Payment Processing Solutions Market Size, Growth Opportunities, Trends Analysis & Global Industry Forecast Report, 2023-2030

Payment Processing Solutions Market was valued at USD 89.8 billion in 2022 and is forecast to touch USD 203.9 billion in 2030 and is expected to register a CAGR of 10.8% during the forecast period.

Payment Processing Solutions Market Overview

Payment processing refers to the automated transactions between customers and merchants. It is a third-party service that processes an individual’s payment and debits it in the merchant’s account. In case a customer purchases the products or services through debit or credit cards, the payment processing company or payment processor is held responsible for handling the transactions on the company’s behalf. The global payment processing solutions market covers different payment methods such as eWallet, credit card, debit card, among others.

To have an edge over the competition by knowing the market dynamics and current trends of “Payment Processing Solutions Market”, request for Sample Report here

Major Payment Processing Solutions Market Drivers

The growth of the payment processing solutions market size is mainly driven due to the increasing eCommerce sales owing to the growing penetration of the internet. The continuous growth of eCommerce is attributed to the rapid technological adoption, which is mainly led by the growing use of devices and the emergence of 4G and 5G technologies. Thus the growth in the eCommerce sector is surging the usage of ePayments. The ePayments eliminates the cost related to the collection of cash for a product purchased. As per the IBEF, the India eCommerce market is projected to touch USD 99 billion by the end of 2024 while increasing at a CAGR of 27% over 2019-2024.

Moreover, the online retail sales in the country is projected to grow due to the accelerating sales on Flipkart, Amazon India, and Paytm Mall.. The government bodies are taking initiatives to support digital payments. The France government introduced the National Strategy for Cashless Payment Instruments, with an aim to encourage electronic means of payment in the country.

Restraints in the Global Payment Processing Solutions Market

On the other hand, the rising threats of cyberattacks on digital payment solutions is hindering the growth of the payment processing market share in terms of revenue. Moreover, the integration of payment technologies in businesses has also surged the risk and concerns related to privacy of data, theft of information, and compliance.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

