Vietnam Cold Storage Market Size & Insights

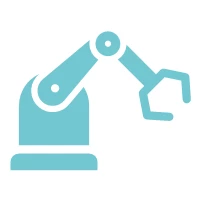

Vietnam Cold Storage Market is estimated to reach USD 716 million in 2032 and the market is estimated to grow at a CAGR of 13.5% from 2025-2032 driven by increasing demand for health food among consumers, increased demand for distribution of vaccines and massive development of Infrastructure.

The demand for cold storage is more attractive due to the high demand from agriculture and seafood exporters across south Vietnam. The market is growing due to the high growth in domestic consumption of meat and seafood along with the rise in government initiatives and investment across the country.

Vietnam Cold Storage Market Overview

Facilities of cold storage are used across various applications such as pharmaceuticals, retail, chemicals, and food, including fresh produce, frozen goods, seafood, and even fresh-cut flowers to maintain unique temperatures. As Building cold storage amenities is a longer and costlier procedure than conventional warehouses. In 2021, Vietnam had a total of 48 cold warehouses with a volume of 700k pallets. Most of the cold stores are in the Southern area, specifically 36 warehouses. On the contrary, there were 11 cold warehouses around the Northern region, and only one was in the Central region. During 2020, only 8.2% of local food suppliers used cold storage systems, while a much higher portion, 66.7%, of exporters made use of such facilities.

Vietnam Cold Storage Market Drivers

Increasing demand for health food among consumers

Growing middle class, coupled with higher disposable income, is offering customers increased access to 5-star, fresh organic product choices. Expanded trade in export and developed transportation agreements are predicted to drive the global need for seafood in Vietnam shortly. The new-generation free trade agreements, alike CPTPP, EVFTA, and UKVFTA are accelerating to drive export demand for agricultural and aquatic products into observing European markets, further growing the need for cold storage systems. In addition, the EU-Vietnam Free Trade Agreement has had a great impact on the development and growth of the Cold Stores Market in Vietnam, as the EU holds the largest share of seafood imports around 23%. As a result, the need for cold storage facilities is on the rise, driving investment trends within the Vietnam Cold Chain Market outlook. To propel the cold chain supply in the medium and long term, it becomes essential to aim at infrastructure development, specifically the enhancement of specific logistics hubs and connections. In the coming years, projects including the highway to the Long Thanh International Airport, Moc Bai Border Gate, Cai Mep Port project, Ring Road 3 and 4, and Hiep Phuoc Port City will enhance the advancement in the Southern Key Economic Region.

Massive development of Infrastructure

Cold chain storage is expanding due to the Vietnam’s master plans for infrastructure development in seaports and airports under Vision 2050. These infrastructure developments are driving to expansion of the need for cold chain storage solutions in the future. The seaports of Vietnam are anticipated to witness large annual goods throughput growth around 5.0%. In response, the Vietnam Government focussed to expand, enhance, and modify different seaports throughout the country which resulted in the rise in demand for cold storage and high demand from seaport exporters. These developments are planned in regions across from Hai Phong and Thanh Hoa in the Northern region, to Da Nang and Khanh Hoa in the Central region, and further down to Ba Ria-Vung Tau and Soc Trang in the Southern region. For example, the Vietnam Ministry of Transportation announced its preliminary development plan for airport in Vietnam in 2021. The government planned for development of International Airports in Hanoi and Ho Chi Minh City. Moreover, it emphasis on establishment of airports in remote locations to improve connectivity around the country which is one of the foremost key drivers for the growing Demand for Cold Storage in Vietnam. The major factor hindering the market growth includes high initial investment costs for the construction and maintenance outlays of a cold warehouse. These facilities require specialized equipment, constant inspections, and greatly higher electricity consumption compared to standard logistics facilities.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Moreover, the establishment of the Van Don Mong Cal Expressway in Quang Ninh, which will link key highways such as Hanoi – Hai Phong, Ha Long -Van Don, and Hai Phong -Ha Long, is anticipated to have a positive impact. It is predicted to decrease both transportation costs and time while simultaneously fortifying the cold chain infrastructure for the Northern Region. In addition, this scenario also offers a great opportunity for market players to expand their business and take long-term benefits.

