Vietnam Construction Equipment Market Overview

In Vietnam, the construction equipment market is majorly propelled by the different key drivers such as huge increment in industrialization, speedy urbanization, effective growth in the investments of government to advance the infrastructure, and enlargement and effective growth in activities of the real estate, and construction enterprises in Vietnam. The market players in the Vietnam construction equipment market 2023 are increasing their investment in various research and development activities to advance new programmed equipment to replace traditional construction equipment is projected to propel the market growth during the near future. Although, the industry of machinery and equipment in Vietnam has witnessed notable growth, making a large contribution to the country’s GDP and different sub-sector industries.

To have an edge over the competition by knowing the market dynamics and current trends of “Vietnam Construction Equipment Market” request for Sample Report here

To have an edge over the competition by knowing the market dynamics and current trends of “Vietnam Construction Equipment Market” request for Sample Report here

The construction market in Vietnam is also experiencing high growth, propelled by economic recovery and the government’s substantial investment in industrial facility development has led to an increased demand for high-quality construction equipment in Vietnam. For instance, the growth in the economy of Vietnam, coupled with augmented investments in infrastructure, real estate, commercial, mining, and housing, has led to speedy expansion in the construction equipment market in Vietnam. This growth is greatly accredited to the transformation of Vietnam into an emerging country, along with the increasing construction and infrastructure projects in Vietnam.