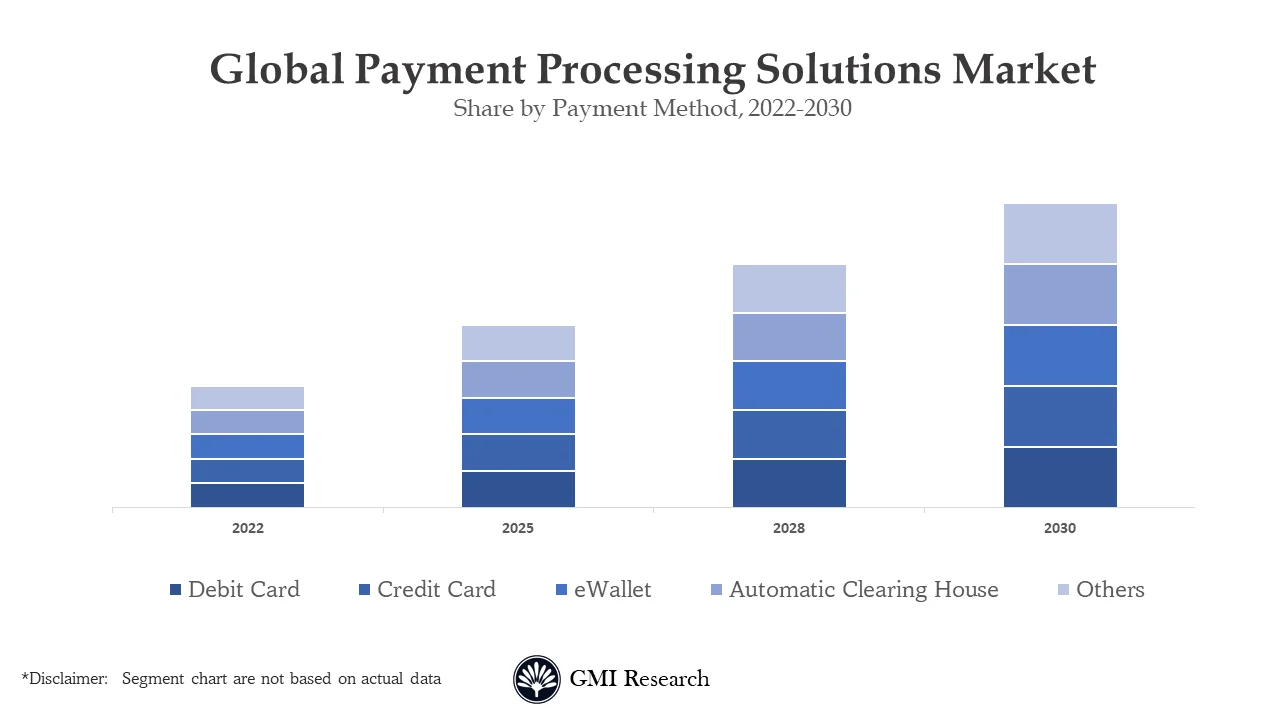

Payment Method – Segment Analysis

Based on the payment method, credit card is projected to grow at a higher CAGR during the forecast period. This is mainly due to the ability of credit card to provide payment options from the merchant’s sides for the products or services purchased and then paying the amount along with the agreed charges. On the other hand, the debit card is expected to dominate the market over the forecast period. The growing use of debit cards for daily transactions, especially in the European countries, is responsible for the growth of the market. In addition to this, there has been an increase in the number of debit cardholders in economies including India, China, and Germany. As per the Reserve bank of India, the total number of debit cardholders reached 944.3 million in India for 2018.

Vertical – Segment Analysis

Based on the vertical, the BFSI is expected to grow at a higher CAGR during the forecast period. The rising adoption of this solutions by the leading banks has surged the market growth over the coming years. In 2017, Mastercard provided Airtel Payments Bank, an outsourced payments processing platform to allow payment services such as card management and support the dispute management processes.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

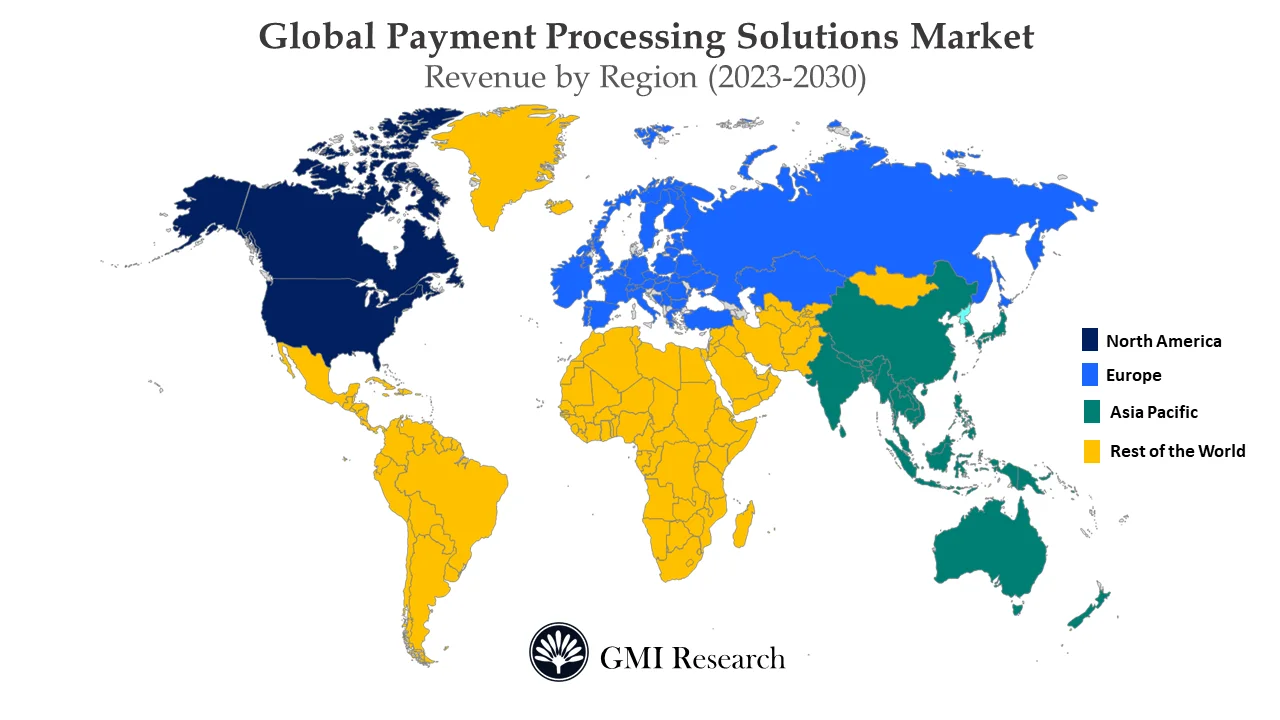

Regional – Segment Analysis:

On the regional coverage, Asia-Pacific is expected to lead the market over the forecast period. The increasing number of transactions conduction through smartphones on a daily basis have surged, especially in India, China, Indonesia, and Malaysia. As per the World Bank, the total percentage of bank account holders in the APAC touched 73% in 2017, which was 13% in 2011. Moreover, the continuous expansion of the retail and consumer goods sector in India, China, and Australia, is further driving the regional market growth.

