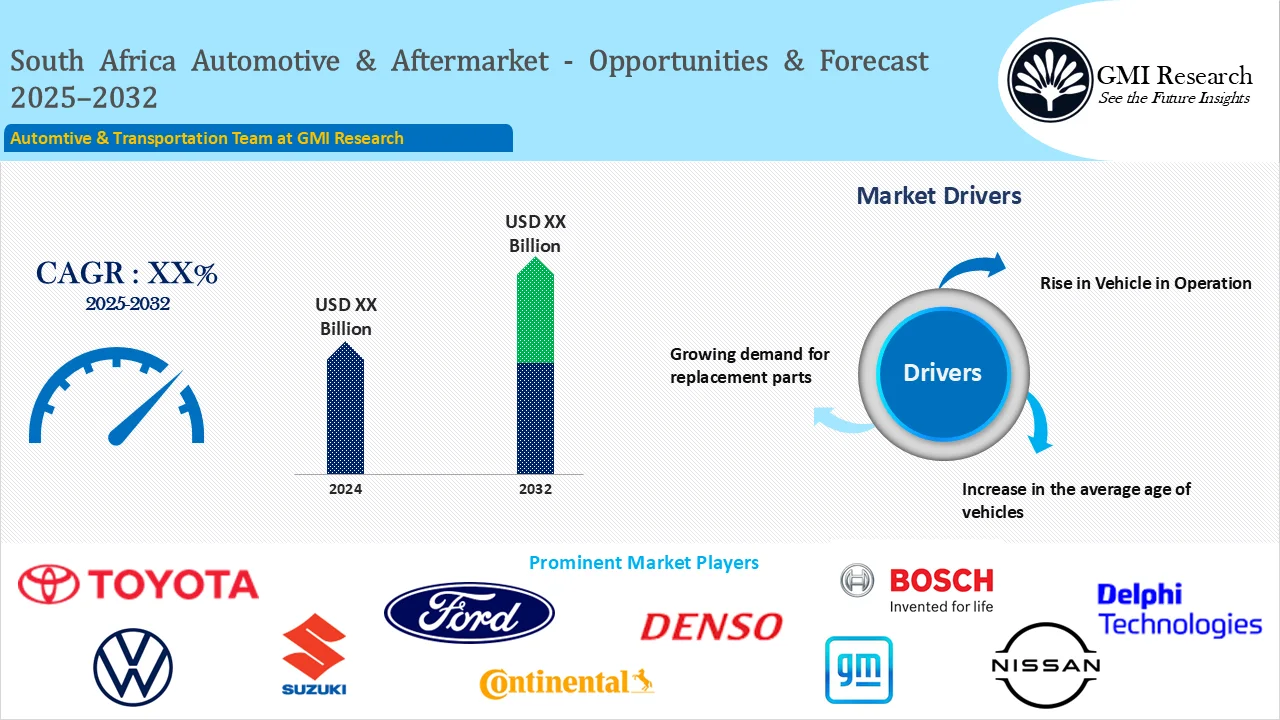

South Africa Automotive Aftermarket Market and Analysis Report – Opportunities and Forecast 2025-2032

South Africa Automotive Aftermarket Market present significant opportunities, with over millions of passenger vehicles are currently out of warranty in 2023, and the passenger cars with an out of warranty population is projected to grow at a robust CAGR from 2024-2032.

Major South Africa Automotive Aftermarket Market Drivers

The South Africa Automotive Aftermarket Market will observe unremitting growth during the forecast period. The market is primarily propelled by automobile drivers’ need to improve different factors of their automobile’s performance, entailing exhaust sound, speed, and visual appearance, among other aspects. The Growth Strategies of the South African Automotive Industry have been aimed at becoming extremely integrated into the global automotive environment on the back of increased foreign direct investment and trade. In addition to this, under the South African Automotive Masterplan (SAAM) 2021-2035, the aim is to introduce 1% of global vehicle production which would take domestic production of vehicles between 1.3-1.5 million units by 2035, relying on the demand of the automotive which further significantly advance the status of the country and global vehicle production ranking.

