Saudi Arabia Meat Market Size & Insights

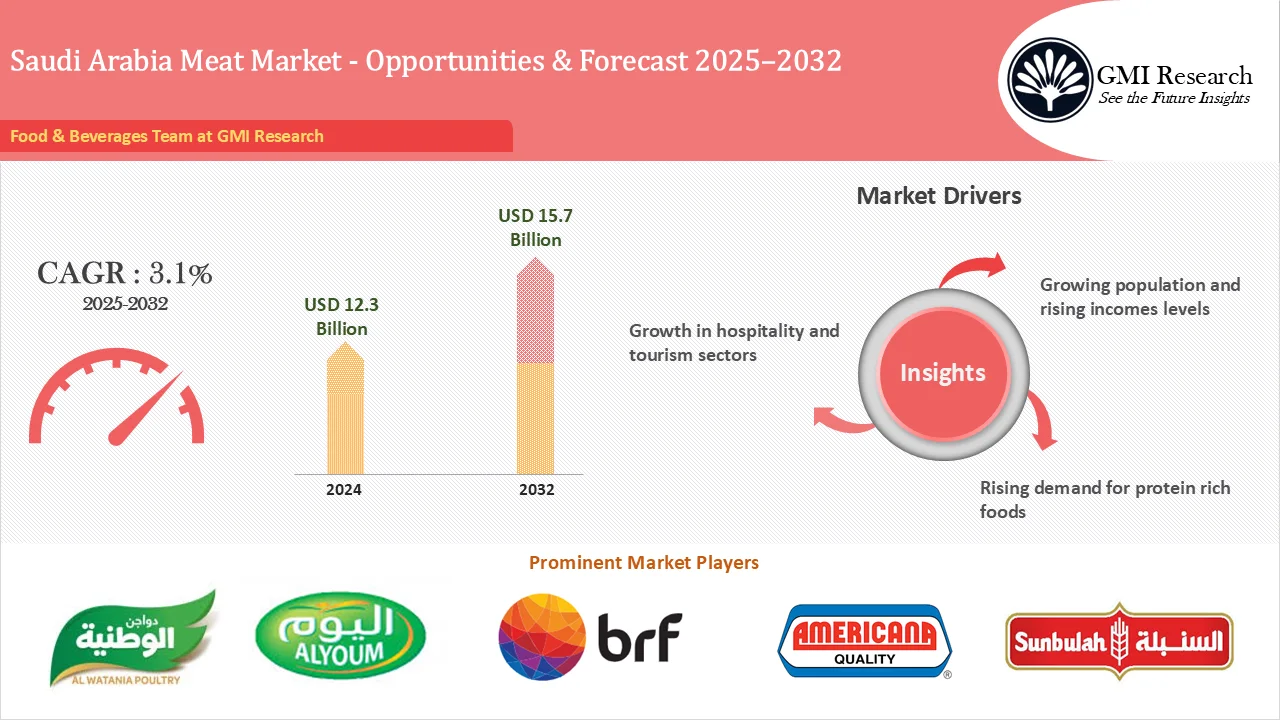

Saudi Arabia Meat Market size reached USD 12.3 billion in 2024 and is estimated to reach USD 15.7 billion in 2032, and the market is estimated to grow at a CAGR of 3.1% from 2025-2032 driven by growing population, rise in urbanization leading to rising meat consumption and increased domestic poultry production combined with government initiatives to enhance food security.

Saudi Arabia Meat Market Drivers

Growing population

The Saudi Arabia meat market is experiencing significant growth largely propelled by the growing population in the country. Saudi population reached around 36.9 million which drives up the need for food especially meat. With a rising population there is an urgent need to secure sufficient food supplies especially protein rich items to ensure adequate nutrition.

Rising Urbanization

Rising urbanization is another factor fueling meat demand. Urbanization brings lifestyle changes that typically involve greater meat consumption. This urbanization trend fuels a growing appetite for processed meats driven by the need for convenience in urban households. Additionally higher disposable incomes across urban areas often lead to increased spending on premium meat products.

Poultry products have become more accessible owing to the booming fast food outlets and supermarkets. Customers can easily find everything from fresh poultry to processed chicken products at these retail outlets. The rising foodservice sector, which is being driven by the emergence of cafés and food delivery services, is driving an increase in the demand for chicken. These developments in retail and foodservice not only drive poultry meat sales but also create new opportunities for producers to reach more customers and introduce various products.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Increased Domestic Poultry Production Combined with Government Initiatives

The other factor supporting market growth is the rising poultry production. Local poultry production has witnessed significant growth with MEWA reporting output reaching 910,000 metric tons in 2021. The industry has reached a major milestone with sixty percent self-sufficiency which reflects significant progress in lowering reliance on imports. The progress has been fueled by advances in farming technology along with better breeding methods and more efficient farm management.

