 2024-2031.

To have an edge over the competition by knowing the market dynamics and current trends of “Nutraceutical Ingredients Market”, request for Sample Report here

Major Nutraceutical Ingredients Market Drivers

The primary drivers for nutraceutical ingredients market growth are a rising prevalence of balanced diets, growing healthcare awareness, adoption of healthy lifestyles, and growing healthcare spending. The global food and beverage market has been positively affected by the rise in nutritional and healthy eating. Customers are more indifferent about their dietary food choices due to the growing awareness of high-quality nutrition. Nutraceuticals are prevailing in the search for high-quality nutrition, especially during the growing incidence of lifestyle disorders. In developing markets, where nearly 40% of mortality is credited to nutrition-related factors, the significance of nutraceuticals has increased. Scientific and clinical findings confirming the nutraceutical ingredient advantages have further driven their market growth. Additionally, the growing market for nutraceutical ingredients is influenced by health-conscious customers, notably with the increasing prevalence of disorders. Growing mortality rates from non-communicable diseases have led customers to accept preventive measures, resulting to nutraceutical ingredients for their different health benefits. The rising budgetary allocation for the healthcare sector serves as a key driver for global nutraceutical ingredients market growth.

Many citizens recognize lifestyle-related diseases as a considerable problem, leading to increased consumer awareness of healthy food items and a rise in the market for nutritive products. Factors such as a long-life probability, an aging population, and an increase in chronic diseases have driven changes in dietary behaviors. The fastest-rising categories in the global health and wellness food and beverage market are fortified foods, followed by naturally healthy and organic foods. Moreover, developing the nutritional content of food by adding nutrients such as minerals and proteins is well-known as food fortification. Recognized institutions such as WHO and FAO of the United Nations consider food fortification a significant tool in combating global malnutrition.

The food fortification market is on the rise, driven by robust organizational support. Different developing countries are going beyond and making food fortification mandatory, leading to an extension of the fortified foods market in different nations. Government and non-government organizations are required to work together with food producers to organize food that addresses micronutrient shortages, introducing an international campaign to challenge with hidden hunger. Adding micronutrients to foods such as wheat, maize flour, oil, and rice coupled with condiments such as salt, is an economically efficient method. Food fortification, being a low-cost innovation, yields economic and long-term capital benefits. Government initiatives to combat chronic hunger, food fortification stands out as a cost-effective and significant investment. The growing awareness of customer health is a primary driver for the enhancement of fortified foods. People around the globe are adopting healthier lifestyles for long-term advantages, developing their immune systems, and reducing vulnerability to illness. Due to evolving lifestyles, consumers have less time or influence to make home-cooked meals. Consequently, there is a change to favor convenience meals, which are typically highly processed and may contain minimal quantities of essential nutrients compared to other types of food post-manufacturing.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

The growing sedentary lifestyle is leading to digestive problems such as constipation, indigestion, and bloating. Thus, there is a rise in digestive health supplement demand from clients looking for solutions to these health concerns. The Organization for Economic Co-operation and Development analysis forecasts that the percentage of health expenditure allocated to overweight and related conditions is estimated to reach 14% in the U.S. from 2020 to 2050. Technology and innovation empower large producers to introduce functional and nutraceutical foods targeting both general health and specific health issues. The adoption of preventive healthcare practices is boosting global product sales. Across emerging countries, the functional beverage market is one of the rapidly growing industries. There is an increasing need for nutritional water and ready-to-drink beverages within the functional beverage market.

The substantial production costs of raw materials for nutraceutical products are a key factor limiting customer admittance to their benefits. This is promoting customers to explore lower-cost substitute proteins. In addition, concerns about inadequate quality in nutraceutical manufacturing have increased, contributing to the challenge of bridging the need and supply gap. Whereas, the expansion of fiber-rich and highly nutritional supplement products is propelling market growth. The growing prevalence of gastrointestinal and lifestyle diseases, coupled with increased spending on personal care, is propelling the demand for dietetic nutrition. Furthermore, customers’ perception of dietary products, along with the linked benefits such as promoting bowel health and controlling blood sugar and cholesterol levels, will generate lucrative opportunities for the market.

The increased accessibility of vitamin-based supplements in different retail outlets, including departmental stores, is an important factor propelling the nutraceutical ingredients market size. These products have widespread customer acceptance due to their evident benefits, such as protection from illness, encouraging youthful vigor, and contributing to overall good health.

