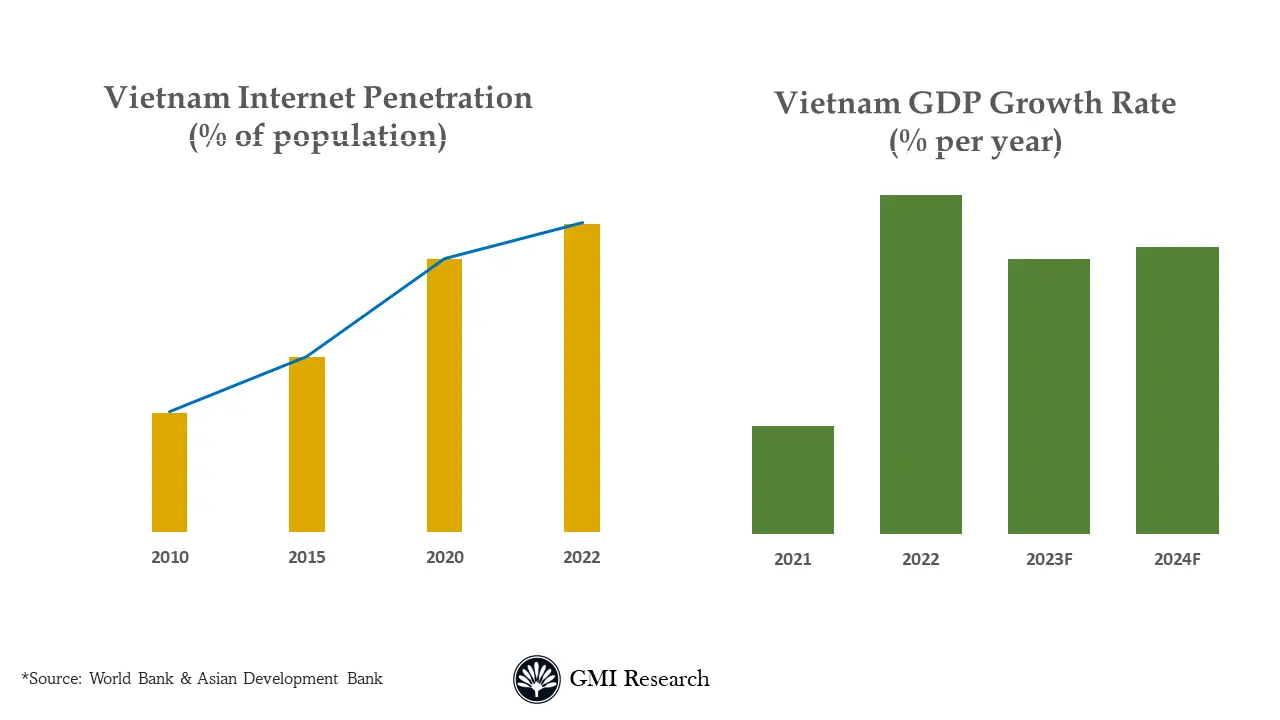

Vietnam Cybersecurity Market is projected to grow at 15.9% in the coming years due to an increase in artificial intelligence attacks, initiatives taken by the government, and expanding IT infrastructure around the country. Vietnam is a growing country, and the market is in the rising phase due to the boost in the usage of smartphones and internet adoption. Moreover, the rise in the need for cloud-based cybersecurity solutions propels the Vietnam Cybersecurity Industry. However, as per world bank, Vietnam’s digital economy is on healthy growth, enhancing at a rate of 10% annually, and it is anticipated to overcome USD 200 billion by 2045. For instance, with advancements in ICT, the country deficiency in sufficient cybersecurity protections, leading to weaknesses broken by hackers. With a growing number of Internet of Things connections, there is a significant rise in demand for effective cybersecurity results. In June 2021, National Cyber Security Center spotted 718 cyber-attacks, witnessing significant concerns, and it recorded a total of 2,915 virtual intrusions throughout the first 2 quarters of 2021, which is an upsurge of 898 equated to the preceding year in Vietnam. With this growing number of cyberattacks and data breach cases, the demand for IT infrastructure development and cybersecurity solutions has risen in Vietnam.