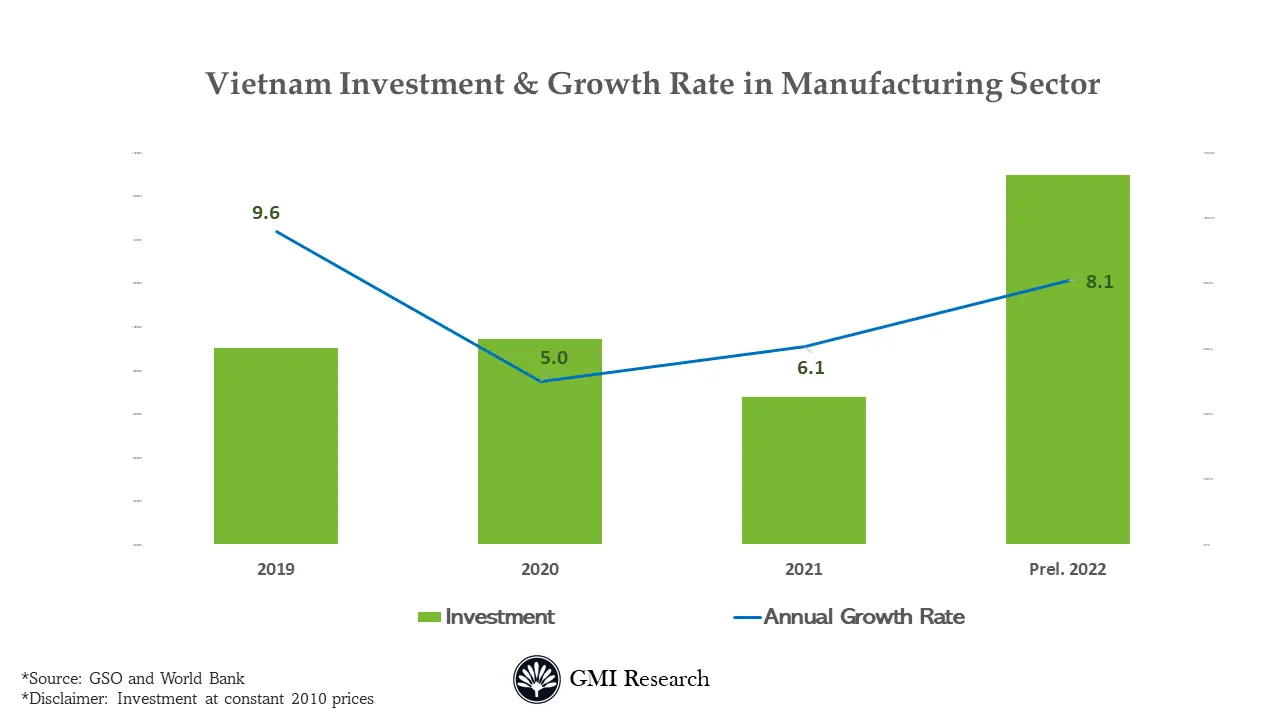

In addition, according to the Asian Development Bank’s prediction, the economy of Vietnam is predicted to achieve a growth rate of 6.5% during 2024, positioning the nation as one of the most speedily rising countries in Southeast Asia. Initiatives by the Government focused on decreasing taxes on imported raw materials and lowering land rental costs are anticipated to have a favorable impact on the manufacturing industry in the country. The deduction in the cost of raw materials and land rents propels the demand in the construction equipment market in Vietnam. Also, as a result of these initiatives by the government, during 2021, Vietnam is positioned 70th in ease of doing business. Over the Southeast companies in Asia, the competitive edge of the country is dominating due to its low-cost business arrangement associated with other nations likewise Thailand, Indonesia, & Malaysia owing to its obtainability of cheap labor and tax incentives delivered by the Government. The easy availability of cheap labor and tax incentives offers huge market opportunities to the giant market players to expand their existence globally. Whereas the industries such as garments, textiles, electronics, and leathers are fostering owing to an increment in demand.

Major Vietnam Construction Equipment Market Drivers

The demand for the construction industry in Vietnam is on the increase, primarily fostered by augmented investment in infrastructure development. Also, rapid growth of the manufacturing industry in the Southeast Asian region has led producers from different parts of the globe to consider placing and setting up their functions in these nations. This shift is propelled by key factors such as increasing domestic customer base, cost savings, and continuous enhancements and enlargements in infrastructure, eventually leading to a risen demand for the construction equipment market. In addition, the initiatives by the government focused on encouraging infrastructure projects and the increasing adoption of advanced technologies improved machinery, including autonomous and electrified equipment, are opening new market opportunities for organizations in the market.

Construction Industry is witnessing a growth and transition towards higher technological innovations. Indeed, automation, digitalization, and connectivity are playing important role in fostering the construction industry forward, leading to significant developments in the construction project. Furthermore, rental companies are actively investing in technologies to meet the increasing demand for improved construction machinery, often substituting older equipment with fresh and advanced machinery fleets. This advancement is the key factor to staying competitive in the emerging Vietnam construction machinery industry.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

The construction industry in Vietnam is predicted to witness augmented demand owing to different key factors such as speedy urbanization and industrialization, significant investment by the government in infrastructure development, and the enlarging efforts of real estate and construction organizations in the region. These factors are anticipated to foster market growth in the coming years more speedily. During 2021, the government of Vietnam is expected to make an investment of $480 billion by 2030 in the upgrade of infrastructure comprising new highways, 11 developed power plants, and effective development of new highways. By the year 2030, the government aims to build a national network of 172 highway routes, enclosing a length of 29,795 km, a substantial rise from the preceding 5,474 km. These investments by the government are predicted to foster market growth in the construction equipment market in Vietnam. Also, the recent growth in the Vietnam construction industry is highly attributed to the nation’s growing number of construction and infrastructure development projects. These advancements have been driving the demand for construction equipment in the Vietnam market.

Additionally, through the PPP model, Vietnam is getting into various public infrastructure projects, including the growth and advancement of its airports. The government has announced plans to invest a huge amount of USD 11 billion in the advancement of the airport in next five years in 2022. Due to these investments in the progress of the airports, the construction equipment industry is anticipated to rise in the near future. For instance, the government plans to allocate $65 billion for road enhancements by 2030. This investment in the advancement of road network development around 48% of total investment across the transportation sector by the year 2030. This investment in road network development makes the market more profitable and offers huge market growth opportunities to the market players as well as investors. Vietnam has different major road construction projects planned for completion during 2022, including Ho Chi Minh City Metro (USD 6.2 billion), Long Thanh Airport (USD 16 billion), North-South Express (USD 18.5 billion), the Lien Chieu Port in Da Nang (USD 147 million), the Hai Van Tunnel 2 (USD 312 million), and Hanoi Ring Road (USD 368 million). These infrastructure projects demonstrate significant investments focused on improving connectivity, and transportation around the country, which further spur the growth of the construction equipment market in Vietnam.

