Saudi Arabia Facility Management Market Overview

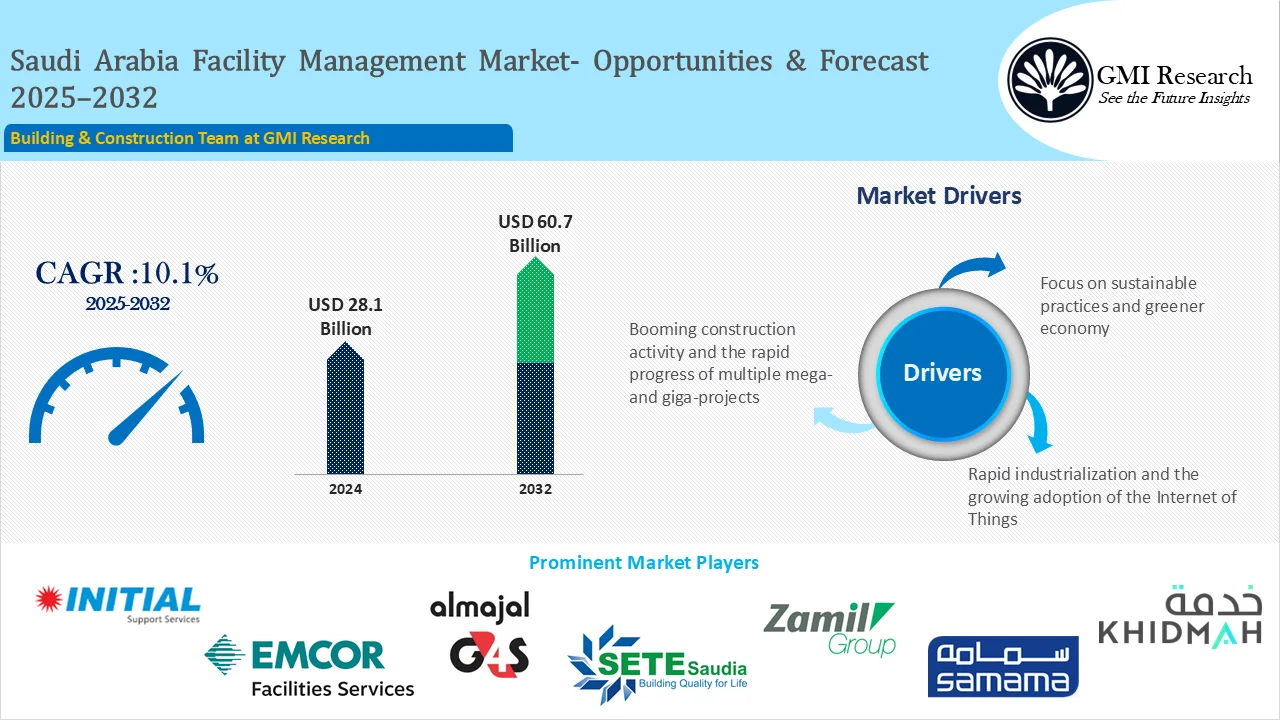

Saudi Arabia Facility Management Market size reached USD 28.1 billion in 2024 and is estimated to reach USD 60.7 billion in 2032, and the market is estimated to grow at a very high CAGR of 10.1% from 2025-2032 driven by rapid industrialization and growing infrastructure projects along with government support for sustainability.

Market Size, Forecast & Key Segment Insights

Market Size & Forecast:

-

- 2024 – USD 28.1 Billion

- 2032 – USD 60.7 Billion

- Market Forecast – CAGR of 10.1% from 2025-2032

Segment Insights:

-

- Facility Management Type Insights: Outsourced facility management leads the market

- FM Offering Type Insights: Soft FM category is anticipated to experience growth

- End-User Industry Insights: Commercial segment holds the largest market share

Saudi Arabia Facility Management Market Drivers

Rapid Industrialization and the growing adoption of internet on things

The Saudi Arabia facility management market growth is expected to be driven by industrial growth along with growing IoT implementation and workforce engagement initiatives. It also contributes to business success by streamlining operations and facilitating effective communication while supporting workforce productivity. It ensures risk mitigation for assets and employees while encouraging sustainable strategies which adds significant value to organizations.

