Water Treatment Chemicals Market Size, Share, Trends Analysis, Global Growth Opportunities & Industry Forecast Report, 2023-2030

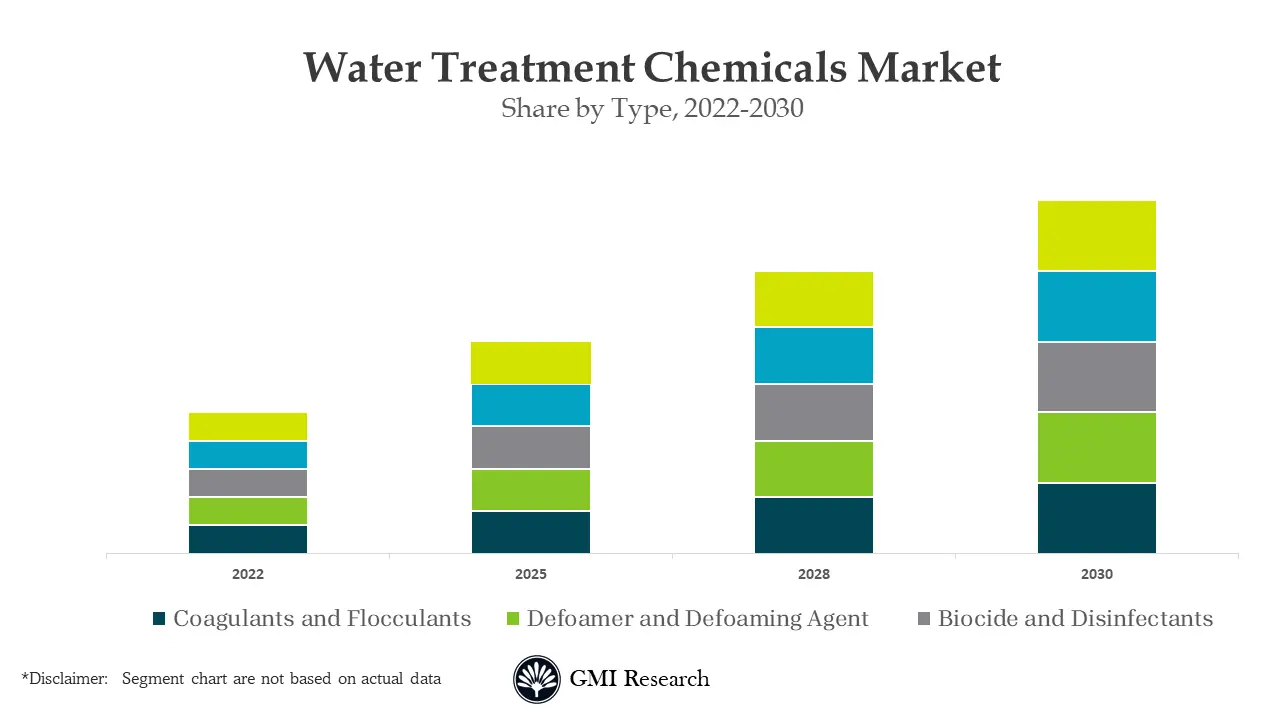

Water Treatment Chemicals Market Size, Share & Trends Analysis Report, By Type (Coagulants & Flocculants, Biocide & Disinfectant, Defoamer & Defoaming Agent, pH & Adjuster & Softener, Scale Inhibitor, Corrosion Inhibitor, Others), By Application (Raw Water Treatment, Water Desalination, Cooling Water Treatment, Boiler Water Treatment, Others), By End-user (Commercial, Residential, Industrial), By Source (Synthetic, Bio-Based)

Water Treatment Chemicals Market was valued at USD 35.8 billion in 2022 and is forecast to touch USD 45.7 billion in 2030, and the market is expected to grow at a CAGR of 3.1% from 2023-2030.

Introduction of the Global Water Treatment Chemicals Market Report

Water treatment chemicals are used for the chemical treatment of water and wastewater to improve the water quality which can be used across various end-use applications such as for drinking, irrigation, industrial water supply, water recreation, among others. Chemicals like flocculant, coagulant, biocide, disinfectant, defoaming agent, PH adjuster, corrosion inhibitor and others are used for removing contaminants from water.