Dry ingredients are estimated to register the fastest growth in the forecast period by form in the global nutraceutical ingredients market

Manufacturers opt for dry nutraceutical ingredients because of their superior stability, ease of handling and storage, and adaptability in different products. Concerns about handling and storage are foremost factors propelling the demand for dry ingredients, given that liquid substances tend to be more unstable than their dry counterparts.

Food segment is projected to account for the largest market size

The consumption of junk food has significantly increased during the past decade, propelled by its palatability, texture, and mouthfeel. Thereby, food producers have started developing items that offer a healthier alternative. The preference for balanced diets and healthy food has stayed strong as customers become more health-conscious and informed. This trend has expanded the applications for functional foods, delivering promising growth opportunities for nutraceutical ingredient producers.

The Probiotics segment registered the global nutraceutical ingredients market growth

Probiotics are frequently employed to assist individuals in maintaining a balanced intestinal flora, known as the gut microbiome. Besides this, probiotics offer additional benefits, including promoting gut microbiome health, restoring balance after treatment or illness, and helping the immune system. The different benefits of probiotics make them a subject of considerable interest among individuals.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

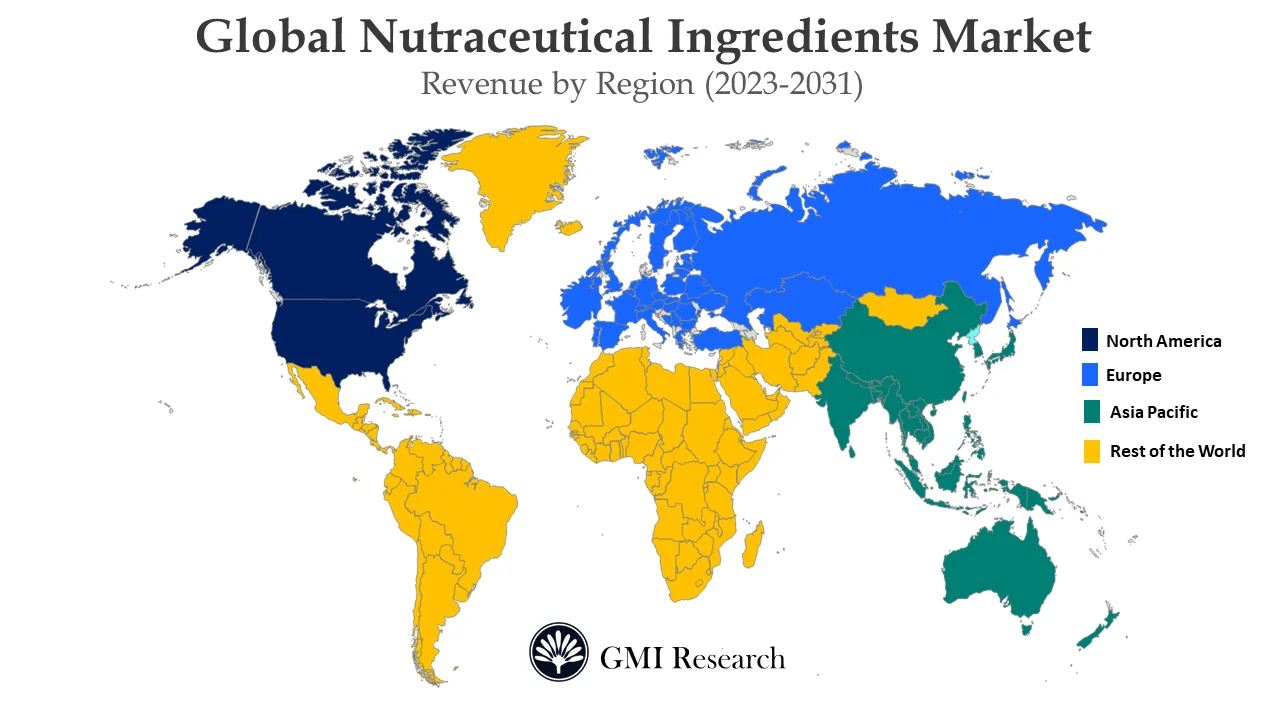

Asia Pacific region is anticipated to hold the highest CAGR in the near period in global nutraceutical ingredients market

The Asia Pacific region leads the nutraceutical ingredients market, holding the largest CAGR and exhibiting the highest growth rate in the forecast period. In APAC, Japan takes the lead in the market, followed by China, and India. Factors like increased working periods and a sedentary lifestyle are propelling customers’ overall health and well-being, supporting metabolic stress. Therefore, customers are increasingly relying on nutraceuticals for self-managed therapy. The awareness of the significance of gut health has prompted customers to look for nutritional solutions. As the economy gets better in some places and increase in disposable income shortly, the market for health-related products is predicted to rise because individuals tend to invest a good sum of their income on staying healthy.