The government under Saudi Vision aims to enhance the economy by diversifying its non-oil industries. The government further intends to use PPPs to enhance its education or transportation infrastructure among others while addressing growing energy demands. It also plans to improve services by implementing public private partnership projects thereby improving accessibility for the facility management sector which supports market growth.

To promote economic diversification and boost technological progress Saudi Arabia has committed to invest around USD 1 trillion in non-hydrocarbon industries by 2035. The government has implemented important measures for the second phase within Saudi Vision aimed at driving sustained growth in construction and related sectors. These developments are set to attract greater investment in construction and tourism thereby accelerating market growth. The World Travel & Tourism highlights a 14% growth in travel and tourism sector in Saudi Arabia which accounts for 9.5% of its total economic impact. The expanding tourism sector is anticipated to drive greater need for facility management during the forecast period.

Furthermore the ongoing infrastructure projects like the Red Sea Project and the Neom City along with the Saudi Vision plan are projected to accelerate digital infrastructure development while fostering business expansion. It is anticipated to drive the facility management market growth in Saudi Arabia. Rising construction activities particularly through PPPs are expected to create a surging need for facility management services like HVAC and security among others.

Focus on sustainable practices and greener economy

Sustainable development along with green building initiatives across Saudi Arabia are also significantly contributing to market growth driven by the environmental targets set in Saudi Vision. The NEOM project which is fully powered by renewable energy marks a significant step toward fostering sustainable infrastructure throughout the country. This significant project combined with various sustainability efforts has fueled an increased demand for building services which adopt environmentally responsible methods.

Facility management services are implemented in several sectors including BFSI and IT along with government sector among others. It is essential in managing numerous operational tasks like asset management and maintenance. The rising demand for data integration and the growing emphasis on comprehensive management of buildings and assets are expected to drive market growth.

Furthermore cloud driven facility management solutions allow businesses to oversee operations remotely. This supports efficient communication and teamwork remotely while also allowing easy access to assets over the internet. Facility management ensures higher efficiency by reducing costs and saving time through the proper assets maintenance. It includes space optimization features and report scheduling among others.

Challenges Faced by Saudi Arabia Facility Management Companies

The market is expected to be hindered by factors like insufficient managerial awareness and skills gap along with the need for standardization. Increased security risks related to devices and networks along with rising security breaches are also expected to constrain market growth.

Are you Looking for a Partner for your Saudi Arabia Market Entry and Expansion plans? GMI Research with decades of experience tracking KSA market is the right choice for you.

KSA Facility Management Market Segment Analysis

Saudi Arabia Facility Management Market by Type Insights: Outsourced facility management leads the market

Based on type, the outsourced facility management leads the market largely attributed to the growing preference among businesses to outsource non core functions to specialized providers. This segment has experienced significant growth especially in cities like Makkah and Riyadh among others where companies are opting to outsource facility management to optimize operation and cut expenses. The inhouse segment is also expanding rapidly primarily owing to the growing demand for directly controlling important operations especially in industries where compliance is essential. To improve efficiency and ensure greater control many organizations are dedicating more resources to enhancing their facility management internally by adopting sophisticated technologies along with sustainable approaches.