To have an edge over the competition by knowing the market dynamics and current trends of “Water Treatment Chemicals Market,” request for Sample Report here

To have an edge over the competition by knowing the market dynamics and current trends of “Water Treatment Chemicals Market,” request for Sample Report here

Major Water Treatment Chemicals Market Drivers

The water treatment market is forecast to witness a promising growth over the forecast period, owing to the growing demand for chemically treated water across food & beverage, pulp & paper, chemicals, oil & gas, and metal industries. Strict norms pertaining wastewater treatment, rising surface water pollution, accelerating population, and rapid urbanization are some of the major factors fueling the water treatment market. In addition, as per the water treatment chemicals market report, the growing need for chemicals from fertilizers, geothermal power generation, and refining applications along with defoamer, corrosion inhibitor, and pH booster, aided by the rapid industrialization, will propel the market growth. Rising incidences of water-borne diseases has increased the demand for safe and clean water, thereby, strengthening the market size.

Water treatment chemical market is driven by the increasing water pollution, rising industrialization and growing demand for chemical treated water across various industries. Moreover, regulatory and sustainability requirements related to water and waste water treatment. Increased consumption among industries such as mining, refining, power generation and chemical manufacturing industries is boosting the market growth of water treatment chemicals across the globe. For instance, the US Environmental Protection Agency (EPA) implemented the Clean Water Act to control water pollution. Increasing awareness regarding the clean and safe water along with the rising government regulations for waste water processing has increased the demand for water treatment chemicals. Rapid development of industrial industry and urbanization is further paving way for water treatment chemicals such as Coagulants, flocculants, Corrosion Inhibitor, among others. Furthermore, technological innovation and new product launches is expected to drive the global water treatment chemicals market.

Alternative water treatment methods like reverse osmosis (RO), ultrafiltration, and UV disinfection is projected to hinder the market expansion for water treatment chemicals as it reduces the need for water treatment chemicals. In addition, increasing demand for environmentally friendly water treatment among industries as a result of the expanding environmental legislation and concerns.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Based on the type, corrosion inhibitor segment is expected to grow at a higher rate.

Increased use of corrosion inhibitors to prevent or reduce corrosion and metal surface deterioration in the equipment, including cooling towers and boilers. Corrosion inhibitors helps to maintain the efficiency of water condition and PH level. In addition, rising water recycling along with the use of poor quality water in cooling system is further boosting the market growth. Additionally, increasing demand to reduce corrosion from various end-user industries such as oil & gas, pulp and paper, among others is supporting the corrosion inhibitor segment.

Based on end users, the industrial segment will experience the higher growth in the market.

Industrial segment is being driven by rising industrialization and increasing demand for water treatment chemicals across various industries. In addition, rise in the number of industries that requires huge amount of water during manufacturing process. Water treatment chemicals are widely used across various industries including oil and gas, pulp and paper, power, chemicals, and food and beverages. Oil and gas industry is driven by the increasing consumption in oil refineries along with the high amount of waste water generated. Power is primarily due to the huge demand of water treatment chemicals for the treatment of the waste water streams, growing need for makeup water for the cooling system, steam circulation systems, and requirement of clean water for better protection against erosion and damage to equipment in the power plant.

Based on source, synthetic segment is expected to be dominate the market.

The synthetic segment is the largest and is growing at the fastest rate as it offers unique properties like cost effectiveness and easy availability of raw materials are driving the market growth.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