Poultry products have become more accessible owing to the booming fast food outlets and supermarkets. Customers can easily find everything from fresh poultry to processed chicken products at these retail outlets. The rising foodservice sector, which is being driven by the emergence of cafés and food delivery services, is driving an increase in the demand for chicken. These developments in retail and foodservice not only drive poultry meat sales but also create new opportunities for producers to reach more customers and introduce various products.

The government has also actively worked to enhance food security and reduce the dependence on imported meat. Various government policies are set to boost meat production in Saudi Arabia like direct subsidies tied to monthly output along with zero interest loans and support for acquiring cattle farming equipment. Caterers serving government facilities like hospitals and schools are also required to use over 70% locally sourced ingredients. Accessible labor along with foreign supplier approvals and a simplified permit procedure will enable quicker localization within the industry.

Are you Looking for a Partner for your Saudi Arabia Market Entry and Expansion plans? GMI Research with decades of experience tracking KSA market is the right choice for you.

Global meat production is 3,55,715 thousand tonnes in 2021 and predicted to reach 3,60,064 thousand tonnes in 2022 as per the Food and Agriculture Organization. The key factors driving the growth of Saudi Arabia meat industry include increasing per capita meat consumption, growing demand for high protein foods and rising consumers awareness about the health benefits of meat consumption across the country. Saudi Halal market is estimated to grow owing to the rise in the number of Hajj and Umrah visitors along with the increasing adoption of Halal lifestyle. For instance, Minister of Environment, Water and Agriculture of Saudi Arabia planned to invest USD 5 Billion to increase self-sufficiency rate of poultry meat production to 80% by 2025. The self-sufficiency of poultry meat increased to 68% in 2022 as compared to 45% in 2016. This investment is aligned with the Saudi Vision 2030 goals which seeks to provide high quality of food at reasonable price and to ensure food security in Saudi Arabia. Moreover, government has strict regulation regarding the importing and distributing of meat across the Saudi Arabia is paving way for local producers to increase domestic production of meat. As per the FAO, ovine meat production in Saudi Arabia are 148 thousand tonnes in 2021 and import is 23 thousand tonnes in 2021. The ovine production is anticipated to reach 152 thousand tonnes in 2022.

Saudi Arabia Meat Market Major Players & Competitive Landscape

Several leading companies are operating in the market includes Americana Group, Tanmiah Food Company, Almarai, Al-Watania Poultry, Alyoum, BRF, Sunbulah among others.

Saudi Arabia Meat Market Scope of the Report

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD 12.3 Billion |

| Market Revenue Forecast in 2032 |

USD 15.7 billion |

| CAGR |

3.1% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Type, By Form, By Distribution Channel, |

| Regional Coverage | Saudi Arabia |

| Companies Profiled | Americana Group, Tanmiah Food Company, Almarai, Al-Watania Poultry, Alyoum, BRF, Sunbulah among others; a total of 7 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Saudi Arabia Meat Market Research Report Segmentation

The Saudi Arabia Meat Market has been segmented on the basis of Type, Form and Distribution Channel. Based on the Type, the market is segmented into Poultry, Beef, Mutton, Other Meat. Based on the Form, the market is segmented into Fresh / Chilled, Frozen, Shelf Stable. Based on the Distribution Channel, the market is segmented into, Convenience Stores, Supermarkets and Hypermarkets, Retail E-commerce, Others.

Saudi Arabia Meat Market by Type

-

- Poultry

- Beef

- Mutton

- Other Meat

Saudi Arabia Meat Market by Form

-

- Fresh / Chilled

- Frozen

- Shelf Stable

Saudi Arabia Meat Market by Distribution Channel

-

- Convenience Stores

- Supermarkets and Hypermarkets

- Retail E-commerce

- Others

Saudi Arabia Meat Market Leading players

-

- Americana Group

- Tanmiah Food Company

- Almarai

- Al-Watania Poultry

- Alyoum

- BRF

- Sunbulah

Frequently Asked Question About This Report

Saudi Arabia Meat Market [UP2829-001001]

Saudi Arabia Meat Market size was estimated at USD 12.3 billion in 2024

Major factors driving the KSA meat market are growing population, rise in urbanization leading to rising meat consumption and increased domestic poultry production combined with government initiatives to enhance food security.

Saudi Arabia Meat Market size is forecast to grow at a steady CAGR of 3.1% from 2025-2032

Major players are Americana Group, Tanmiah Food Company, Almarai, Al-Watania Poultry, Alyoum, BRF, Sunbulah among others.

Growing consumption of poultry is projected to drive the market.

Related Reports

- Published Date: Feb-2025

- Report Format: Excel/PPT

- Report Code: UP2829-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Saudi Arabia Meat Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research