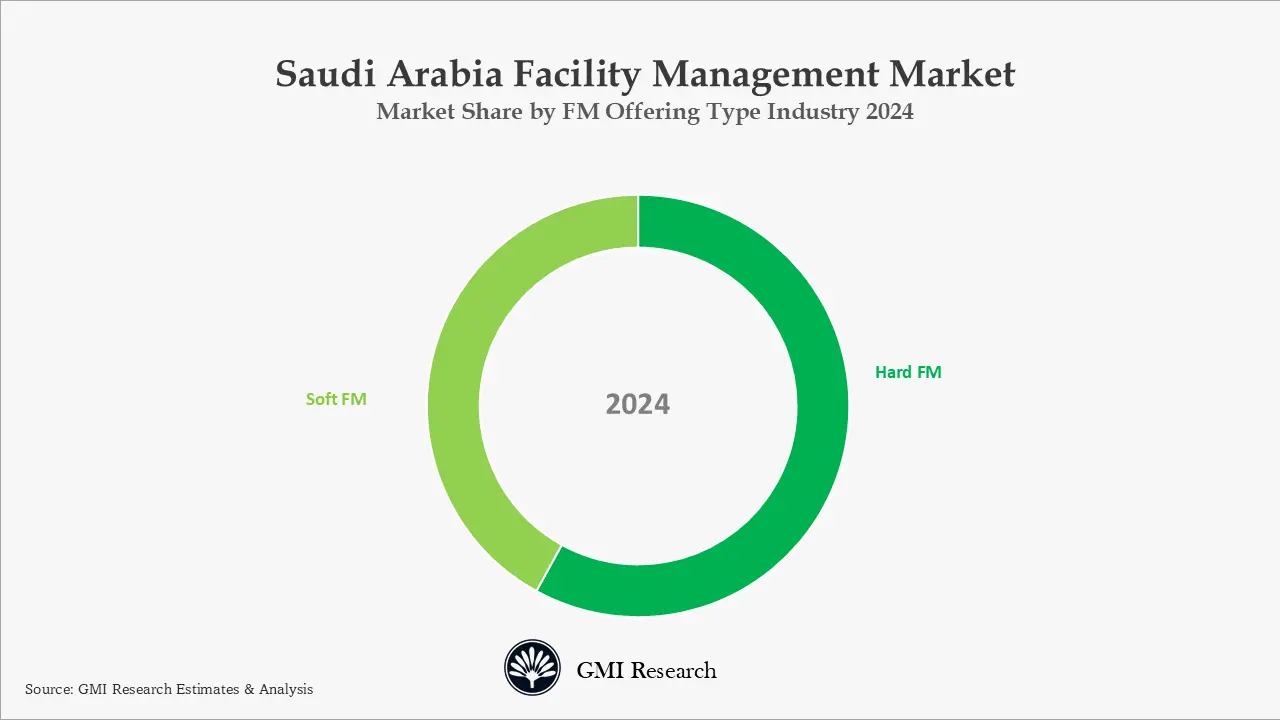

Saudi Arabia Facility Management Market by Offering Type Insights: Soft FM category is anticipated to experience growth

Based on offering type, the Soft FM category is anticipated to experience growth driven by the rising need for services like security management and cleaning among others. Furthermore the increasing need from commercial businesses is contributing significantly to market growth. As an example Musanadah Facilities Management entered into a five year contract with Zain Telecom to deliver soft along with various facility services. The hard FM segment covers essential services like mechanical and structural management among others which affect the physical infrastructure within buildings. The growing need for onsite mechanical services across industrial and commercial environments is also supporting the segment growth. With a rising construction project and a shift toward sustainable energy use the segment continues to grow with businesses focusing more on efficient building maintenance.

Saudi Arabia Facility Management Market by End-User Industry Insights: Commercial segment holds the largest market share

Based on end user industry the commercial segment holds the largest market share. The retail sector is experiencing a surging need for facility management with industry leaders embracing innovation and technology to enhance the shopping experience. Commercial environments need various facility services like accounting or procurement management among others which makes expert facility services crucial for efficient operations. The industrial segment is also expanding owing to a rapidly growing manufacturing sector bolstered by major government projects. Growing attention to operational efficiency in the manufacturing industry is boosting the need for comprehensive facility management.