As of now, equipment, tools, machinery, and spare parts constitute the 3rd-largest export collection of Vietnam. Based on the primary data from the General Department of Customs, during Sept. 2022, equipment, machinery, and spare parts exports of Vietnam reached approx. $4.15 billion. This figure presents a 7.73% decline compared to 2022, August but marked a substantial 38.79% rise compared to Sept. 2021. These exports registered for 12.11% of total exports during September in Vietnam. Also, during the first 9 months of this specific year, the export of machinery and equipment totaled $34.2 billion in Vietnam, reflecting a notable 30.3% rise compared to the same year in 2021, and registering for 13.9% of Vietnam’s total exports. This percentage of exports presents a boost in the Vietnam construction equipment market 2023 and brings more competition in the market as it also raises the demand for construction equipment.

For detailed scope of the “Vietnam Construction Equipment Market” report request a Sample Copy of the report

The growth in the construction equipment market is commonly enhanced by the development of the residential as well as commercial construction segment in Vietnam. In addition, government initiatives focused on fostering residential and industrial infrastructure, with investments in public infrastructure such as transportation, utilities, and energy are the key drivers that are anticipated to further present a positive impact on demand for the construction equipment market in Vietnam during 2023-2030.

Key Developments

-

- In 2022, Vietnam initiated the construction of a USD 520 M industrial park project situation in the Binh Thuan area in South Vietnam. This industrial park spread in 10 sq km, is predicted to be completed by 2025. It will cater to a broad class of sectors, including materials and food processing.

- In 2022, Vietnam initiated the construction of the Cadia Qui Nhon, a development project that can be used collectively by different industries, with a predicted value of USD 320 million. This project encompasses two 40-floor multi-facility high-rise buildings located on a 0.52-hectare site in Binh Dinh area. This project provides a variety of facilities including residential and commercial spaces, to meet the lifestyle demands of the local and international population.

- The Ministry of Transport in Vietnam has announced a huge plan for the advancement of logistics infrastructure in the south region, with a vision extending until 2045. This plan comprises Ho Chi Minh City and the region of Tay Ninh, Dong Nai Province, Binh Duong, Ba Ria-Vung Tau, and Binh Phuoc.

Competitive Insights

The construction equipment market in Vietnam is dominated by different leading players such as Hanoi Agricultural Machinery and Agricultural Extension Company, Vietnam Engine and Agricultural Machinery Corporation, and Vietnam Institute of Agricultural Engineering and Post-Harvest Technology. In addition, in the Vietnam Market, there are few international companies that are functioning to dominate the market and maintain their global presence such as CNH Industrial, CLAAS KGaA GmbH, Kubota, Tong Yang Moolsan, Iseki and Yanmar, Buhler, Tong Yang, Shandong Huaxin, CLAAS KGaA GmbH, and others. In the Vietnam market, these brands are majorly reliant on their distributor and agent network to expand and enter.

Segments covered in the Report:

The Vietnam Construction Equipment Market has been segmented on the basis of Engine Capacity, Equipment Category, Propulsion Type and Application. Based on the Engine Capacity, the market is segmented into more than 500 HP, Up to 250 HP, 250-500 HP. Based on the Equipment Category, the market is segmented into Material Handling Equipment, Earth Moving Machinery, Heavy Construction Equipment, Others. Based on the Propulsion Type, the market is segmented into Diesel, CNG/LNG/RNG. Based on the Application, the market is segmented into Infrastructure, Residential, Commercial.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD Million |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Hanoi Agricultural Machinery and Agricultural Extension Company, Vietnam Engine and Agricultural Machinery Corporation, and Vietnam Institute of Agricultural Engineering and Post-Harvest Technology. CNH Industrial, CLAAS KGaA GmbH, Kubota, Tong Yang Moolsan, Iseki and Yanmar, Buhler, Tong Yang, Shandong Huaxin, CLAAS KGaA GmbH., among others; a total of 12 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Vietnam Construction Equipment Market by Engine Capacity

-

- Up to 250 HP

- 250-500 HP

- More than 500 HP

Vietnam Construction Equipment Market by Equipment Category

-

- Earth Moving Machinery

- Material Handling Equipment

- Heavy Construction Equipment

- Others

Vietnam Construction Equipment Market by Propulsion Type

-

- Diesel

- CNG/LNG/RNG

Vietnam Construction Equipment Market by Application

-

- Infrastructure

- Commercial

- Residential

Related Reports

- Published Date: Sep-2023

- Report Format: Excel/PPT

- Report Code: UP3540-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Vietnam Construction Equipment Market and Analysis Report – Opportunities and Forecast 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research