Top Market Players

Some of the leading players operating in the market include PayPal Payments Private Limited, Fiserv, Inc., FIS, Square, Inc., Global Payments Direct, Inc., Wirecard, ACI Worldwide, Inc., Mastercard, VISA, and Adyen, among others.

Key Developments:

-

- In 2020, Fiserv, Inc., collaborated with Deluxe Corporation, one of the leading technology company, to introduced merchant solutions for Deluxe small business customer.

- In 2019, PayPal Payments Private Limited entered a partnership with Citibank to allow the bank’s institutional clients to make payments into the individual’s PayPal digital wallets.

- In 2019, FIS acquired Worldpay, with an aim to become global leader in technology and solutions for merchants, banks, and capital markets.

Segments covered in the Report:

The global Payment Processing Solutions market has been segmented on the basis of Payment Method, Deployment Type, Vertical, and regions. Based on Payment Method, the market is segmented into eWallet, credit card, debit card, automatic clearing house, and others. Based on Deployment Type, the market is segmented into On-Premises and Cloud-Based. Based on Vertical, the market is segmented into BFSI, Government and Utilities, Telecom and IT, Healthcare, Real Estate, Retail and Ecommerce, Media and Entertainment, Travel and Hospitality, and Others.

For detailed scope of the “Payment Processing Solutions Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 89.8 billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Payment Method, By Deployment Type, By Vertical, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | PayPal Payments Private Limited, Fiserv, Inc., FIS, Square, Inc., Global Payments Direct, Inc., Wirecard, ACI Worldwide, Inc., Mastercard, VISA, and Adyen, among others; a total of 10 companies covered |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Payment Processing Solutions Market by Payment Method

-

- eWallet

- Credit Card

- Debit Card

- Automatic Clearing House

- Others

Global Payment Processing Solutions Market by Deployment Type

-

- On-Premises

- Cloud-Based

Global Payment Processing Solutions Market by Vertical

-

- BFSI

- Government and Utilities

- Telecom and IT

- Healthcare

- Real Estate

- Retail and Ecommerce

- Media and Entertainment

- Travel and Hospitality

- Others

Global Payment Processing Solutions Market by Region

-

-

North America Payment Processing Solutions Market (Option 1: As a part of the free 25% customization)

- By Payment Method

- By Deployment Type

- By Vertical

- US Market All-Up

- Canada Market All-Up

-

Europe Payment Processing Solutions Market (Option 2: As a part of the free 25% customization)

- By Payment Method

- By Deployment Type

- By Vertical

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Payment Processing Solutions Market (Option 3: As a part of the free 25% customization)

- By Payment Method

- By Deployment Type

- By Vertical

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Payment Processing Solutions Market (Option 4: As a part of the free 25% customization)

- By Payment Method

- By Deployment Type

- By Vertical

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Payment Processing Solutions (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- PayPal Payments Private Limited

- Fiserv, Inc.

- FIS

- Square, Inc.

- Global Payments Direct, Inc.

- Wirecard

- ACI Worldwide, Inc.

- Mastercard

- VISA

- Adyen

Frequently Asked Question About This Report

Payment Processing Solutions Market [UP1726-001001]

The major factors that driving the payment processing solutions market size is due to the increasing eCommerce sales owing to the growing penetration of the internet.

The credit card is projected to grow at a higher CAGR during the forecast period. This is mainly due to the ability of credit card to provide payment options from the merchant’s sides for the products or services purchased and then paying the amount along with the agreed charges.

The growth rate of Payment Processing Solutions Market during 2023-2030 is 10.8%.

Asia-Pacific is projected to lead the market during the forecast period. The increasing number of transactions conduction through smartphones on a daily basis have surged, especially in India, China, Indonesia, and Malaysia

- Published Date: Jun - 2023

- Report Format: Excel/PPT

- Report Code: UP1726-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Payment Processing Solutions Market Size, Growth Opportunities, Trends Analysis & Global Industry Forecast Report, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research