Railway Telematics Market Size and Analysis Report by Solution, By Railcar, By Component, and By Region- Global Opportunities & Forecast 2021-2028

Railway Telematics Market Size and Analysis Report by Solution (Fleet Management, Automatic Stock Control, Remote Data Access, Rail Tracking & Tracing), By Railcar (Hoppers, Tank Cars, Well Cars, Box Cars, Refrigerated Boxcar, and others), By Component (Telematics Control Unit, Sensors), and By Region.

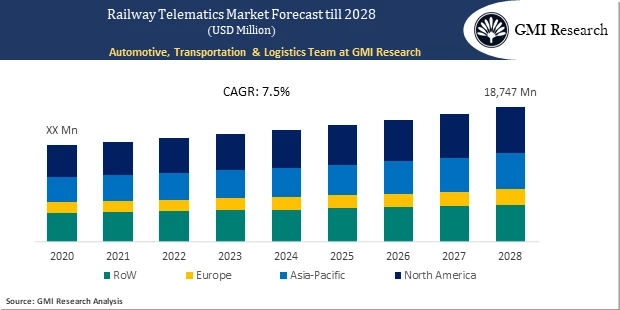

Railway Telematics Market size is predicted to reach USD 18,747 Million by 2028, estimated to grow at a CAGR of 7.5% during 2021-2028.

Introduction of the Railway Telematics Market Report

Railway Telematics systems are primarily implemented by rail corporations, rail management companies, and insurance companies to monitor the location and behavior of railcars. Railway telematics is an integration of different technology elements such as hardware, software, and network elements. Telematics records the GPS position and helps in the optimized planning of routes and resources.

To have an edge over the competition by knowing the market dynamics and current trends of “Railway Telematics Market”, request for Sample Report here

Market Dynamic

Key Drivers and Emerging Trends

The increasing urbanization resulted in the development of smart cities. Government bodies are taking initiatives for smart cities to provide better transportation and increase the pace of operational activities. Increased budget for the development of railways and the demand for safer, secure, and efficient transportation systems is expected to raise demand for Railway Telematics. Moreover, the implementation of the railway intelligence system needs combined efforts from various stakeholders such as telecom operators, service providers, manufacturers, and end-user. The government is implementing Public-Private Partnership (PPP) in railways, which allows the private sector to contribute to the intelligent railways initiative offered by the government, which can be a factor to drive the market growth.

Additionally, the need for telematics in freight and cargo transportation has increased globally. Increasing population has given rise to the development of transportation infrastructure. The rail industry is undergoing continuous changes in terms of technology for higher efficiency and safety. For instance, in 2020, Trinity rail joint ventured with GATX Corp to accelerate the adoption of GPS location and other telematics.

Restraint in the Railway Telematics Market

However, trains equipped with the advanced system require active internet for transmitting and receiving signals with the control station to regulate its operations. Hence it becomes easy for the hacker to discover the loophole to hack the system, making it vulnerable to attack the network. Such cyberattacks will further restrict the market growth of railway telematics market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Solution – Segment Analysis

Based on Solution, the rail tracking & tracing segment is expected to witness higher growth in the coming years due to the growing demand for predictive maintenance of freight wagons to identify operational issues. Rail tracking & tracing offers various solutions such as collision detection and prevention, and shock detectors for accurate threat analysis are some factors expected to drive the growth of the segment.

Railcar – Segment Analysis

Based on Railcar, the hoppers segment is expected to witness higher growth in the coming years. Hoppers help in freight activities and bulk transportation of commodities such as grain, coal, and ore. The growing demand across various logistics and freight transportation for transporting and tracking consignments is expected to drive the demand of telematics for hopper railcars.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here.

Regional – Segment Analysis

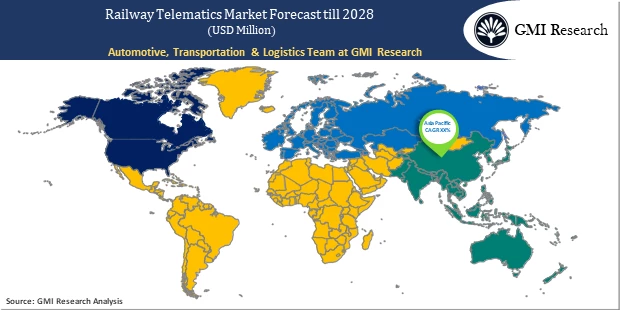

Based on region, the Asia Pacific region is expected to grow as the largest market for Railway Telematics globally during the forecast period. Emerging countries such as India, China, and others have recognized the benefits of expanding railway infrastructure and its positive impact on the economy. However, advancement in trains require the upgradation of signalling technology, monitoring system, and others. Furthermore, increasing awareness about accident and driver safety, the expansion of logistics and freight transportation has given rise to the entry of several OEMs in the region and is expected to drive the market for railway telematics.

Top Market Players

Several leading companies in the market include Siemens AG, Hitachi Ltd., Robert Bosch, Knorr-Bremse, Alstom SA, Intermodal Telematics, Railnova, Trinity Industries, Savvy Telematics, Intrex Telematics, and among others.

Key Developments:

-

- In 2021, Trinity Rail Group launched a new service technology platform, Trinsight. The product will provide real-time intelligence on the location, condition, and location of the rail equipment. It will improve rail transportation efficiencies and safety.