In addition, the increment in the average age of vehicles along with the growing demand for replacement parts among vehicle owners is fostering the growth of the South Africa Automotive Aftermarket. Although the Automotive Industry in South Africa is confirmed to be prolonged and customer requirement rises, the automotive aftermarket in South Africa will be fostered. The growing popularity of e-commerce platforms has positively impacted the market growth.

For instance, foreign direct investment is critical to fostering growth and introducing jobs in the domestic economy. Additionally, the South Africa Automotive Market incorporates the distribution, production, servicing, and maintenance of motor vehicles and components. They cooperate to confirm warranty service, environment prevention, driver safety, spare parts accessibility, and information about technical innovations. Indeed, the digitization of component delivery sales and services, along with online platforms for aftermarket components in coordination with different auto-part supplier groups, is prepared to fascinate significant investments from foremost market players in the automotive industry. This trend reflects the rising significance of e-commerce and digital platforms in the automotive aftermarket segment, improving suppliers and clients. For instance, the main international Car Companies in South Africa– including BMW, Daiman Chrysler, General Motors, Ford, Fiat, Nissan, Volkswagen, and Toyota, would drive the market growth.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

The implementation of the right-to-repair policy in South Africa is ready to bring about extensive implications for both aftermarket retailers and the repairer industry. The primary objective of this policy is to improve competition within the segment by eradicating entry barriers and subsequently, decreasing the cost of servicing and repairing automobiles that are still under the warranty of the factory. This local industry is undergoing significant modifications, with the growth of online retail and the execution of the right-to-repair policy creating short and medium-term difficulties for businesses. With the confirmed robust growth throughout 2023, firms will be required to grip new business models and establish strategic partnerships to adapt to these changing aspects efficiently.

Key Development

-

- During August 2022, Mitsubishi Motors turned out an improved Triton range around the South African Automotive Market. The Mitsubishi Triton8 Single Cab is endowed with Mitsubishi’s well-introduced DOHC inter-cooled 2.4-liter turbo diesel engine, fostering 100kw of power and 324 Nm of ultimate torque. This translates to commendable fuel effectiveness, averaging at 8.0 ltrs per 100 km, giving fleet owners relaxation from soaring fuel costs. In addition, the inclusion of an extensive 75-ltr fuel tank confirms an economical long-distance travel.

As the automotive industry progressively highlights improved fuel economy and decreased emissions, there a robust predictions of speedy growth in the requirement of vehicles which further fosters the requirement for automotive aftermarket services.

Segments covered in the Report:

The South Africa Automotive Aftermarket has been segmented on the basis of vehicle type, certification, replacement part. Based on the vehicle type, the market has been segmented into commercial vehicles and passenger vehicles. By replacement parts, the market is segmented into tire, battery, brake parts, filters, Lighting Components, Electronic components, Lubricants, Clutch Parts, Engine Components and others. Based on certification, the market has been segmented into Genuine Parts, Certified Parts, Counterfeit Parts, Others.

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD Million |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Vehicle Type, By Replacement Parts, By Certification, |

| Regional Coverage | South Africa |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

South Africa Automotive Aftermarket by Vehicle Type

-

- Commercial Vehicles

- Passenger Vehicles

South Africa Automotive Aftermarket by Replacement Parts

-

- Tire

- Battery

- Brake Parts

- Filters

- Air Filter

- Oil Filter

- Others

- Lighting Components

- Electronic components

- Lubricants

- Clutch Parts

- Engine Components

- Timing Belt

- Spark Plugs

- Others

- Others

South Africa Automotive Aftermarket by Certification

-

- Genuine Parts

- Certified Parts

- Counterfeit Parts

- Others

Related Reports

- Published Date: Mar-2025

- Report Format: Excel/PPT

- Report Code: UP3506-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

South Africa Automotive Aftermarket Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research