Vietnam Food and Beverages Market Size & Insights

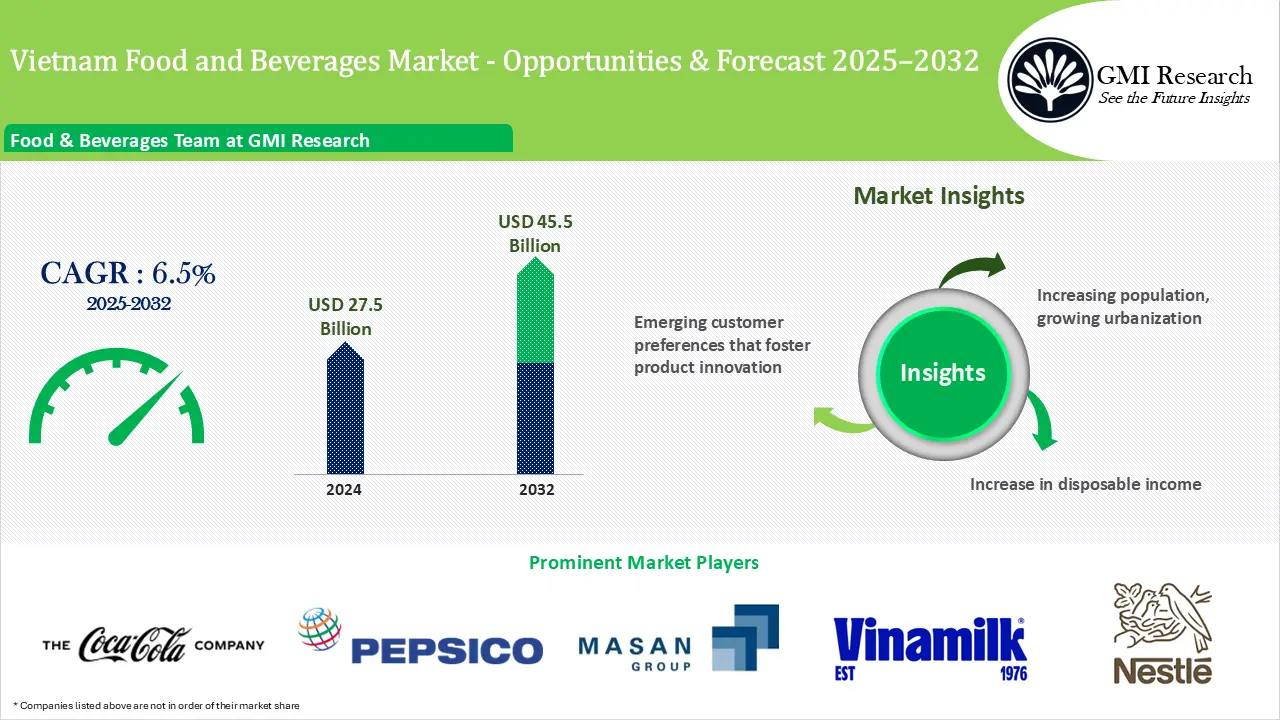

Vietnam Food and Beverages Market size is forecast to grow at robust CAGR of 6.5% between 2025 and 2032 primarily driven by increasing population, rising urbanization, growing disposable income, and emerging customer preferences fostering product innovation.

Vietnam Food and Beverages Market Overview

The market of food and beverage in Vietnam is predicted to rise in the coming years due to significant growth in disposable income and, a growing population, coupled with changing trends and product advancements. The robust GDP growth in Vietnam which stood at 6.1% in 2024 an increase of 1.1 pts over 2023, the robust economic growth is improving living standard in Vietnam eventually driving demand for food & beverages market. Vietnam’s status as a relatively youthful nation is predicted to shape its future growth potential, leading to the emergence of fresh cultural and lifestyle trends that balance regional tractions with international preferences.