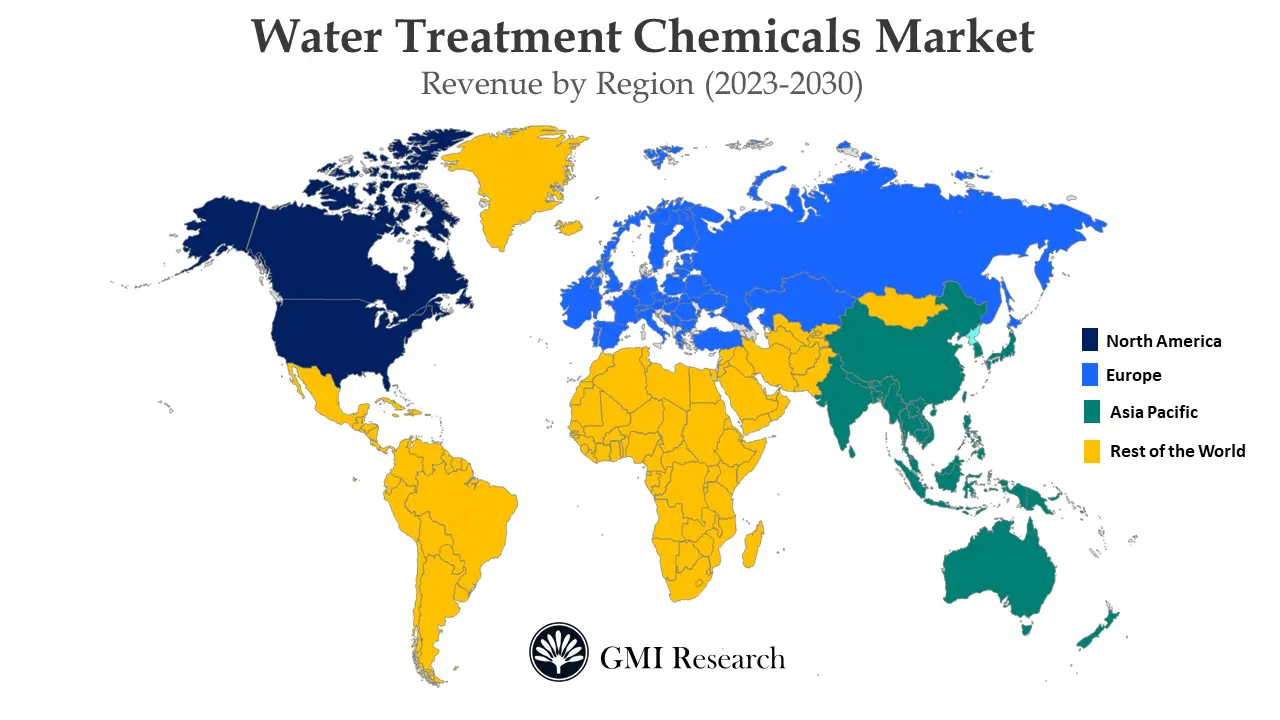

Based on region, Asia Pacific region is growing at the fastest rate.

Asia-Pacific water treatment chemical market is driven by the high demand from countries like China, India, Indonesia, and Vietnam. This is owing to the various factors such as rapid urbanization, growing industrialisation, strong economic growth and high population size in Asia Pacific countries. Moreover, increasing environment concerns along with the growing infrastructure development of water treatment facility across the APAC region. Surge in the number of industries including food & beverages, textiles, dairy, and chemicals in the developing countries including China, India, and Indonesia are expected to support the growth of the market in the region. For example, China planned to build 80,000 km of sewage pipeline and to increase sewage treatment capacity by 20 Mm3 per day by 2025. Rapid expansion of end-user industries and increase in the standards of water quality is expected to boost the market growth. In addition, rising government investments in water and wastewater treatment is supporting the APAC water treatment chemical market. For instance, Indian government planned to invest USD 7,271 Million to provide clean and safe drinking water to every household, will increase the demand for water treatment in India.

North America is expected to lead the global water treatment chemicals market during the forecast period. This is primarily attributed to stringent government regulations imposed for controlling the disposal of wastewater from both municipal and industrial sources into environment in the region. Additionally, the strong demand for clean drinking water, rising awareness regarding the reusability of water and conservation of the environment is expected to the drive the market growth.

Water Treatment Chemicals Market Leaders

Some of the major players operating in the global Water Treatment Chemicals market includes BASF SE, Ecolab, Solenis, Nouryon, Kemira Oyj, Baker Hughes, The Dow Chemical Company, SNF Group, Cortec Corporation, Buckman and Solvay S.A., among others.

Key Development:

-

- In 2022, Solenis acquired Clearon Corp. to grow its product portfolio of water treatment chemicals products for both the residential and commercial pool water and spa treatment.

- In 2022, Baker Hughes, Dussur, Saudi Aramco, and SABIC entered into an agreement to provide supply oilfield and industrial chemicals in Saudi Arabia region. Baker Hughes and Dussur are PIF companies, while Saudi Aramco and SABIC are renowned Saudi corporation.

- In 2022, Cortec and Bionetix has introduced specialized operating wastewater treatment plants. Both the companies specialized in different segments Bionetix in biological wastewater treatment and Cortec specialized in corrosion control technology has optimized and created wastewater treatment plants that will ease the life of operators.