To have an edge over the competition by knowing the market dynamics and current trends of “Vietnam Cybersecurity Market” request for Sample Report here

To have an edge over the competition by knowing the market dynamics and current trends of “Vietnam Cybersecurity Market” request for Sample Report here

Drivers

Growing demand for high-speed internet penetration, rising spending by government authorities on the development of IT infrastructure, and increasing existence of international market players are the key drivers enhancing the growth of the Vietnam Cybersecurity Market Trends in the coming period. Certainly, Vietnam has observed an increment in cyberattacks over the past several years, which has compromised personal data and the leakage of financial and confidential information. Given the international prevalence of cyberattacks and data breaches, there is a high demand for Security Information and Event Management technology and services. For instance, the IBM Security X-Force Threat Intelligence Index shows that Asia is now the number-one targeted region for cyberattacks, registering 26% of the analyzed attacks in 2021. This increases the demand for cybersecurity solutions around the country.

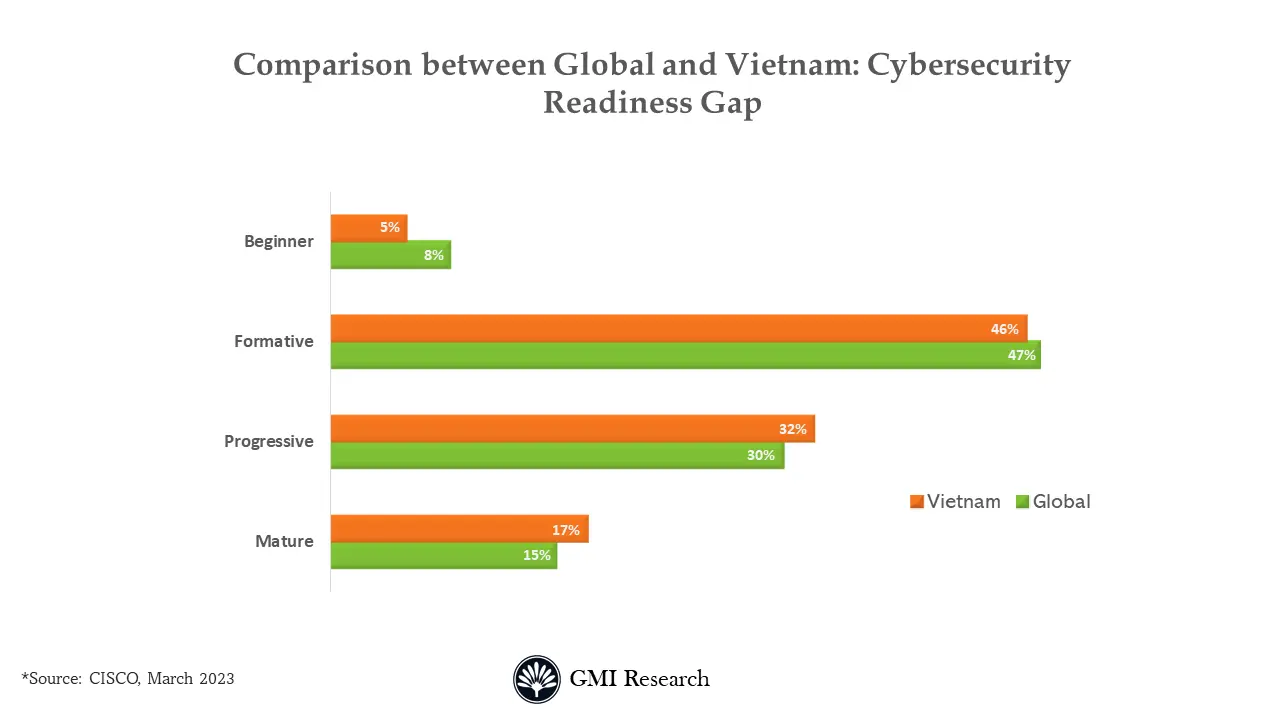

The surging amount of time people spend on social media platforms is making personal information more prone to cyberattacks. Moreover, the extensive usage of smartphones and devices and the accessibility of connected devices have resulted in the generation of huge volumes of data. This data adoption through smart devices creates both opportunities and challenges in terms of data security and privacy. The high and fast adoption of cloud computing services by organizations in Vietnam, lowering the functional and maintenance costs while eliminating the need for high capital investments and on-site infrastructure setup, is introducing favorable opportunities for growth in the Vietnam Cybersecurity Market Companies. The boost in automation and the increase in Internet-connected devices, coupled with the growing frequency of data breaches, are anticipated to drive significant growth in Vietnam. For instance, based on the National Cybersecurity Index 2023, ranking of Vietnam in the global cybersecurity index and ICT development Index are 25th and 108th, respectively. These rankings reflect the country’s advancement and development of IT infrastructure concerning cybersecurity challenges and its growth in the Vietnam Cybersecurity Market.