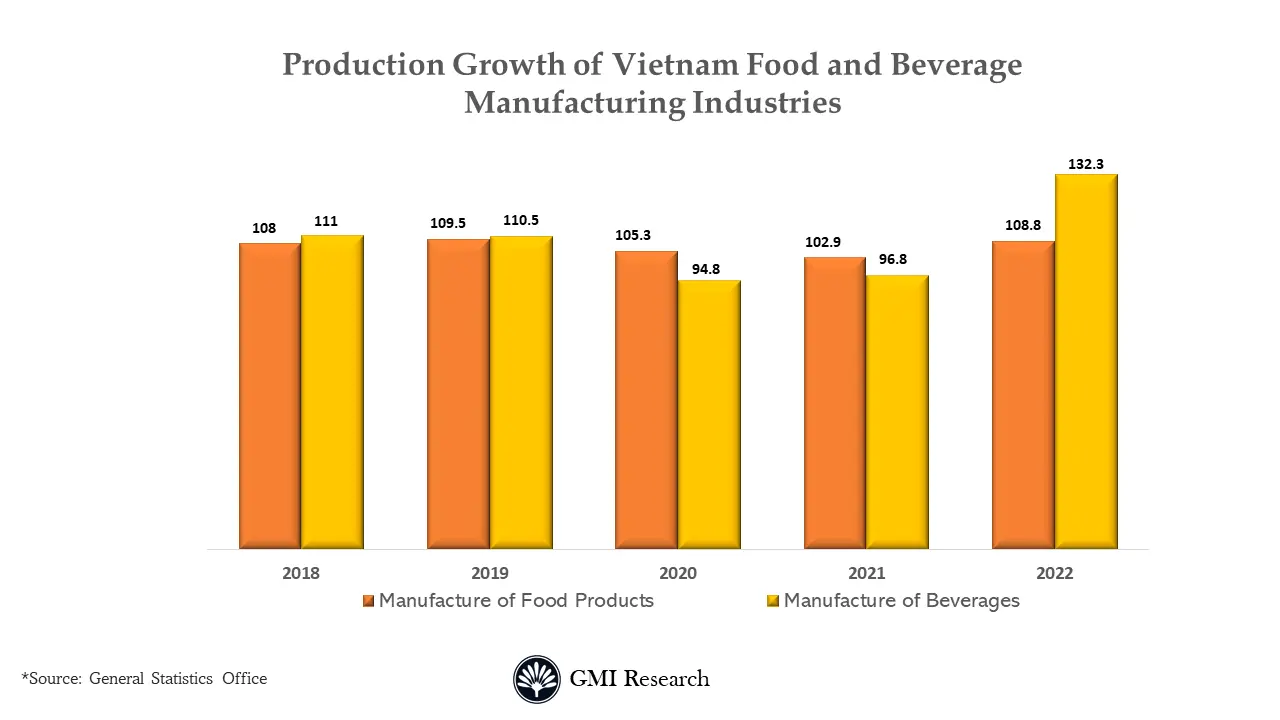

According to the Vietnam Ministry of Industry and Trade, in 2022 Vietnam’s food processing and manufacturing industry expanded by 8.8%. In the sector of food processing, there are more than 8,500 recorded companies and the annual demand for food ingredients surpasses 120 million tons.

Customers in Vietnam are focussing on organic foods, eco-friendly options, and imported products, even at a higher price point. This move in preference is propelling the emergence of dietary trends and leading the growth in the Vietnam F&B Market with strong demand for healthier choices such as gluten-free, keto meals, and eat-clean. Customers are becoming more conscious of how their environment can impact the quality of their food, and this heightened environmental awareness is pushing food and beverage establishments to be more sustainable. Moreover, the F&B Market in Vietnam is witnessing the impact of this on customers accepting cashless payment habits such as QR codes, mobile phone payments, and contactless cards for safer and contact-free transactions daily. In 2022, based on the Mastercard New Payment Index, clients in APAC rose their usage to 69% of at least one digital payment method, while 88% of end users managed at least one new mode of payment. This increase in percentage offers a huge opportunity for market players in the Vietnam Food and Beverage Market to expand their business by accepting digital payment methods.

