Rare Earth Metals Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

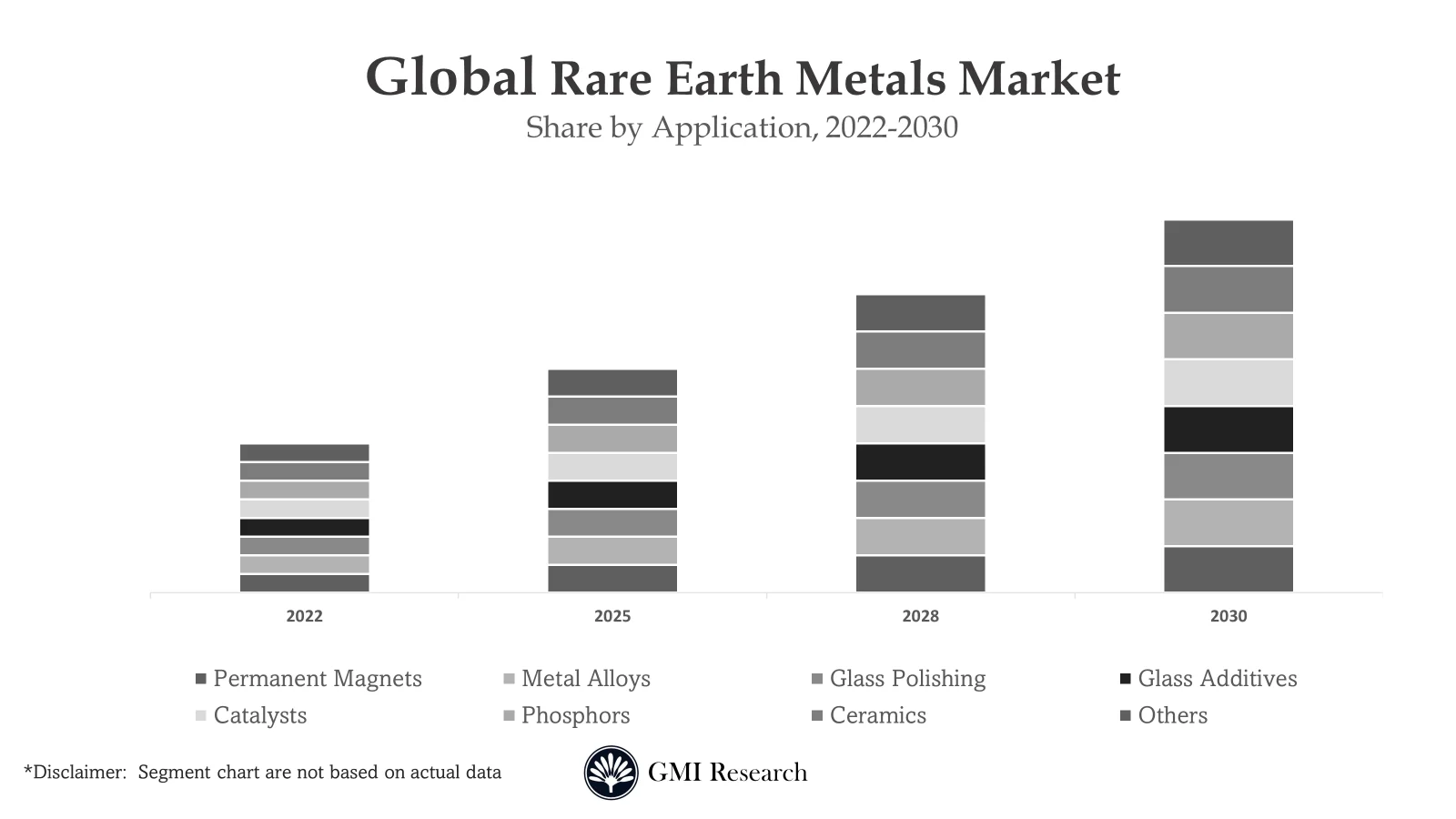

GMI Research analysis indicates that the Rare Earth Metals Market size was estimated at USD 5.9 billion in 2022 and is slated to register a double digit CAGR of 11.6% over the period 2023-2030 and is projected to reach USD 14.2 billion in 2030.