In Japan, foods or nutraceuticals industry encouraging improvements in the gastrointestinal tract are the most common, followed by claims related to decreasing triglycerides, which come second after cholesterol reduction. Japan’s healthcare expenditure, accounting for 10.74% of the GDP in 2020 as per the World Bank, positions it among the topmost countries in health expenditures. The notable rise in healthcare spending has an accomplishment of these ingredients in the Japanese market. Moreover, the functional beverage segment in the nutraceutical ingredient market is anticipated to witness an ongoing growth rate in the forecast period. This is attributed to the increasing adoption of health and fitness drink products, which are in high demand, especially in regions including Malaysia, China, India, and Japan.

Top Market Players

Various notable players operating in the market include Cargill, Incorporated, BASF SE, International Flavors & Fragrances, Inc., Archer Daniels Midland Company, Associated British Foods PLC, Ajinomoto Co., Koninklijke DSM N.V., Ingredion Incorporated, Nutraceutix, Inc., FMC Corporation among others.

Key Developments:

-

- In 2023, ADM announced the introduction of a new production plant across Spain with an investment of US$ 30 million to address an increase in product requirements in the coming 5 years.

- In 2022, Tate & Lyle announced an acquisition of Quantum Hi-Tech Biological to reinforce the organization’s dietary fiber market across Asia.

- In 2022, ABF Ingredients announced an acquisition of Fytexia Group to extend its product portfolio in food, pharmaceutical, and nutritional sectors.

- In 2020, Chr. Hansen Holding A/S acquired HSO Health Care GmbH. The acquisition of the Austria-based B2B Company specializing in probiotics for women’s health is expected to strengthen and expand Chr. Hansen’s global microbial platform.

Segments covered in the Report:

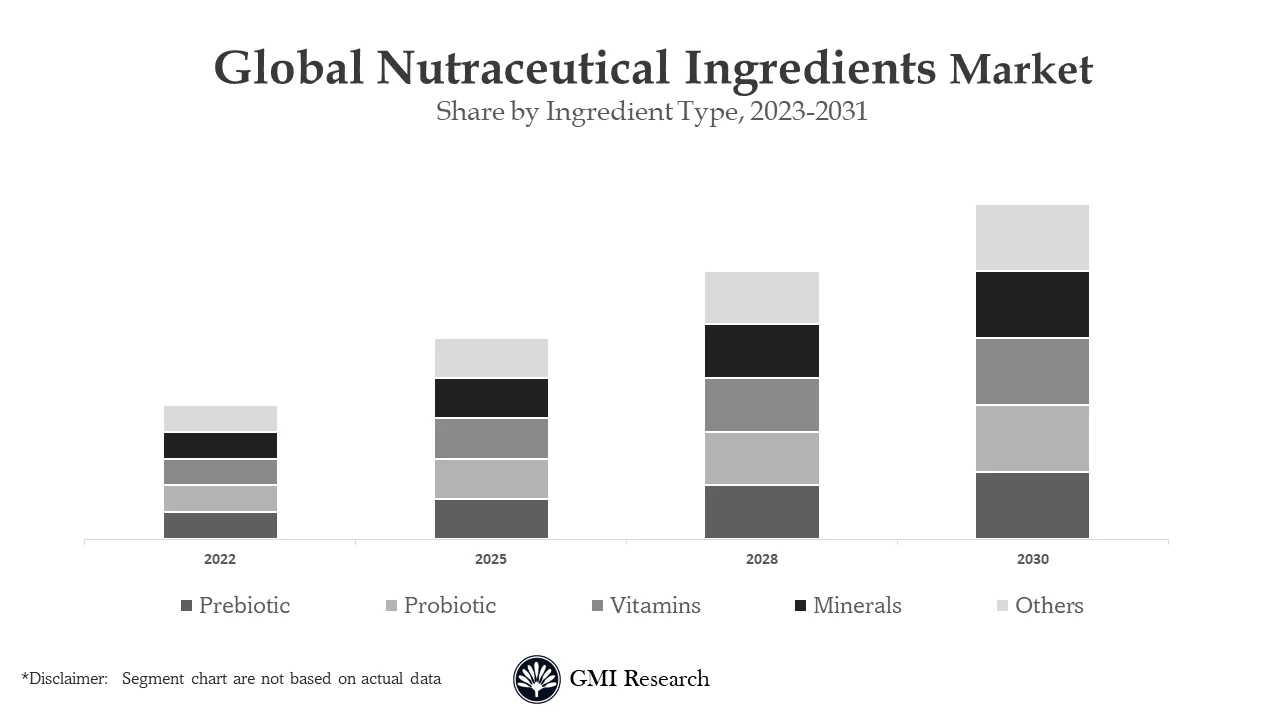

The Global Nutraceutical Ingredients Market has been segmented on the basis of Ingredient Type, Form and Application. Based on the Ingredient Type, the market is segmented into Probiotics, Proteins and Amino Acids, Phytochemicals & Plant Extracts, Fibers & Specialty Carbohydrates, Omega-3 Fatty Acids, Vitamins, Prebiotic, Carotenoids, Minerals. Based on the Form, the market is segmented into Dry and Liquid. Based on the Application, the market is segmented into Food, Beverage, Personal Care, Animal Nutrition and Dietary Supplement.

For detailed scope of the “Nutraceutical Ingredients Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2023) |

USD 190.4 billion |

| Market Base Year |

2023 |

| Market Forecast Period |

2024-2031 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Ingredient Type, By Form, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Cargill, Incorporated, BASF SE, International Flavors & Fragrances, Inc., Archer Daniels Midland Company, Associated British Foods PLC, Ajinomoto Co., Koninklijke DSM N.V., Ingredion Incorporated, Nutraceutix, Inc., FMC Corporation among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Nutraceutical Ingredients Market by Ingredient Type

-

- Probiotics

- Proteins And Amino Acids

- Phytochemicals & Plant Extracts

- Fibers & Specialty Carbohydrates

- Omega-3 Fatty Acids

- Vitamins

- Prebiotic

- Carotenoids

- Minerals

Global Nutraceutical Ingredients Market by Form

-

- Dry

- Liquid

Global Nutraceutical Ingredients Market by Application

-

- Food

- Beverage

- Personal Care

- Animal Nutrition

- Dietary Supplement

Global Nutraceutical Ingredients Market by Region

-

-

North America Nutraceutical Ingredients Market (Option 1: As a part of the free 25% customization)

- By Ingredient Type

- By Form

- By Application

- US Market All-Up

- Canada Market All-Up

-

Europe Nutraceutical Ingredients Market (Option 2: As a part of the free 25% customization)

- By Ingredient Type

- By Form

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Nutraceutical Ingredients Market (Option 3: As a part of the free 25% customization)

- By Ingredient Type

- By Form

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Nutraceutical Ingredients Market (Option 4: As a part of the free 25% customization)

- By Ingredient Type

- By Form

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Nutraceutical Ingredients Market (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Cargill, Incorporated

- International Flavors & Fragrances, Inc.

- BASF SE

- Archer Daniels Midland Company

- Associated British Foods PLC

- Ajinomoto Co.

- Koninklijke DSM N.V.

- Ingredion Incorporated

- Nutraceutix, Inc.

- FMC Corporation

Frequently Asked Question About This Report

Nutraceutical Ingredients Market [UP1275A-00-0620]

The cosmetic segment is expected to grow at a prominent rate over the forecast period primarily due to the growing demand for natural ingredients in cosmetic and beauty products, the rise in the global aging population coupled with the demand for products to improve and maintain the appearance and feel youthful.

The North America is expected to account for a notable market share during the forecast period owing to the rising health-conscious population together with high disposable income, growing awareness towards mental health, and high demand for functional foods among consumers.

The growth rate of Nutraceutical Ingredients Market during forecast period is 7.1%.

The key players in this market are Cargill, Incorporated, BASF SE, International Flavors & Fragrances, Inc., Archer Daniels Midland Company, Associated British Foods PLC, Ajinomoto Co., Koninklijke DSM N.V., Ingredion Incorporated, Nutraceutix, Inc., FMC Corporation, among others.

Related Reports

- Published Date: Feb-2024

- Report Format: Excel/PPT

- Report Code: UP1275A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Nutraceutical Ingredients Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2024-2031

$ 4,499.00 – $ 6,649.00

Why GMI Research