Vietnam Food and Beverages Market Growth Drivers

Increasing Population, Growing Urbanization and Increase in Disposable Income

The population of Vietnam is growing steadily, on an average the population is increased by 1 million people every year, in the next five years the population Is expected to increase by 5 million people. According to Mid-Term Population Census of 2024, on April 1, 2024, Vietnam’s population was 101.1 million people. The rise in urbanization is also contributes to a surge in the demand for food and beverages in Vietnam.

Economic growth reached 5.0% in 2023 due to the moderation of domestic demand and the challenging external environment and gradually accelerating to 6.1% in 2024 and 6.1% in 2025 as per IMF. As the middle class expands in Vietnam and coupled with effective growth in disposable income around various sectors of the population, higher spending power will further raise demand for Vietnam’s food and beverage industry. Growing disposable income is driving consumer spending is propelling hospitality & tourism industry is thereby driving demand for food & beverages in Vietnam.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Emerging Customer Preferences that Foster Product Innovation

Generation Z is now entering adulthood, characterized by their openness to trends and a willingness to invest their resources in dining-out experiences, which is fostering the growth of the Food and beverages Market. As per the UN Population Fund report, 25% of Vietnam’s population in 2023, which is nearly 100 million people, falls within the age group of 16-30, while 22% are under the age of 14. This demographic presents Vietnam as an exceptionally youthful nation. In addition, this generation is particularly alert to the environmental impacts of their actions, making them significant drivers of food and beverage market trends in Vietnam during 2023-2030. These trends entail a highlight on ethical sourcing and an increasing demand for locally sourced products. The domestic food and beverage industry in Vietnam is witnessing the fastest growth in market value. This expansion can be coupled with the amalgamation of key factors, including population growth, growing household incomes, and moves in customer preferences and behaviors.

Furthermore, the growing customer preference for organic, fresh food products, and natural ingredients among customers owing to increased awareness of health awareness is the key factor projected to boost demand for the Food and Beverage market. As the middle class expands in Vietnam and coupled with effective growth in disposable income around various sectors of the population, higher spending power will further raise demand within the Vietnam food and beverage industry.

Vietnam Food and Beverages Market Segment Analysis

Product Type Market Insights: Food and non-alcoholic beverages continue to hold the largest share

Food and non-alcoholic beverages continue to hold the largest share in terms of essential spending within total household spending. Due to a shift in customer preference towards higher-value products, increasing household income the market is anticipated to grow in the forecast period. The consumers in Vietnam with different income levels, place a strong emphasis on product safety and superiority. Subsequently, they are becoming more inclined to pay higher prices, specifically for products from foreign brands.

Distribution Channel Market Insights: Small retailers, including convenience Stores, provision shops and other sundry outlets, account for majority of F&B total sales

Small retailers, including convenience Stores, provision shops and other sundry outlets, account for majority of F&B total sales, while supermarkets, hypermarkets, department stores, E-commerce comprise the remaining. Supermarkets and hypermarkets leads the distribution channel in big cities, The E-commerce F&B sales are booming driven by high mobile and internet penetration coupled with huge varieties of products available to choose from.

In addition, the consistent growth of the mass grocery retail industry in main towns as well as smaller cities is boosting food consumption by delivering competitive pricing choices to customers.

Vietnam Food and Beverages Market Major Players & Competitive Landscape

Several leading companies are include Orion, Nestle, Masan Group, Vietnam Dairy Products JSC (Vinamilk), TH True Milk, Kido Group, Masan MeatLife, Unilever, Coca-Cola, PepsiCo, Heineken, Vietnam Beverage Co.

The market’s relatively low barriers to entry allow numerous new brands to enter the market and gain shelf presence within a short timeframe.

Are you Looking for a Partner for your Vietnam Market Entry and Business Expansion plans? GMI Research with decades of experience tracking Vietnam market is the right choice for you.