To have the edge over the competition by knowing the market dynamics and current trends of “Rare Earth Metals Market,” request for Sample Report here

Major Rare Earth Metals Market Drivers

The primary drivers to drive the global rare earth metals market are a rise in the need for clean energy globally, an increase in demand from different industries such as consumer electronics, automotive, and others, and adoption of electronic gadgets, and mobile devices. Natural sources such as solar, wind, geothermal, and tidal energy are increasingly identified as the future of clean energy. Rare earth elements produce components and equipment essential for introducing renewable energy. This includes solar cells, wind turbine magnets, components in smartphones, and cells used in electric vehicles.

The renewable energy industry, a foremost consumer of rare earth metals and products, depends on elements such as dysprosium and neodymium for manufacturing permanent magnets used in wind turbines. The growing need for hybrid and electric vehicles is estimated to foster the rare earth metal market. Rare earth metals are essential in the electric vehicle industry, specifically in the production of batteries that power these environmentally friendly vehicles. In hybrid vehicles, the usage of magnets made from rare earth metals is fundamental for the electric motors that propel these vehicles. This growth in the electric vehicle market is supporting the overall growth of the global rare earth metal market.

The increased demand for consumer durables and electronics, including smartphones, and laptops, has propelled the increased usage of rare earth metals. These metals are enhancing the performance of components such as microphones, and speakers within these consumer electronics devices. The magnetic and high-temperature resistance properties of rare earth metals make them valuable in different electronic applications. As continuous technological innovations, the increase in rare earth metals demand in the electronics sector is predicted to drive the market share in the forecast period. Besides this, the rapid urbanization and infrastructure development in emerging nations often lead to increased demand for technologies and products that require rare earth metals. These metals have different uses in various applications, from electronics to renewable energy technologies that drive their consumption due to rising urbanization and infrastructure projects. The different infrastructural and development activities result in digitizing developing economies, which present different market growth opportunities.

Also, rare earth metals are not being economically exploitable. International Energy Agency states that the demand for rare earth elements in clean energy technologies is predicted to triple if countries accomplish their clean energy policy goals. Governments globally are presenting the significance of these metals in advancing technologies crucial for the renewable energy sector. As nations strengthen efforts to curb carbon emissions, the usage of rare earth metals in clean energy production becomes increasingly important for confirming secure and resilient energy systems. Prominent energy producers, including Siemens Gamesa Renewable Energy and Vestas Wind Systems, are implementing permanent magnet generators using neodymium-iron-boron in their state-of-the-art offshore wind turbines. This results in an increasing trend toward using rare earth metals in improved technologies for sustainable energy production. To lower production costs and develop performance, specifically at higher temperatures, producers are creating other rare earth elements such as dysprosium, praseodymium, and terbium in addition to neodymium for magnet production. Rare earth metals are also being used as substitutes for metals in PV solar cells, contributing to increased cell effectiveness and lessen the cost.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Meanwhile, the volatility in prices of rare earth oxides in North America and Western Europe is attributed to their relatively low volume share among other minerals. These rare earth oxides are essential in the production of different products, including batteries, aircraft alloys, bearings, and automotive motors. The increasing demand for products using rare earth metals is predicted to result in increased raw material prices and supply chain disruptions. In addition, China’s monopoly in the market has led to high export prices is predicted to be a challenge to market growth. Furthermore, China’s restriction on the supply of rare earth oxides to meet future requirements has created additional disruptions for end-use supply chain industries across foreign countries.

Whereas, rare earth metals find applications in the healthcare sector, contributing to the manufacturing of different medical devices including sleep apnea machines, pacemakers, insulin pumps, and MRI machines. Scandium finds applications in the healthcare sector, contributing to the production of high-strength aluminum alloys, assisting laser research, and helping in the development of high-strength metal halide lamps.