Increasing demand for medicine distribution

The capacity of Cold Storage in Vietnam has attained strong traction, propelled by a growing number of orders for medications from importers and exporters. Moreover, the growth rate of this market continued to grow even after the pandemic due to the latest advancements in vaccine development, the beginning of new vaccines and medications, and the start of new treatments. In Vietnam, the significant growth middle class along with their increasing taste and preferences towards higher quality substitutes for fresh produce and imported meats, coupled with changing behavior due to the pandemic, are key drivers for the cold chain logistics and warehousing growth in the nation. As a result, the need for cold storage is on the rise, leading to investment trends in the cold supply chain and opening new development opportunities.

Are you Looking for a Partner for your Vietnam Market Entry and Business Expansion plans? GMI Research with decades of experience tracking Vietnam market is the right choice for you.

Vietnam Cold Storage Market Major Players & Competitive Landscape

Several leading companies are ABA Cooltrans, Sojitz, Lineage, Mekong Logistics, Konoike Group, Transimex and many more.

Vietnam Cold Storage Market News

-

- In 2023, Sojitz Corporation and Kokubu Group entered into a partnership with the New Land Co. Ltd. to collaborate to establish Vietnam Japan Long LLC. Through this new venture, both companies planned to expand four temperature cold chain logistics businesses in the southern part of Vietnam.

- In 2023, Lineage Logistics, a popular temperature-controlled industrial REIT and integrated solutions provider, signed an agreement with SK Logistics a cold-storage warehouse operator based in Hanoi, Vietnam to provide cold storage solutions across the APAC region.

- In 2022, ABA Cooltrans Group opened another cold distribution center in the Linh Tung Export Processing Zone positioned in Thu Duc City, covering 10,000 square meters, with a total investment of 250 billion VND. On completion, this center will acquire nearly 5,000 square meters of cold storage space, capable of transporting and storing up to 8,000 tons of goods to nearly 1,000 points across the Ho Chi Minh City area.

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 716 million |

| Market Revenue Forecast in 2032 |

USD Million |

| CAGR |

13.5% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Storage Type, By Temperature Range, By Application |

| Regional Coverage | Vietnam |

| Companies Profiled | ABA Cooltrans, Sojitz, Lineage, Mekong Logistics, Konoike Group, Transimex among others; a total of 6 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Vietnam Cold Storage Market Research Report Segmentation

The Vietnam Cold Storage Market has been segmented on the basis of Storage Type, Temperature Range, and Application. Based on Storage Type, the market is segmented into Facilities/Services and Equipment. The Facilities/Services segment is further segmented into Refrigerated Warehouse and Cold Room. Based on Temperature Range, the market is segmented into Chilled (0°C to 15°C), Frozen (-18°C to -25°C), and Deep-frozen (Below -25°C). Based on Application, the market is segmented into Fruits & Vegetables, Dairy, Fish, Meat, & Seafood, Processed Food, Pharmaceuticals and Others.

Vietnam Cold Storage Market by Storage Type

-

- Facilities/Services

- Refrigerated Warehouse

- Cold Room

- Equipment

- Facilities/Services

Vietnam Cold Storage Market by Temperature Range

-

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

Vietnam Cold Storage Market by Application

-

- Fruits & Vegetables

- Dairy, Fish, Meat, & Seafood

- Processed Food

- Pharmaceuticals

- Others

Vietnam Cold Storage Market Leading players

-

- ABA Cooltrans

- Sojitz

- Lineage

- Mekong Logistics

- Konoike Group

- Transimex

Frequently Asked Question About This Report

Vietnam Cold Storage Market [UP3537-001001]

Vietnam Cold Storage Market size is forecast to reach USD 716 million in 2032

Vietnam Cold Storage Market is driven by increasing demand for health food among consumers, increased demand for distribution of vaccines and massive development of Infrastructure.

Vietnam Cold Storage Market is forecast to grow at a CAGR of 13.5% from 2025-2032

Major Vietnam Cold Storage companies are ABA Cooltrans, Sojitz, Lineage, Mekong Logistics, Konoike Group, Transimex and many more.

Related Reports

- Published Date: Mar-2025

- Report Format: Excel/PPT

- Report Code: UP3537-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Vietnam Cold Storage Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research