Vietnam Food and Beverages Market News

-

- In 2023, Growth eum Capital Partners is set to invest nearly $100 million to gain a stake in Vietnam’s International Dairy Products JSC. This strategy reflects their interest in capitalizing on the expanding dairy market in the region.

- In 2023, Suntory PepsiCo Vietnam Beverage Company has outlined plans to invest an additional $38.8 million in its Can Tho facility in South Vietnam. This investment focuses on establishing new production lines dedicated to purified water and tea manufacturing.

- In 2023, the HCM Government established a Food and Beverage Association with the objective of exploring, enhancing, and preserving Vietnam cuisine. This association looks to encourage Vietnam cuisine traditions both within the country and international stage.

- In 2022, Nestlé has extended its retail coffee offerings in East Asia by introducing Starbucks packaged coffee to the Vietnamese market primarily targeting hospitality locations and offices.

- In 2022, Heineken Vietnam officially discovered its largest brewery located in Ba Ria Vung Tau, over the past five years it now stands as the region’s largest following multiple expansions to introduce new products to the Vietnam Market.

Vietnam Food and Beverages Market Scope of the Report

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD Million |

| CAGR |

6.5% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Regional Coverage | Vietnam |

| Companies Profiled | Orion, Nestle, Masan Group, Vietnam Dairy Products JSC (Vinamilk), TH True Milk, Kido Group, Masan MeatLife, Unilever, Coca-Cola, PepsiCo, Heineken, Vietnam Beverage Co. among others; a total of 11 companies covered |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Vietnam Food and Beverages Market Research Report Segmentation

The Vietnam Food and Beverages Market has been segmented on the basis of Product Type and Distribution Channel. Based on the Product Type, the market is segmented into Beverage and Food. Based on the Distribution Channel, the market is segmented into Supermarkets/Hypermarkets, Convenience Stores, Online, Others. The Beverage segment is further segmented into Alcoholic Beverages, Non-Alcoholic Beverages. The Food segment is further segmented into Bakery and Confectionery, Frozen Food, Dairy and Dairy Alternative Products, Meat, Poultry and Seafood, Frozen Food & Ready Meals, Breakfast Cereals and Others.

Vietnam Food and Beverages Market by Product Type

-

- By Beverage

- Alcoholic Beverages

- Non Alcoholic-Beverages

- By Food

- Bakery and Confectionery

- Frozen Food

- Dairy and Dairy Alternative Products

- Meat, Poultry and Seafood

- Frozen Food & Ready Meals

- Breakfast Cereals

- By Beverage

Vietnam Food and Beverages Market by Distribution Channel

-

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

Vietnam Food and Beverages Market Leading players

-

- Orion

- Nestlé

- Masan Group

- Vietnam Dairy Products JSC (Vinamilk)

- TH True Milk

- Kido Group

- Masan MeatLife

- Unilever

- Coca-Cola

- PepsiCo

- Heineken

- Vietnam Beverage Co.

Frequently Asked Question About This Report

Vietnam Food and Beverages Market

The market growth of Vietnam Food and Beverages is primarily driven by increasing population, rising urbanization, growing disposable income, and emerging customer preferences fostering product innovation.

Vietnam Food and Beverages Market provides significant opportunities and is forecast to reach USD 45.5 billion in 2032, growing at a CAGR of 6.5% from 2025-2032

Major players operating in the market are Orion, Nestle, Masan Group, Vietnam Dairy Products JSC (Vinamilk), TH True Milk, Kido Group, Masan MeatLife, Unilever, Coca-Cola, PepsiCo, Heineken, Vietnam Beverage Co..

Ho Chin Minh and Hanoi are the two major demand centres in Vietnam.

Food and non-alcoholic beverages continue to hold the largest share in terms of essential spending within total household spending.

Small retailers, including convenience Stores, provision shops and other sundry outlets, account for majority of F&B total sales in Vietnam.

Related Reports

- Published Date: Feb-2025

- Report Format: Excel/PPT

- Report Code: UP3539-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Vietnam Food and Beverages Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research