Moreover, significant investments in technological innovations in different industries are predicted to lead the key trends and market growth opportunities. These technological advancements not only focus on developing effectiveness but also incorporate sustainability practices, specifically within the green energy segment. Hence, the adoption of these metals is predicted to grow significantly if the emerging nations meet their prescribed objectives of clean energy and green energy.

The neodymium oxide segment is estimated to hold the largest market share in global rare earth metals market

The usage of neodymium oxide in the production of neodymium-iron-boron magnets, known for their strengths, is widespread in different modern applications including aircraft, consumer electronics such as microphones and headphones, and vehicles. The growing need for clean energy applications is a propelling the market.

The Phosphors segment is estimated to hold the highest CAGR in global market in the forecast period

By application, the phosphors segment is predicted to witness the highest CAGR because they are important in applications that need color in the emitted light, such as fluorescent lamps, cathode ray tube displays, and other applications. Key elements in this sector include terbium, yttrium, and europium. Phosphorus is important in converting incident radiation into light of desired colors, with their properties determined by the elements included in them. The demand for rare earth oxide phosphor products is predicted to grow due to government policies in different regions, including Canada, China, the U.S., and the European Union, encouraging the replacement of incandescent lamps with LED lamps and fluorescent lights.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Customization here

Asia Pacific region is predicted to exhibit the highest revenue share in the forecast period

Asia Pacific region holds a significant share in the market, propelled by rising investments in the healthcare industry and increasing need and production across the ceramic sector. This has led to a substantial increase in the consumption of rare earth elements around the region. Additionally, the global supply of high-value rare earth elements is highly sensitive to changes in China’s manufacturing sector, as the majority of the world’s supply, nearly 78% in 2021, comes from China, based on reports of the US Geological Survey.

In 2021, China manufactured a total of 26.08 million motor vehicles, indicating a 3% increase from the previous year. Meanwhile, India produced 4.39 million motor vehicles, witnessing a significant 30% growth compared to the previous years, are disclosed by OICA. These numbers of automotive production in China and India is predicted to increase the demand for rare earth elements.

Top Market Players

Various notable players operating in the market include Aluminum Corporation of China Ltd, ARAFURA RESOURCES, Avalon Advanced Materials Inc., Minmetals Land Limited, Eutectix, Iluka Resources Limited, Lynas Rare Earths Ltd, Peak Resources, Rare Element Resources Ltd, Rio Tinto among others.

Key Developments:

-

- In 2022, Solvay announced an expansion of its operations of rare earths in La Rochelle, France to serve customers in the fastest-rising wind power, electronics, and electric vehicles market.

- In 2022, Australia’s Lynas invested USD 500 million to extend capacity to address the growing demand for rare earth elements.

- In 2022, Iluka announced the development and investment of Eneabba Phase 3 rare earth refinery across Western Australia and USD 1.2 billion respectively to strengthen the portfolio and produce high-performance dysprosium, terbium, and others.

- In 2021, Rio Tinto collaborated with the United States Geological Survey (USGS) to seek for critical minerals under the Continental Divide near Montana’s Boulder Batholith. USGS teamed up with a resource company to fly airborne geophysical surveys in areas of interest in 2022 as part of its Earth Mapping Resources Initiative (Earth MRI), allowing it to double the area under survey.

- In 2021, Rio Tinto initiated the production of scandium oxide by constructing a commercial-scale demonstration plant in Sorel-Tracy, Quebec. The initial capacity of the scandium oxide is 3 ton per year, which is nearly 20% of the current global production.