Furthermore, favorable government initiatives like ‘Make in Vietnam’ and cybersecurity laws focused on assisting the cybersecurity industry are expected to have a positive impact on the growth of the Vietnam Cybersecurity Market. Nonetheless, the implementation of Security Operation Centers in all government institutions further highlights the government’s commitment to improving cybersecurity solutions and is projected to drive market growth. In 2022, a National Cybersecurity Strategy was issued by the government to address cyberspace challenges until 2050 with a vision towards 2030, which presents a positive impact on cybersecurity. The objective of the government behind this strategy is to continue ranking Vietnam on the global cybersecurity index with the range of 25th – 30th by 2050. This target of the government reflects a boost in market opportunities and an increase in demand for cybersecurity solutions.

Furthermore, favorable government initiatives like ‘Make in Vietnam’ and cybersecurity laws focused on assisting the cybersecurity industry are expected to have a positive impact on the growth of the Vietnam Cybersecurity Market. Nonetheless, the implementation of Security Operation Centers in all government institutions further highlights the government’s commitment to improving cybersecurity solutions and is projected to drive market growth. In 2022, a National Cybersecurity Strategy was issued by the government to address cyberspace challenges until 2050 with a vision towards 2030, which presents a positive impact on cybersecurity. The objective of the government behind this strategy is to continue ranking Vietnam on the global cybersecurity index with the range of 25th – 30th by 2050. This target of the government reflects a boost in market opportunities and an increase in demand for cybersecurity solutions.

The data from Kaspersky Security Network is motivating, reflecting a huge decrease in both online and offline cyberattacks in Vietnam during 2022, with a drop of nearly 33.8% compared to the previous year. This deduction has a positive impact and development on the market and encourages the usage of cybersecurity solutions in connected devices which further fosters Vietnam Cybersecurity Market Size. Although, the firm announced that, they blocked and detected nearly 41,989,163 cyber intrusions over the internet targeting users’ computers in Vietnam during the past year. This number is notably lower than the over 63 million cases registered during the previous year.

Additionally, in May 2022, the National Cyber Security Monitoring Center issued a warning and gave assistance in handling 847 cyberattacks that resulted in disrupted information systems in Vietnam. This brought the total number of incidents during the first 5 months of the year to 5,463, with malicious attacks covering 68.7% of them. Among these incidents, there were 161 phishing attacks, 226 deface attacks, and 460 malware attacks. For instance, this indicates a positive trend and impact on the Vietnam Cybersecurity Market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

IT and Telecommunication segment is projected to dominate the market growth.

The growth of the Vietnam Telecom Market during 2023-2030 is being driven by various key factors such as increasing use of smartphones coupled with the growing demand for high-speed data connectivity among consumers. In addition, the continuing procedure of speedy urbanization, the growing living standards among the population is predicted to foster the growth of the IT & Telecom industry in Vietnam. The expansion of 5G commercial coverage to 16 cities and provinces during 2021 by mobile network operators marks a significant step in advancing telecommunications infrastructure in Vietnam which further drives the Vietnam Cybersecurity Market Share. Moreover, the Department of Telecommunication has taken corrective actions to enable the acceptance of smartphone services and packages of internet, making them more available to the public. Also, all three foremost mobile network delivery services introducing Mobile Money services open new market opportunities and develop space for accomplishing the goal of 100% of grownups with Mobile Money accounts. The collaborative efforts between both to prevent customers from spam calls, texts, and SIM-connected problems present a boost in enhancing the user experience and cybersecurity in the telecommunications sector.

In May 2020, two Vietnamese-invested enterprises, MB Cambodia and Viettel Pte., Ltd., signed an agreement as a special credit package deal focused on upgrading Cambodia’s telecommunications network. This partnership reflects the commitment to improving digital connectivity and infrastructure in the region which develops the growth and demand for cybersecurity solutions in Vietnam. Moreover, the Ministry of Information and Communications in Vietnam has also announced a plan that comprises a secure national digital infrastructure, propelling new opportunities for digital economic growth, and strengthening e-governance. These aims are integral components of the Ministry’s action plan to implement a national strategy for the 4th industrial revolution by 2030. These initiatives by the government are presenting significant growth to the cybersecurity market in Vietnam as developing and strengthening IT infrastructure is one of the foremost drivers of this market.