- In 2021, Siemens AG announced digitalization of Finnentrop interlocking. The company stated that 404 interlocking are to be implemented, which include switch points and derailers.

Segments covered in the Report:

The Railway Telematics Market has been segmented based on Solution, Railcar, Component, and region. Based on Solution, the market is segmented into Fleet Management, Automatic Stock Control, Remote Data Access, Rail Tracking & Tracing. Based on Railcar, market is segmented into Hoppers, Tank Cars, Well Cars, Box Cars, Refrigerated Boxcar, and others. Based on Component, the market is segmented into Telematics Control unit, Sensors.

For detailed scope of the “Railway Telematics Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is global railway telematics market growing? What will be the growth trend in the future?

- What are the key drivers and restraints in railway telematics Market? What will be the impact of drivers and restraints in the future?

- What are the regional revenues and forecast breakdowns? Which are the major regional revenue pockets for growth in the global railway telematics market?

- Which solution generated maximum revenues in 2020 and identify the most promising solution during the forecast period?

- What are the various railcars of global railway telematics Market and how they are poised to grow?

- What companies are the major participants in this market and their business strategies, how does the competitive landscape look like?

|

Report Coverage |

Details |

| Market Base Year |

2020 |

| Market Forecast Period |

2021-2028 |

| Market Revenues (2028) |

USD 18,747 Million |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Solution, By Railcar, By Component, and By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Siemens AG, Hitachi Ltd., Robert Bosch, Knorr-Bremse, Alstom SA, Intermodal Telematics, Railnova, Trinity Industries, Savvy Telematics, Intrex Telematics, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Railway Telematics Market by Solution

-

-

- Fleet Management

- Automatic Stock Control

- Remote Data Access

- Rail Tracking & Tracing

-

Global Railway Telematics Market by Railcar

-

-

- Hoppers

- Tank Cars

- Well Cars

- Box Cars

- Refrigerated Boxcar

- Others

-

Global Railway Telematics Market by Component

-

-

- Telematic Control Unit

- Sensors

-

Global Railway Telematics Market by Region

-

- North America Railway Telematics Market (Option 1: As a part of the free 25% customization)

- North America Railway Telematics Market by Solution

- North America Railway Telematics Market by Railcar

- North America Railway Telematics Market by Component

- US Railway Telematics Market All-Up

- Canada Railway Telematics Market All-Up

- Europe Railway Telematics Market (Option 2: As a part of the free 25% customization)

- Europe Railway Telematics Market by Solution

- Europe Railway Telematics Market by Railcar

- Europe Railway Telematics Market by Component

- UK Railway Telematics Market All-Up

- Germany Railway Telematics Market All-Up

- France Railway Telematics Market All-Up

- Spain Railway Telematics Market All-Up

- Rest of Europe Railway Telematics Market All-Up

- Asia-Pacific Railway Telematics Market (Option 3: As a part of the free 25% customization)

- Asia-Pacific Railway Telematics Market by Solution

- Asia-Pacific Railway Telematics Market by Railcar

- Asia-Pacific Railway Telematics Market by Component

- China Railway Telematics Market All-Up

- India Railway Telematics Market All-Up

- Japan Railway Telematics Market All-Up

- Rest of APAC Railway Telematics Market All-Up

- RoW Railway Telematics Market (Option 4: As a part of the free 25% customization)

- RoW Railway Telematics Market by Solution

- RoW Railway Telematics Market by Railcar

- RoW Railway Telematics Market by Component

- Brazil Railway Telematics Market All-Up

- South Africa Railway Telematics Market All-Up

- Saudi Arabia Railway Telematics Market All-Up

- UAE Railway Telematics Market All-Up

- Rest of world (remaining countries of the LAMEA region) Railway Telematics Market All-Up

- North America Railway Telematics Market (Option 1: As a part of the free 25% customization)

Major Players Operating in the Railway Telematics market (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

-

- Siemens AG

- Hitachi Ltd.

- Robert Bosch

- Knorr-Bremse

- Alstom SA

- Intermodal Telematics

- Railnova

- Trinity Industries

- Savvy Telematics

- Intrex Telematics

-

Frequently Asked Question About This Report

Railway Telematics Market [UP2805-001001]

Asia Pacific is expected to capture a significant growth in the global Railway Telematics market due to the emerging countries such as India, China, and others have recognized the benefits of expanding railway infrastructure and its positive impact on the economy.

The key drivers boosting the growth of the global Railway Telematics market includes the increasing urbanization resulted in the development of smart cities. Government bodies are taking initiatives for smart cities to provide better transportation and increase the pace of operational activities.

Several notable players operating in the railway telematics market includes Siemens AG, Hitachi Ltd., Robert Bosch, Knorr-Bremse, Alstom SA, Intermodal Telematics, Railnova, Trinity Industries, Savvy Telematics, Intrex Telematics, and among others.

The growth rate of railway telematics market during 2021-2028 is 7.5%.

- Published Date: Jan-2022

- Report Format: Excel/PPT

- Report Code: UP2805-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Railway Telematics Market Size and Analysis Report by Solution, By Railcar, By Component, and By Region- Global Opportunities & Forecast 2021-2028

$ 4,499.00 – $ 6,649.00

Why GMI Research