- In Jun 2019, Avalon Advanced Materials Inc. entered into an agreement with Cheetah Resources Pty Ltd to collaborate for development of rare earth resources on the collective leases of the Nechalacho Project at Thor Lake near Yellowknife, NWT, Canada. Under this agreement, Cheetah will have ownership of the near-surface mineral resources, primarily the T-Zone and Tardiff Zones that are above a depth of 150 meters above sea level. The Avalon will have ownership of the deeper resources in the Basal Zone

- In Dec 2018, Eutectix LLC and Materion Corporation entered into an intellectual property licensing agreement, which is a license to the entire Materion bulk metallic glass patent portfolio and any and all patents arising therefrom, and the license is exclusive for the first five years. This agreement will increase the market penetration of their technology and enhance business relationships.

Segments covered in the Report:

The Global Rare Earth Metals Market has been segmented on the basis of Type and Application. Based on the Type, the market is segmented into Cerium Oxide, Lanthanum Oxide, Neodymium Oxide, Yttrium Oxide, Dysprosium Oxide, Terbium Oxide, Scandium Oxide, Other Oxides. Based on the Application, the market is segmented into Permanent Magnets, Metal Alloys, Glass Polishing, Glass Additives, Catalysts, Phosphors, Ceramics, Others.

For detailed scope of the “Rare Earth Metals Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 5.9 billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Type, By Application, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Aluminum Corporation of China Ltd, ARAFURA RESOURCES, Avalon Advanced Materials Inc., Minmetals Land Limited, Eutectix, Iluka Resources Limited, Lynas Rare Earths Ltd, Peak Resources, Rare Element Resources Ltd, Rio Tinto. a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Rare Earth Metals Market by Type

-

- Cerium Oxide

- Lanthanum Oxide

- Neodymium Oxide

- Yttrium Oxide

- Dysprosium Oxide

- Terbium Oxide

- Scandium Oxide

- Other Oxides

Global Rare Earth Metals Market by Application

-

- Permanent Magnets

- Metal Alloys

- Glass Polishing

- Glass Additives

- Catalysts

- Phosphors

- Ceramics

- Others

Global Rare Earth Metals Market by Region

-

-

North America Rare Earth Metals Market Option 1: As a part of the free 25% customization

-

-

-

- By Type

- By Application

- US Market All-Up

- Canada Market All-Up

-

-

-

Europe Rare Earth Metals Market Option 2: As a part of the free 25% customization

- By Type

- By Application

- Spain Market All-Up

- Germany Market All-Up

- UK Market All-Up

- France Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Rare Earth Metals Market Option 3: As a part of the free 25% customization

- By Type

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

ROW Rare Earth Metals Market Option 4: As a part of the free 25% customization

- By Type

- By Application

- Brazil Market All-Up

- UAE Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Leading Market Players (Option 5: As a part of the free 25% customization – Profiles of 5 Additional Companies of your Choice)

-

- Aluminum Corporation of China Ltd

- ARAFURA RESOURCES

- Avalon Advanced Materials Inc.

- Minmetals Land Limited

- Eutectix

- Iluka Resources Limited

- Lynas Rare Earths Ltd

- Peak Resources

- Rare Element Resources Ltd

- Rio Tinto

Frequently Asked Question About This Report

Rare Earth Metals Market [UP427A-00-0620]

Rare-Earth Metals market was estimated at USD 5.9 billion in 2022.

Various notable players in the Rare Earth Metals market include Aluminum Corporation of China Ltd, ARAFURA RESOURCES, Avalon Advanced Materials Inc., Minmetals Land Limited, Eutectix, Iluka Resources Limited, Lynas Rare Earths Ltd, Peak Resources, Rare Element Resources Ltd, Rio Tinto

The major factors that are driving the growth of the Global Rare Earth Metals Market include increasing demand from emerging countries, the dependency of ‘Green Technology’ on unique earth elements, and growing adoption of rare earth metal across verticals such as in magnet.

Permanent Magnet segment is expected to lead the market during the forecast period owing to the increasing usage of these magnets across various application in various industries such as electronics, automotive, power generation, medical, and among others.

Related Reports

- Published Date: Dec-2023

- Report Format: Excel/PPT

- Report Code: UP427A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Rare Earth Metals Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research