In May 2020, two Vietnamese-invested enterprises, MB Cambodia and Viettel Pte., Ltd., signed an agreement as a special credit package deal focused on upgrading Cambodia’s telecommunications network. This partnership reflects the commitment to improving digital connectivity and infrastructure in the region which develops the growth and demand for cybersecurity solutions in Vietnam. Moreover, the Ministry of Information and Communications in Vietnam has also announced a plan that comprises a secure national digital infrastructure, propelling new opportunities for digital economic growth, and strengthening e-governance. These aims are integral components of the Ministry’s action plan to implement a national strategy for the 4th industrial revolution by 2030. These initiatives by the government are presenting significant growth to the cybersecurity market in Vietnam as developing and strengthening IT infrastructure is one of the foremost drivers of this market.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

By 2025, the MIC targets to boost Vietnam’s digital infrastructure and the goal is to have Vietnam’s government index ranked among the top four countries in Southeast Asia, on the basis of the United Nations ranking. The position of Vietnam in the Global Cybersecurity Index, holding the 7th rank around the Asia-Pacific region. To accomplish this aim, the ministry highlights different key areas that further develop Vietnam Cybersecurity Market Growth such as developing a robust database and connection infrastructure, advancing research and development activities in priority of technologies, growing international partnerships, and uplifting cybersecurity awareness and responsibilities.

Key Developments

-

- In 2022, Kasikornbank of Thailand showcased its intention to develop as a provincial digital bank by launching a growth drive around Vietnam by investment of around USD 75 Mn to boost its facility setup around AEC+3, which comprises ASEAN plus China, Japan, and South Korea. The strategic aim behind this is to improve the bank’s ability to deliver digital services to clients in different sectors.

- In 2022, Amazon Web Services planned to expand its reach in Vietnam by motivating more clients to use its offshore-situated cloud services. However, the government of Vietnam is also offsetting the pressure for local companies to store their data within the nation for safety purposes. The strategy of Amazon comprises growing its existence across the Socialist Republic of Vietnam to prevent native data center clients.

- In 2023, CMC Telecom accomplished a significant transformation, moving from a traditional ISP to a CSP. This shift is effectively contributing to introducing Vietnam as a Digital Hub, not only within the Asia Pacific region but also on the international stage. The strategy is in accord with the mission of driving Vietnam towards becoming a digitally advanced nation. Also, it serves the role of digital technology in serving international markets and developing the country’s position in the digital scope.

- In 2022, IBM made a multi-million-dollar investment to develop resources aimed at helping businesses in the APAC region to better prepare for and manage the rising risk of cyberattacks. The principal point of this investment is the establishment of the new IBM Security Command Center, which presents a groundbreaking initiative as a training hub for cybersecurity response approaches by using highly realistic simulated SOCs. The aim is to prepare individuals varying from C-Suite executives to technical professionals in efficiently mitigating cyberattacks.

Segments covered in the Report:

The Vietnam Cybersecurity Market has been segmented on the basis of security type, deployment mode, organization size, and vertical. Based on security type, the market is segmented into network security, endpoint security, cloud security, internet security, and others. Based on the deployment mode, the market is segmented into on-premises and cloud. Based on organization size, the market is segmented into SMEs and large enterprises. Based on the vertical, BFSI, government and defence, energy and utilities, healthcare, IT and telecommunication, retail, manufacturing, and others.

For detailed scope of the “Vietnam Cybersecurity Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD Million |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Security Type, By Deployment Mode, By Vertical, By Organization Size, |

| Regional Coverage | vietnam |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Vietnam Cybersecurity Market by Security Type

-

- Network Security

- Endpoint Security

- Cloud Security

- Internet Security

- Others

Vietnam Cybersecurity Market by Deployment Mode

-

- On-Premises

- Cloud

Vietnam Cybersecurity Market by Vertical

-

- BFSI

- Government and Defence

- Energy and Utilities

- Healthcare

- IT and Telecommunication

- Retail

- Manufacturing

- Others

Vietnam Cybersecurity Market by Organization Size

-

- SMEs

- Large Enterprises

- Published Date: Sep-2023

- Report Format: Excel/PPT

- Report Code: UP3538-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Vietnam Cybersecurity Market and Analysis Report – Opportunities and Forecast 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research