Saudi Arabia Facility Management Market Major Players & Competitive Landscape

Several leading companies are Initial Saudi Group, Saudi Emcor Company, Almajal G4S, SeteSaudia, Zamil Group, Samama Holding Group, Khidmah Saudi Arabia, Engie Cofely Energy Services LLC, Al Yamama Company, Olive Arabia Co. Ltd. among others.

Saudi Arabia Facility Management Market Recent Development

-

- In 2024, REGA in Saudi Arabia has introduced its first facility management aiming to reshape the housing industry across the country. It aims to improve living standards by effectively managing residential communities.

- In 2022, Khidmah launched Khidmah Home which is a digital platform that provides expert maintenance to property managers and occupants.

- In 2022, Khidmah introduced a digital platform Khidmah Home. This platform will offer professional maintenance services to residents and property owners.

- In 2020, ENGIE Cofely, one of the prominent leaders in providing zero-carbon energy and innovative integrated facilities management solutions signed an agreement with the Energy City Development Company (“ECDC”), the owner and developer of King Salman Energy Park (“SPARK”). With this agreement, ENGIE Cofely will provide facilities management advisor and training provider for SPARK.

Saudi Arabia Facility Management Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 | USD 28.1 Billion |

| Market Revenue Forecast in 2032 | USD 60.7 Billion |

| CAGR | 10.1% |

| Market Base Year | 2024 |

| Market Forecast Period | 2025-2032 |

| Base Year & Forecast Units | Revenues (USD Billion) |

| Market Segment | By Type, By Offering Type, By End-User Industry |

| Regional Coverage | Saudi Arabia |

| Companies Profiled | Initial Saudi Group, Saudi Emcor Company, Almajal G4S, SeteSaudia, Zamil Group, Samama Holding Group, Khidmah Saudi Arabia, Engie Cofely Energy Services LLC, Al Yamama Company, Olive Arabia Co. Ltd., among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Saudi Arabia Facility Management Market Research Report Segmentation

Saudi Arabia Facility Management Market has been segmented on the basis of Type, Offering Type, and End-User Industry. Based on Type, the market is segmented into In-house Facility Management and Outsourced Facility Management. Based on Offering Type, the market is segmented into Hard FM and Soft FM. Based on End-User Industry, the market is segmented into Residential, Industrial, and Commercial.

Saudi Arabia Facility Management Market by Type

-

- In-house Facility Management

- Outsourced Facility Management

Saudi Arabia Facility Management Market by Offering Type

-

- Hard FM

- Soft FM

Saudi Arabia Facility Management Market by End-User Industry

-

- Residential

- Industrial

- Commercial

Saudi Arabia Facility Management Market Leading players

-

-

Initial Saudi Group

-

Saudi Emcor Company

-

Almajal G4S

-

SeteSaudia

-

Zamil Group

-

Samama Holding Group

-

Khidmah Saudi Arabia

-

Engie Cofely Energy Services LLC

-

Al Yamama Company

-

Olive Arabia Co. Ltd

-

Frequently Asked Question About This Report

Saudi Arabia Facility Management Market [UP591A-00-0620]

Saudi Arabia Facility Management Market size was estimated at USD 28.1 billion in 2024

Saudi Arabia Facility Management Market is primarily driven by rapid industrialization and growing infrastructure projects along with government support for sustainability.

Saudi Arabia Facility Management Market offers tremendous opportunities and the market is forecast to grow at a very high CAGR of 10.1% from 2025-2032.

The market is dominated by Initial Saudi Group, Saudi Emcor Company, Almajal G4S, SeteSaudia, Zamil Group, Samama Holding Group, Khidmah Saudi Arabia, Engie Cofely Energy Services LLC, Al Yamama Company, Olive Arabia Co. Ltd. among others.

Commercial segment holds the largest market share and it is projected to dominate the market during the forecast period.

Related Reports

- Published Date: Feb-2025

- Report Format: Excel/PPT

- Report Code: UP591A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Saudi Arabia Facility Management Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research