- In 2021, Kemira announced to expand its production capacity by more than 100,00 per year in UK. The company planned to increase ferric based Water treatment chemicals production.

- In 2021, Ecolab acquired Purolite in order to offer high-quality purification and separation solutions for USD 3.7 billion.

- In 2021, Kemira made two investments to expand water treatment chemicals capacity at its Yanzhou site in China to cater the growing Asia-Pacific market.

- In 2020, DuPont De Numours, Inc. acquired OxyMem Limited, a company that designs and develops Membrane Aerated Biofilm Reactor (MABR) technology for the treatment and purification of municipal and industrial wastewater. With this acquisition, DuPont will enhance its offerings in water treatment market.

- In 2020, Solenis acquired Poliquimicos which specialized in manufacturing and supply chain of specialized chemicals solution for water treatment industries.

Segments covered in the Report:

The global Water Treatment Chemicals market has been segmented on the basis of Type, Application, End-user, Source, and region. Based on Type, the market has been segmented into Coagulants & Flocculants, Biocide & Disinfectant, Defoamer & Defoaming Agent, pH & Adjuster & Softener, Scale Inhibitor, Corrosion Inhibitor and Others. Based on the Application, the market has been segmented into Raw Water Treatment, Water Desalination, Cooling Water Treatment, Boiler Water Treatment and Others. Based on End-user, the market has been segmented into Commercial, Residential and Industrial. Based on Source, the market has been segmented into Synthetic and Bio-Based.

For detailed scope of the “Water Treatment Chemicals Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 35.8 billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Type, By Application, By End-user, By Source, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Kemira Oyj, Kurita Water Industries Ltd., Ecolab, Inc., BASF SE, DuPont De Numours, Inc., Akzo Nobel N.V., Baker Hughes Company, Lonza Group Ltd., The DOW Chemical Company, and Solenis LLC, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Water Treatment Chemicals Market by Type

-

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale Inhibitor

- Corrosion Inhibitor

- Others

Global Water Treatment Chemicals Market by Application

-

- Raw Water Treatment

- Water Desalination

- Cooling Water Treatment

- Boiler Water Treatment

- Others

Global Water Treatment Chemicals Market by End-user

-

- Commercial

- Residential

- Industrial

Global Water Treatment Chemicals Market by Source

-

- Synthetic

- Bio-Based

Global Water Treatment Chemicals Market by Region

-

-

- North America Water Treatment Chemicals Market (Option 1: As a part of the free 25% customization)

- By Type

- By Application

- By End-user

- By Source

- US Market All-Up

- Canada Market All-Up

- Europe Water Treatment Chemicals Market (Option 2: As a part of the free 25% customization)

- By Type

- By Application

- By End-user

- By Source

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific Water Treatment Chemicals Market (Option 3: As a part of the free 25% customization)

- By Type

- By Application

- By End-user

- By Source

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW Water Treatment Chemicals Market (Option 4: As a part of the free 25% customization)

- By Type

- By Application

- By End-user

- By Source

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America Water Treatment Chemicals Market (Option 1: As a part of the free 25% customization)

-

Major Players Operating in the Global Water Treatment Chemicals (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- BASF SE

- Ecolab

- Solenis

- Nouryon

- Kemira Oyj

- Baker Hughes

- The Dow Chemical Company

- SNF Group

- Cortec Corporation

- Buckman and Solvay S.A.

Frequently Asked Question About This Report

Water Treatment Chemicals Market [UP1755-001001]

Major chemicals used in water treatment includes Coagulants & Flocculants, Scale Inhibitor, Corrosion Inhibitor and Others.

Analysis from GMI Research finds that the Water Treatment Chemicals Market will grow at a CAGR of 3.1% from 2023-2030.

Water treatment chemical market is driven by the increasing water pollution, rising industrialization and growing demand for chemical treated water across various industries.

Increasing demand for eco-friendly water treatment among industries.

Major players operating in the global water treatment chemicals market includes BASF SE, Ecolab, Solenis, Nouryon, among others.

Water Treatment Chemicals Market registered a revenue of USD 35.8 billion in 2022 and is projected to reach USD 45.7 billion in 2030.

- Published Date: Mar - 2023

- Report Format: Excel/PPT

- Report Code: UP1755-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Water Treatment Chemicals Market Size, Share, Trends Analysis, Global Growth Opportunities & Industry Forecast Report, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research